Does Electronic Authorization for Payroll Deduction Massachusetts Form

Understanding the Electronic Authorization for Payroll Deduction Massachusetts Form

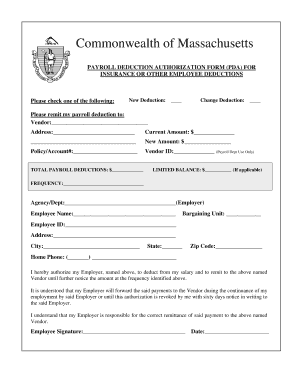

The Electronic Authorization for Payroll Deduction Massachusetts Form is a document used by employers and employees to authorize payroll deductions electronically. This form streamlines the process of managing payroll deductions for various purposes, such as benefits, retirement contributions, and other financial obligations. By utilizing this form, both parties can ensure that deductions are handled efficiently and in compliance with state regulations.

How to Use the Electronic Authorization for Payroll Deduction Massachusetts Form

To use the Electronic Authorization for Payroll Deduction Massachusetts Form, employees must fill out the required fields accurately. This includes providing personal information, such as name, address, and Social Security number, along with the specific details regarding the deductions being authorized. Once completed, the form should be submitted electronically, ensuring that it is securely stored for future reference.

Steps to Complete the Electronic Authorization for Payroll Deduction Massachusetts Form

Completing the Electronic Authorization for Payroll Deduction Massachusetts Form involves several key steps:

- Gather necessary personal information, including your Social Security number and employment details.

- Specify the type of deductions you wish to authorize, such as health insurance or retirement contributions.

- Review the form for accuracy, ensuring all required fields are filled out correctly.

- Submit the form electronically through your employer's designated platform.

Key Elements of the Electronic Authorization for Payroll Deduction Massachusetts Form

Important elements of the Electronic Authorization for Payroll Deduction Massachusetts Form include:

- Employee Information: Full name, address, and Social Security number.

- Employer Information: Company name and contact details.

- Deductions Authorized: Specific deductions being requested.

- Signature: An electronic signature to validate the authorization.

State-Specific Rules for the Electronic Authorization for Payroll Deduction Massachusetts Form

Massachusetts has specific regulations governing payroll deductions. Employers must adhere to these rules to ensure compliance. This includes providing employees with clear information about the deductions and obtaining explicit consent before processing any payroll deductions. Understanding these state-specific rules is crucial for both employers and employees to avoid potential legal issues.

Examples of Using the Electronic Authorization for Payroll Deduction Massachusetts Form

Common scenarios for using the Electronic Authorization for Payroll Deduction Massachusetts Form include:

- Employees opting into health insurance plans offered by their employer.

- Setting up contributions to retirement accounts, such as a 401(k).

- Authorizing payroll deductions for union dues or other membership fees.

Legal Use of the Electronic Authorization for Payroll Deduction Massachusetts Form

The Electronic Authorization for Payroll Deduction Massachusetts Form is legally binding once completed and signed. It ensures that both the employer and employee have a clear understanding of the deductions being authorized. Employers must maintain records of these forms to demonstrate compliance with state and federal regulations regarding payroll deductions.

Quick guide on how to complete does electronic authorization for payroll deduction massachusetts form

Complete Does Electronic Authorization For Payroll Deduction Massachusetts Form effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and store it securely online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Does Electronic Authorization For Payroll Deduction Massachusetts Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Does Electronic Authorization For Payroll Deduction Massachusetts Form without any hassle

- Obtain Does Electronic Authorization For Payroll Deduction Massachusetts Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with the features that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your changes.

- Select your preferred method of sharing your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhaustive form searching, or mistakes that require printing fresh document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Does Electronic Authorization For Payroll Deduction Massachusetts Form to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the does electronic authorization for payroll deduction massachusetts form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Electronic Authorization For Payroll Deduction Massachusetts Form?

The Electronic Authorization For Payroll Deduction Massachusetts Form is a document that allows employees to authorize payroll deductions electronically. This form simplifies the process of managing payroll deductions, ensuring compliance with Massachusetts regulations. Using airSlate SignNow, businesses can easily create, send, and eSign this form.

-

How does airSlate SignNow facilitate the Electronic Authorization For Payroll Deduction Massachusetts Form?

airSlate SignNow streamlines the process of completing the Electronic Authorization For Payroll Deduction Massachusetts Form by providing an intuitive platform for document management. Users can create templates, send forms for eSignature, and track the status of submissions in real-time. This efficiency helps businesses save time and reduce errors.

-

Is there a cost associated with using airSlate SignNow for the Electronic Authorization For Payroll Deduction Massachusetts Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost depends on the features and number of users required. However, the platform is designed to be cost-effective, providing signNow value for managing the Electronic Authorization For Payroll Deduction Massachusetts Form.

-

What features does airSlate SignNow offer for managing payroll deduction forms?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSignature capabilities. These features enhance the management of the Electronic Authorization For Payroll Deduction Massachusetts Form, making it easier for businesses to handle payroll deductions efficiently. Additionally, the platform ensures compliance with legal standards.

-

Can I integrate airSlate SignNow with other software for payroll management?

Yes, airSlate SignNow offers integrations with various payroll and HR software solutions. This allows businesses to seamlessly incorporate the Electronic Authorization For Payroll Deduction Massachusetts Form into their existing workflows. Integrations enhance efficiency and ensure that all payroll processes are synchronized.

-

What are the benefits of using airSlate SignNow for payroll deduction forms?

Using airSlate SignNow for the Electronic Authorization For Payroll Deduction Massachusetts Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick turnaround times on document processing, which can improve employee satisfaction and compliance. Additionally, it minimizes the risk of errors associated with manual processes.

-

Is airSlate SignNow secure for handling sensitive payroll information?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the Electronic Authorization For Payroll Deduction Massachusetts Form, are protected. The platform uses encryption and secure access controls to safeguard sensitive payroll information. Businesses can trust that their data is handled with the utmost care.

Get more for Does Electronic Authorization For Payroll Deduction Massachusetts Form

- Parking permit westminster high school form

- Ahrr word form

- Oklahoma vintage decal application form

- Nps form s4

- Patient information sheet primary health medical group

- Cfs 444 2 s appointment of short term guardian spanish illinois form

- Professional wrestling license application form

- To download the credit card authorization form us spiritleaders

Find out other Does Electronic Authorization For Payroll Deduction Massachusetts Form

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later