Char004 2018-2026

What is the Char004

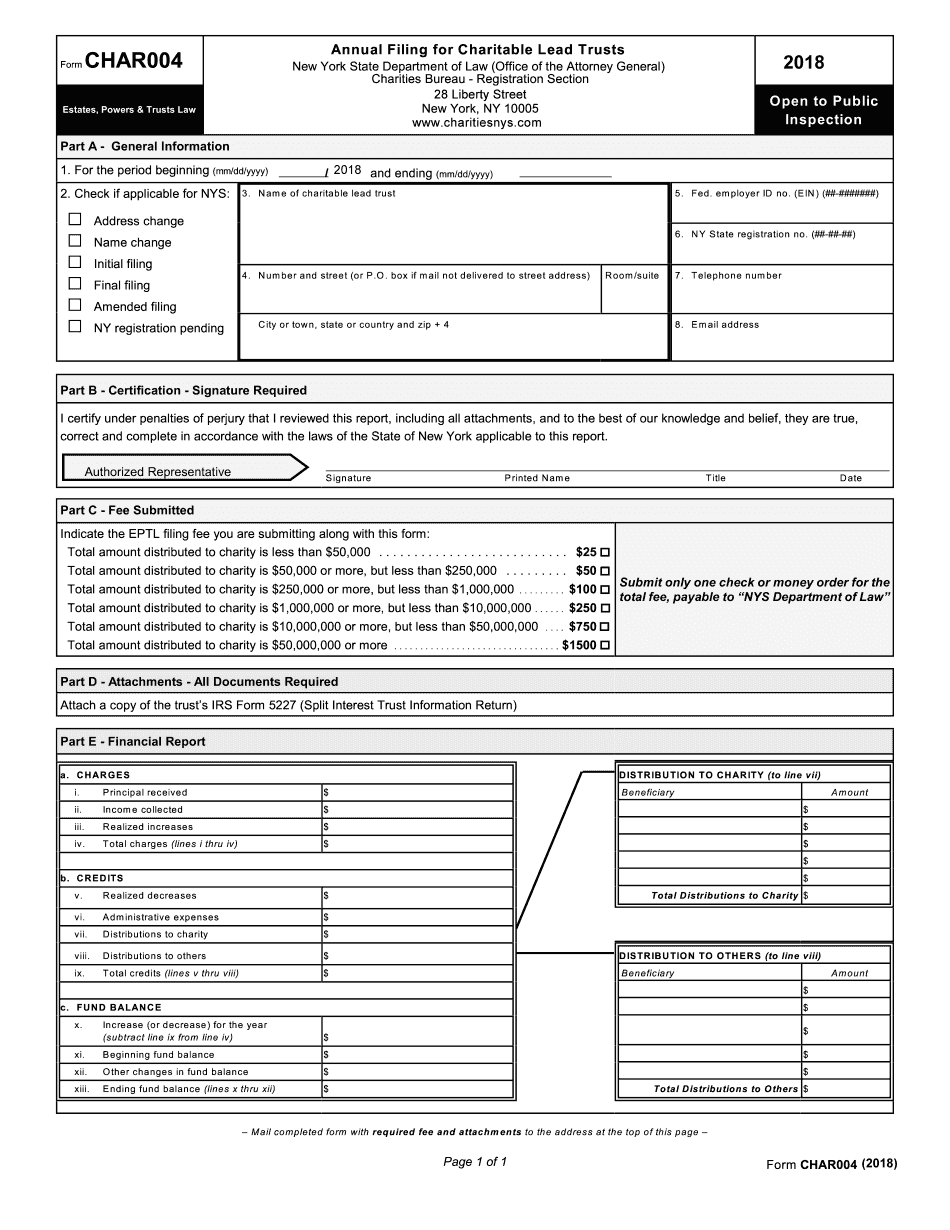

The Char004 form, also known as the Charity Distributed Line form, is a document used primarily by charitable organizations in the United States to report certain financial activities. This form is essential for maintaining transparency and compliance with federal regulations. It captures information regarding the distribution of funds and resources by charities, ensuring that they adhere to legal standards and guidelines set forth by the IRS.

