6 K 1 Cbd201105136k1 Form

What is the 6 K 1 Cbd201105136k1

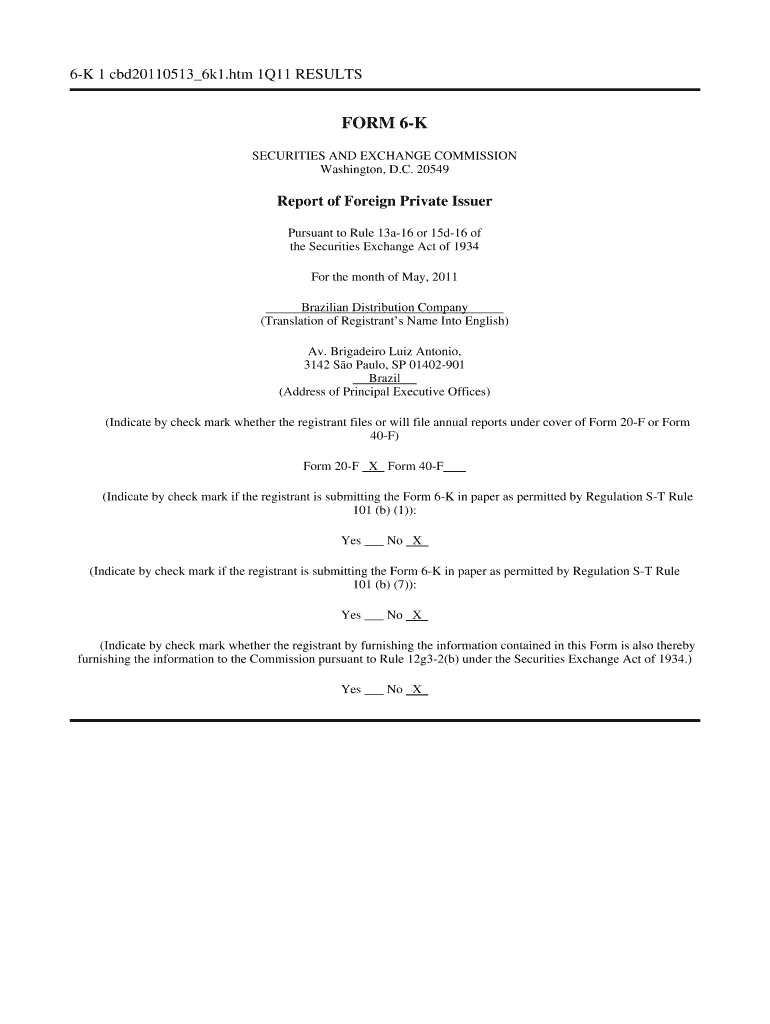

The 6 K 1 Cbd201105136k1 is a specific form used in the United States for reporting income, deductions, and credits related to certain business entities. This form is particularly relevant for partnerships and limited liability companies (LLCs) that have opted for pass-through taxation. It provides essential information to the Internal Revenue Service (IRS) and helps ensure compliance with federal tax regulations.

How to use the 6 K 1 Cbd201105136k1

To use the 6 K 1 Cbd201105136k1 effectively, individuals or businesses must accurately complete the form with detailed financial information. This includes reporting income earned, expenses incurred, and any applicable deductions. Each partner or member of the business entity will receive a copy of the form, which they will use to report their share of the income or loss on their personal tax returns.

Steps to complete the 6 K 1 Cbd201105136k1

Completing the 6 K 1 Cbd201105136k1 involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the form with accurate figures, ensuring that all income and deductions are correctly reported.

- Provide the required information for each partner or member, including their share of profits and losses.

- Review the completed form for accuracy before submission.

- Distribute copies to all relevant parties, ensuring they have the information needed for their tax filings.

Legal use of the 6 K 1 Cbd201105136k1

The legal use of the 6 K 1 Cbd201105136k1 is crucial for compliance with IRS regulations. It is important for businesses to file this form accurately and on time to avoid potential penalties. The information reported on the form must reflect the actual financial activities of the business entity, as discrepancies can lead to audits or legal issues. Understanding the legal implications of this form helps ensure that all parties involved are protected under tax laws.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the 6 K 1 Cbd201105136k1. These guidelines include instructions on how to report various types of income, deductions, and credits. It is essential to refer to the latest IRS publications and updates to ensure compliance with any changes in tax law. Following these guidelines helps prevent errors that could result in audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 6 K 1 Cbd201105136k1 are critical for maintaining compliance. Typically, the form must be filed by the due date of the entity's tax return, which is usually March 15 for partnerships and LLCs. It is important to stay informed about any changes to these deadlines, as missing them can result in penalties. Keeping a calendar of important dates can help ensure timely submissions.

Quick guide on how to complete 6 k 1 cbd201105136k1

Effortlessly Prepare [SKS] on Any Device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to easily find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance your document-based processes now.

How to Edit and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 6 k 1 cbd201105136k1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 6 K 1 Cbd201105136k1?

6 K 1 Cbd201105136k1 is a unique identifier for a specific document or form within the airSlate SignNow platform. It allows users to easily track and manage their documents, ensuring that all necessary information is readily accessible. This feature enhances the overall efficiency of document management.

-

How does airSlate SignNow support the 6 K 1 Cbd201105136k1 process?

airSlate SignNow streamlines the 6 K 1 Cbd201105136k1 process by providing an intuitive interface for sending and signing documents electronically. Users can easily create, send, and track their documents, ensuring a smooth workflow. This efficiency saves time and reduces the likelihood of errors.

-

What are the pricing options for using 6 K 1 Cbd201105136k1 with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those utilizing the 6 K 1 Cbd201105136k1 feature. Pricing is competitive and designed to provide value for businesses of all sizes. You can choose a plan that best fits your document management requirements.

-

What features are included with the 6 K 1 Cbd201105136k1 functionality?

The 6 K 1 Cbd201105136k1 functionality includes features such as document templates, real-time tracking, and secure eSigning. These features enhance user experience and ensure that all documents are handled efficiently. Additionally, users can customize their workflows to suit their specific needs.

-

What are the benefits of using airSlate SignNow for 6 K 1 Cbd201105136k1?

Using airSlate SignNow for 6 K 1 Cbd201105136k1 offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform allows for quick document turnaround times, which can signNowly improve business operations. Moreover, it provides a user-friendly experience for both senders and signers.

-

Can I integrate airSlate SignNow with other tools while using 6 K 1 Cbd201105136k1?

Yes, airSlate SignNow supports integrations with various third-party applications, making it easy to incorporate the 6 K 1 Cbd201105136k1 process into your existing workflows. This flexibility allows businesses to enhance their productivity by connecting with tools they already use. Integration options include CRM systems, cloud storage, and more.

-

Is there customer support available for 6 K 1 Cbd201105136k1 users?

Absolutely! airSlate SignNow provides dedicated customer support for users of the 6 K 1 Cbd201105136k1 feature. Whether you have questions about functionality or need assistance with troubleshooting, the support team is available to help you maximize your experience with the platform.

Get more for 6 K 1 Cbd201105136k1

Find out other 6 K 1 Cbd201105136k1

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online