Nj Cbt Extension 2018-2026

What is the NJ CBT Extension

The NJ CBT Extension, formally known as the New Jersey Corporation Business Tax Extension, allows businesses to extend the deadline for filing their corporation business tax return. This extension is particularly important for corporations that need additional time to prepare their financial statements or gather necessary documentation. By filing this extension, businesses can avoid penalties associated with late submissions while ensuring compliance with state tax regulations.

Steps to Complete the NJ CBT Extension

Completing the NJ CBT Extension involves several key steps that must be followed to ensure accuracy and compliance:

- Gather necessary financial documents, including income statements and balance sheets.

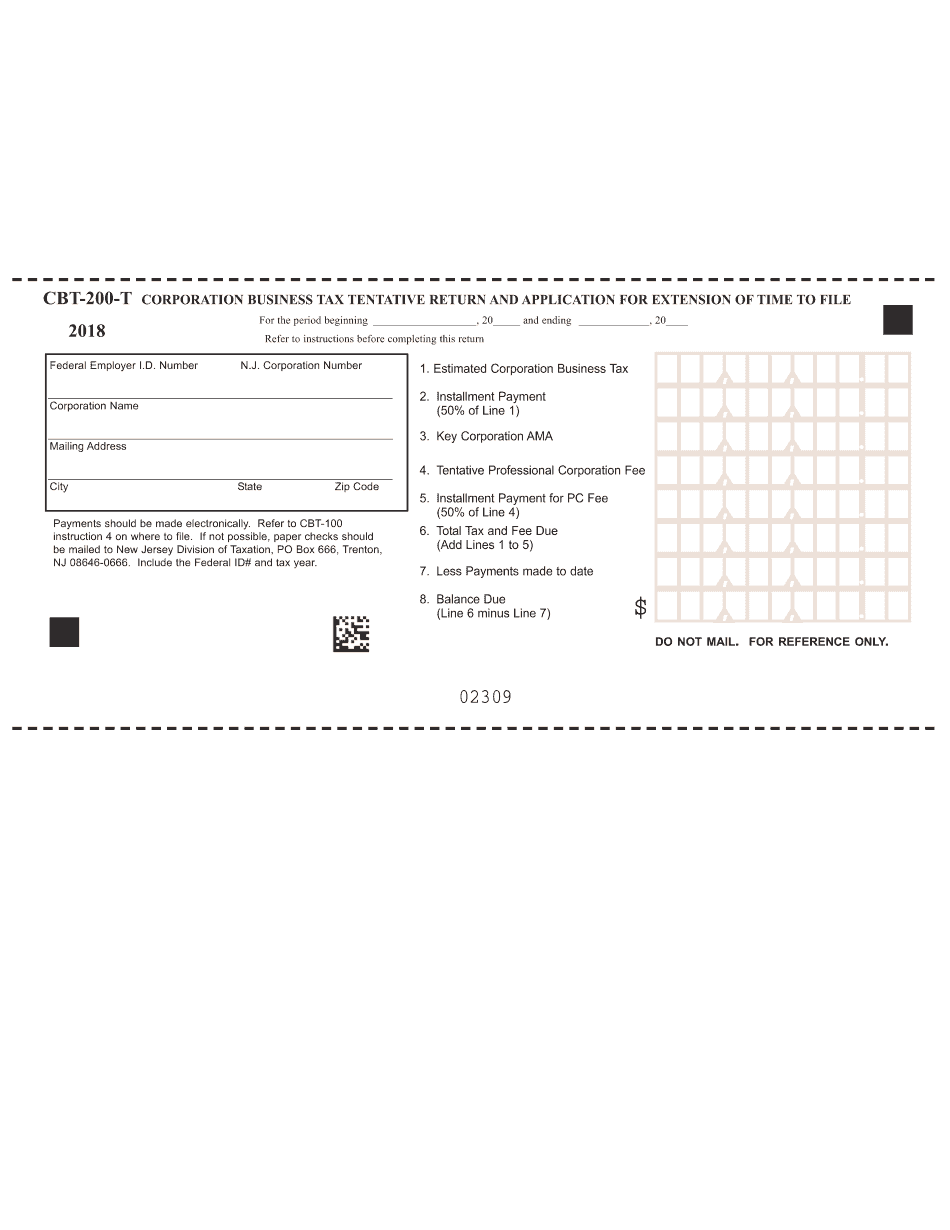

- Obtain the NJ CBT 200 T form, which is specifically designed for this extension.

- Fill out the form accurately, providing all required information, including the business name, address, and tax identification number.

- Calculate any estimated tax liability, if applicable, and include this information on the form.

- Review the completed form for accuracy before submission.

