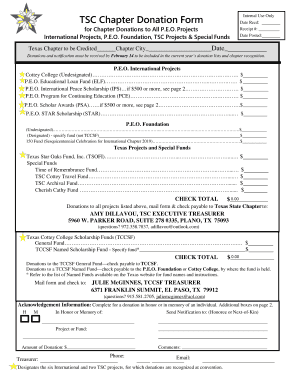

Peotexas Org Form

What is the Peotexas Org

The Peotexas Org is a nonprofit organization that facilitates charitable donations and provides donors with the necessary documentation for tax purposes. This organization plays a vital role in ensuring that donors receive valid receipts for their contributions, which can be used for tax deductions. Understanding the Peotexas Org is essential for both donors and organizations seeking to maintain compliance with IRS regulations.

Key elements of the Peotexas Org

Several key elements define the Peotexas Org and its operations. These include:

- Documentation: The organization issues donation receipts that include essential details such as the donor's name, the amount donated, and the date of the contribution.

- Tax Compliance: The Peotexas Org ensures that all receipts meet IRS standards, allowing donors to claim deductions on their tax returns.

- Transparency: The organization maintains transparent records of donations, which helps build trust between donors and the nonprofit sector.

IRS Guidelines

The IRS has specific guidelines regarding charitable donations and the issuance of receipts. Donors should be aware that:

- For donations over $250, a written acknowledgment from the Peotexas Org is required.

- The acknowledgment must include the organization’s name, the amount of the donation, and a statement indicating whether any goods or services were provided in exchange for the donation.

- Donors should retain their receipts for at least three years after filing their tax returns to ensure compliance with IRS regulations.

Steps to complete the Peotexas Org

Completing the donation process through the Peotexas Org involves several straightforward steps:

- Select a donation method: Choose whether to donate online, by mail, or in person.

- Fill out the donation form: Provide necessary information, including your name, address, and donation amount.

- Submit your donation: Complete the transaction based on your chosen method.

- Receive your donation receipt: The Peotexas Org will issue a receipt confirming your contribution, which you should keep for tax purposes.

Legal use of the Peotexas Org

The Peotexas Org operates within legal frameworks established for nonprofit organizations. This includes compliance with state and federal regulations governing charitable contributions. Organizations must ensure that:

- They are registered as a nonprofit entity.

- They adhere to financial reporting requirements.

- They provide accurate and timely receipts to all donors.

Form Submission Methods

Donors can submit their contributions to the Peotexas Org through various methods, ensuring convenience and accessibility:

- Online: Donations can be made through the organization's secure website.

- Mail: Donors may send checks or money orders to the organization's mailing address.

- In-Person: Contributions can also be made directly at designated locations during operational hours.

Quick guide on how to complete peotexas org

Finish Peotexas Org effortlessly on any gadget

Digital document administration has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the proper form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Peotexas Org on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest method to modify and eSign Peotexas Org with ease

- Locate Peotexas Org and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, the hassle of form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Peotexas Org and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the peotexas org

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a donations receipt and why is it important?

A donations receipt is a document provided to donors that acknowledges their contributions to a nonprofit organization. It is important for tax purposes, as donors can use it to claim deductions on their income tax returns. Using airSlate SignNow, you can easily create and send donations receipts to ensure your donors have the necessary documentation.

-

How can airSlate SignNow help me manage donations receipts?

airSlate SignNow offers a streamlined process for creating, sending, and eSigning donations receipts. With our user-friendly interface, you can customize receipts to include your organization's branding and specific donation details. This ensures that your donors receive professional and accurate documentation quickly.

-

Is there a cost associated with using airSlate SignNow for donations receipts?

Yes, airSlate SignNow offers various pricing plans that cater to different organizational needs. Our plans are designed to be cost-effective, allowing you to manage donations receipts without breaking the bank. You can choose a plan that fits your budget while still benefiting from our robust features.

-

Can I integrate airSlate SignNow with other tools for managing donations?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and fundraising platforms, allowing you to manage donations and receipts in one place. This integration helps streamline your workflow, making it easier to track donations and generate receipts efficiently.

-

What features does airSlate SignNow offer for creating donations receipts?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning for donations receipts. You can easily add fields for donor information and donation amounts, ensuring that all necessary details are captured. This makes the process of generating receipts quick and hassle-free.

-

How secure is the information on donations receipts created with airSlate SignNow?

Security is a top priority at airSlate SignNow. All donations receipts created and sent through our platform are protected with advanced encryption and secure storage. This ensures that sensitive donor information remains confidential and safe from unauthorized access.

-

Can I track the status of donations receipts sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of donations receipts in real-time. You can see when a receipt has been sent, viewed, and signed, providing you with complete visibility over your documentation process. This feature helps you stay organized and ensures that your donors receive their receipts promptly.

Get more for Peotexas Org

- Warranty deed from two individuals to llc nebraska form

- Subcontractors information statement corporation or llc nebraska

- Request for information from prime contractor individual nebraska

- Quitclaim deed by two individuals to corporation nebraska form

- Warranty deed from two individuals to corporation nebraska form

- Request for information from prime contractor corporation or llc nebraska

- Prime contractors information statement individual nebraska

- Quitclaim deed from individual to corporation nebraska form

Find out other Peotexas Org

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself