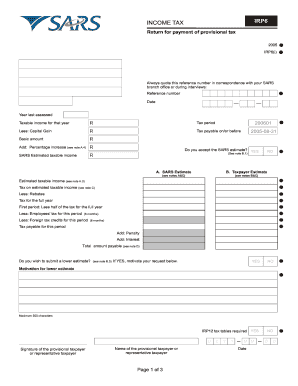

Irp6 Form

What is the IRP6 Form?

The IRP6 form is a tax document used by businesses in the United States to report and pay their estimated income tax. This form is particularly relevant for corporations and partnerships. It allows these entities to estimate their tax liability for the year and make quarterly payments to the IRS, helping to ensure compliance with federal tax obligations. The IRP6 form is essential for maintaining accurate financial records and avoiding penalties for underpayment of taxes.

How to Obtain the IRP6 Form

To obtain the IRP6 form, individuals and businesses can visit the official IRS website, where the form is available for download in PDF format. The form can also be requested by contacting the IRS directly. It is important to ensure that you are using the most current version of the form, as tax regulations can change. Additionally, some tax preparation software may include the IRP6 form as part of their offerings, allowing for easier completion and submission.

Steps to Complete the IRP6 Form

Completing the IRP6 form involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Calculate your estimated tax liability based on your projected income for the year.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the appropriate deadline.

Legal Use of the IRP6 Form

The IRP6 form is legally recognized as a valid method for businesses to report and pay estimated taxes. Proper completion and timely submission of this form help businesses avoid penalties and interest associated with late payments. It is crucial for businesses to understand their obligations under federal tax law and to maintain compliance by using the IRP6 form as intended.

Filing Deadlines / Important Dates

Filing deadlines for the IRP6 form are critical for maintaining compliance. Generally, estimated tax payments are due quarterly, with specific deadlines set by the IRS. For most businesses, these deadlines fall on the fifteenth day of April, June, September, and January of the following year. It is essential to mark these dates on your calendar to avoid penalties for late filing or payment.

Form Submission Methods

The IRP6 form can be submitted to the IRS through various methods. Businesses may choose to file electronically using approved tax software or submit a paper form via mail. Electronic filing is often faster and allows for immediate confirmation of receipt, while mailing the form requires additional time for processing. It is important to choose a submission method that aligns with your business needs and ensures timely compliance.

Quick guide on how to complete irp6 form

Effortlessly Prepare Irp6 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Irp6 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Irp6 Form with Ease

- Obtain Irp6 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to keep your changes.

- Decide how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irp6 Form to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irp6 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the irp6 form and why do I need to download it?

The irp6 form is a crucial document used for tax purposes in certain jurisdictions. Downloading the irp6 form in PDF format allows you to fill it out easily and submit it to the relevant authorities. With airSlate SignNow, you can quickly access the irp6 form download PDF and streamline your filing process.

-

How can I download the irp6 form PDF using airSlate SignNow?

To download the irp6 form PDF using airSlate SignNow, simply navigate to our document library and search for the irp6 form. Once located, you can easily download it in PDF format for your convenience. This feature ensures you have the latest version of the irp6 form ready for use.

-

Is there a cost associated with downloading the irp6 form PDF?

Downloading the irp6 form PDF through airSlate SignNow is included in our subscription plans, which are designed to be cost-effective for businesses of all sizes. We offer various pricing tiers to suit your needs, ensuring you can access essential documents like the irp6 form without breaking the bank.

-

What features does airSlate SignNow offer for managing the irp6 form?

airSlate SignNow provides a range of features for managing the irp6 form, including eSigning, document sharing, and secure storage. You can easily collaborate with others on the irp6 form download PDF, ensuring everyone has access to the latest version. Our platform simplifies the entire document management process.

-

Can I integrate airSlate SignNow with other applications for the irp6 form?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the irp6 form. Whether you use CRM systems or cloud storage services, our platform can connect seamlessly, enhancing your document management experience with the irp6 form download PDF.

-

What are the benefits of using airSlate SignNow for the irp6 form?

Using airSlate SignNow for the irp6 form offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform allows you to quickly download the irp6 form PDF, eSign it, and share it securely, making the entire process efficient and reliable for your business needs.

-

Is the irp6 form download PDF secure with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, ensuring that your irp6 form download PDF is protected with advanced encryption and secure access controls. You can trust that your sensitive information remains confidential while using our platform for document management.

Get more for Irp6 Form

- Client confidentiality release dona international dona form

- Application for hardship waiver school fees usd 497 usd497 form

- Application for 3 years disability hunting amp fishing license form

- New board member announcement sample form

- City of sanger tx permits form

- New hauler application corpus christi texas form

- Building inspectionscity of montgomery form

- Www pdffiller com461638717 ancillary providerfillable online ancillary provider id request form blue cross

Find out other Irp6 Form

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online