Legal Use of the NJ CBT Extension

The NJ CBT Extension is legally recognized under New Jersey tax law, allowing businesses to extend their filing deadline without incurring penalties. To ensure the extension is valid, it is essential to submit the form by the original due date of the tax return. This legal framework supports businesses in managing their tax obligations while maintaining compliance with state regulations.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the NJ CBT Extension is crucial for compliance. The standard due date for the NJ CBT 200 T form is typically the 15th day of the fourth month following the end of the corporation's tax year. For most businesses operating on a calendar year, this means the deadline is April 15. Filing the extension form on or before this date ensures that businesses can take advantage of the extended deadline without penalties.

Required Documents

To successfully file the NJ CBT Extension, businesses must prepare several key documents:

- Completed NJ CBT 200 T form.

- Financial statements, including income statements and balance sheets.

- Any supporting documentation that may be required for tax calculations.

Having these documents ready ensures a smooth filing process and helps avoid delays.

Form Submission Methods (Online / Mail / In-Person)

The NJ CBT Extension can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the New Jersey Division of Taxation website, which is often the quickest method.

- Mailing the completed form to the appropriate address provided by the state.

- In-person submission at designated tax offices, if preferred.

Each method has its own advantages, and businesses should choose the one that best fits their needs.

Quick guide on how to complete form cbt 200 t corporation business tax tentative return and

Prepare Nj Cbt Extension smoothly on any device

Digital document management has gained traction among companies and individuals. It presents a perfect eco-friendly substitute for conventional printed and signed papers, as you can obtain the correct form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Nj Cbt Extension on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

The easiest way to edit and eSign Nj Cbt Extension effortlessly

- Obtain Nj Cbt Extension and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nj Cbt Extension and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form cbt 200 t corporation business tax tentative return and

How to generate an electronic signature for your Form Cbt 200 T Corporation Business Tax Tentative Return And online

How to create an electronic signature for your Form Cbt 200 T Corporation Business Tax Tentative Return And in Google Chrome

How to make an electronic signature for signing the Form Cbt 200 T Corporation Business Tax Tentative Return And in Gmail

How to create an electronic signature for the Form Cbt 200 T Corporation Business Tax Tentative Return And right from your smart phone

How to create an electronic signature for the Form Cbt 200 T Corporation Business Tax Tentative Return And on iOS

How to generate an electronic signature for the Form Cbt 200 T Corporation Business Tax Tentative Return And on Android devices

People also ask

-

What is the cbt 200 t and how does it benefit my business?

The cbt 200 t is an advanced document signing solution designed to streamline the way you handle electronic signatures. By utilizing cbt 200 t, businesses can enhance productivity, reduce paperwork, and ensure secure transactions. This tool is perfect for companies looking to modernize their document workflow.

-

How does airSlate SignNow integrate with the cbt 200 t?

AirSlate SignNow fully supports the cbt 200 t by providing seamless integration features that allow you to manage documents effortlessly. By using airSlate SignNow alongside cbt 200 t, you can automate workflows and synchronize multiple applications. This integration enhances team collaboration and saves time.

-

What pricing options are available for the cbt 200 t?

The cbt 200 t comes with flexible pricing plans suited for various business needs. Whether you're a small startup or a large enterprise, there's a plan that fits your budget. Additional discounts may be available for annual subscriptions.

-

What features does the cbt 200 t offer that set it apart from competitors?

The cbt 200 t boasts unique features like customizable templates, secure storage, and real-time tracking of document status. These functionalities make it a versatile tool in the eSignature space, ensuring your business operates at maximum efficiency. With robust compliance and security measures, the cbt 200 t is a trusted option.

-

Can I try the cbt 200 t before committing to a purchase?

Yes, airSlate SignNow offers a free trial period for the cbt 200 t, allowing you to experience its features firsthand. This trial will help you understand how the cbt 200 t can fit into your business operations. Once you're satisfied, you can choose a suitable pricing plan to continue enjoying the benefits.

-

How secured is data handled with the cbt 200 t?

Security is a top priority for the cbt 200 t, which employs advanced encryption and compliance with industry regulations. This ensures that your sensitive documents and data are well-protected during the signing process. You can trust the cbt 200 t to offer a secure environment for all your electronic transactions.

-

What types of documents can I manage using the cbt 200 t?

The cbt 200 t supports a wide range of document types, including contracts, agreements, and forms. This versatility allows businesses from various sectors to utilize the tool for nearly any signing need. No matter the document, cbt 200 t simplifies the eSignature process.

Get more for Nj Cbt Extension

- Pdf forms for simple will

- Healthwell foundation forms 43620358

- Car payment contract template form

- Hr 039 form

- Supadopt 101 form

- Superior court of california county of solano local rules form

- Attorney or party without attorney name state ba 786647574 form

- Office of the district attorneymendocino county ca form

Find out other Nj Cbt Extension

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form