How to use the Char004

Using the Char004 form involves several key steps. First, organizations must gather all necessary financial data, including income, expenses, and distributions made during the reporting period. Once the data is compiled, it can be entered into the Char004 form. It is crucial to ensure that all information is accurate and complete, as discrepancies can lead to compliance issues. After filling out the form, organizations should review it for accuracy before submission.

Steps to complete the Char004

Completing the Char004 form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including bank statements and receipts.

- Fill in the organization’s name, address, and tax identification number at the top of the form.

- Report total income and expenses in the designated sections.

- Detail the distributions made to beneficiaries, ensuring compliance with IRS guidelines.

- Review the completed form for accuracy and completeness.

- Submit the form by the required deadline, either electronically or via mail.

Legal use of the Char004

The Char004 form must be used in accordance with U.S. laws governing charitable organizations. This includes compliance with the IRS regulations regarding the reporting of financial activities. Proper use of the form ensures that organizations maintain their tax-exempt status and avoid potential penalties. It is vital for organizations to understand the legal implications of the information reported on the Char004 form.

Required Documents

To complete the Char004 form accurately, organizations must have several documents on hand. These include:

- Financial statements for the reporting period.

- Bank statements that reflect all transactions.

- Receipts for expenses incurred.

- Documentation of distributions made to beneficiaries.

Having these documents readily available will facilitate a smoother completion process and help ensure compliance with reporting requirements.

Form Submission Methods

The Char004 form can be submitted through various methods, depending on the preferences of the organization and the requirements of the IRS. The submission options include:

- Online submission through the IRS e-filing system, which is often the fastest method.

- Mailing a printed version of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Each method has its own guidelines and deadlines, so organizations should choose the one that best fits their needs.

Quick guide on how to complete char500 charities bureau

Complete Char004 seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a great environmentally friendly substitute for traditional printed and signed paperwork, as you can obtain the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Char004 on any platform with airSlate SignNow Android or iOS applications and streamline any document-focused process today.

How to modify and eSign Char004 with ease

- Find Char004 and then click Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your alterations.

- Decide how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and eSign Char004 and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the char500 charities bureau

How to make an eSignature for the Char500 Charities Bureau online

How to make an eSignature for your Char500 Charities Bureau in Chrome

How to make an eSignature for putting it on the Char500 Charities Bureau in Gmail

How to generate an eSignature for the Char500 Charities Bureau from your smart phone

How to create an electronic signature for the Char500 Charities Bureau on iOS

How to create an eSignature for the Char500 Charities Bureau on Android OS

People also ask

-

What is Char004 in relation to airSlate SignNow?

Char004 refers to a specific feature set within airSlate SignNow that enhances the eSigning experience. This feature enables users to streamline document workflows, making it easier to send, sign, and manage documents electronically.

-

How does Char004 improve document management?

With Char004, airSlate SignNow simplifies document management by automating repetitive tasks and ensuring that all signatures are collected efficiently. This leads to faster turnaround times and improved productivity for businesses.

-

What are the pricing options for Char004 on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the Char004 features. Customers can choose from monthly or annual subscriptions, ensuring they find a plan that fits their budget and needs.

-

Can Char004 integrate with other software?

Yes, Char004 is designed to seamlessly integrate with various software applications, enhancing your existing workflows. Users can connect airSlate SignNow with tools like CRM systems and project management platforms to boost efficiency.

-

What benefits does Char004 provide for small businesses?

Char004 offers small businesses a cost-effective solution to manage their document workflows. By utilizing airSlate SignNow's features, small enterprises can save time and resources while ensuring compliance and security in their document processes.

-

Is Char004 user-friendly for non-technical users?

Absolutely! Char004 within airSlate SignNow is designed with a user-friendly interface, making it accessible for non-technical users. The intuitive design allows anyone to easily send and eSign documents without extensive training.

-

How secure is Char004 in terms of data protection?

Char004 adheres to stringent security protocols to ensure that all documents are protected. With features like encryption and secure cloud storage, airSlate SignNow prioritizes the safety of your sensitive information.

Get more for Char004

- Medical certificate england golf form

- Medical certificate malaysia pdf form

- Affidavit of loss tin id form

- Jubilee insurance company of kenya limited form

- Llc contribution agreement llc capital contributions form

- Dilations and scale factors independent practice worksheet 517711039 form

- Chinese gender calendar form

- Pdf miscellaneous simple permit application form

Find out other Char004

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now