Form 144 Waiver of the Time Period for Assessment Sbr Gov Bc

What is the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc

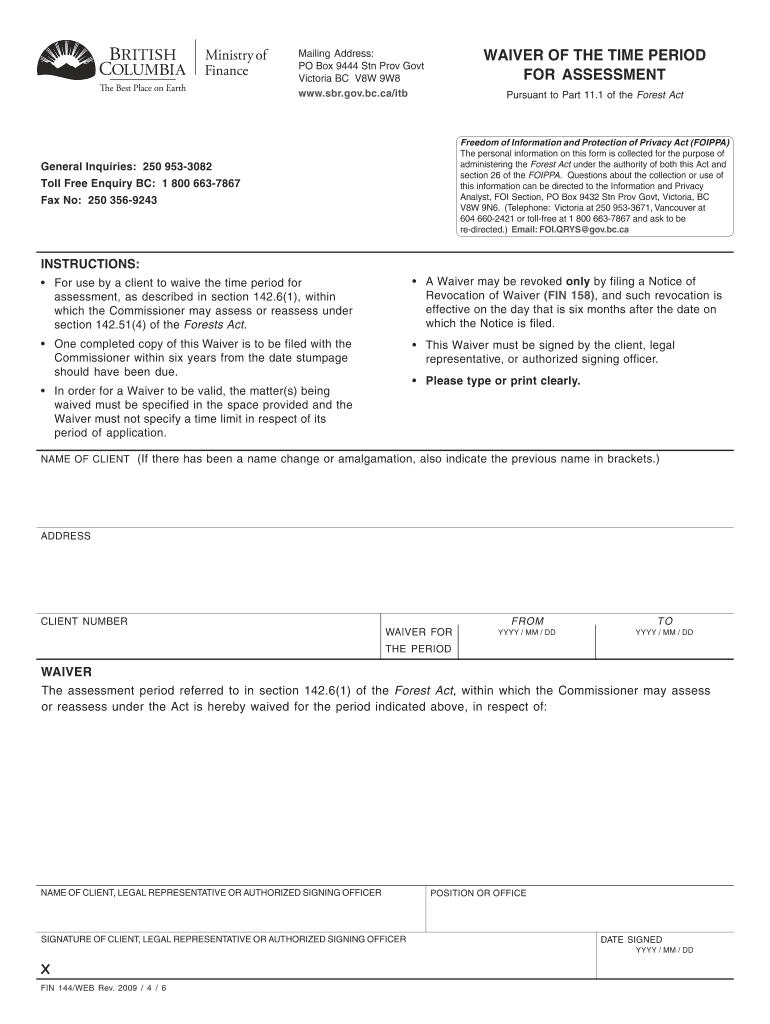

The Form 144 Waiver Of The Time Period For Assessment is a legal document used by taxpayers to waive the statutory time limits for the assessment of taxes. This form is particularly relevant in situations where a taxpayer may need to extend the period during which the IRS can assess additional taxes or penalties. It is often utilized in cases involving audits, disputes, or other tax-related issues that require additional time for resolution. By submitting this form, taxpayers agree to extend the assessment period, allowing for a thorough review of their tax situation.

How to use the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc

Using the Form 144 Waiver involves a few straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from the IRS or relevant tax authority. Next, fill out the form with accurate information, including your personal details and the specific tax year in question. Once completed, submit the form to the appropriate tax authority, either electronically or by mail, depending on the submission options available. It is essential to keep a copy of the submitted form for your records.

Steps to complete the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc

Completing the Form 144 Waiver requires careful attention to detail. Follow these steps:

- Obtain the form from the IRS or your local tax authority.

- Provide your name, address, and taxpayer identification number.

- Indicate the tax year for which you are waiving the assessment period.

- Sign and date the form to validate your request.

- Submit the completed form as instructed, ensuring you meet any deadlines.

Legal use of the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc

The legal use of the Form 144 Waiver is significant in tax law. By signing this waiver, taxpayers legally agree to extend the time frame during which the IRS can assess taxes. This can be beneficial in various scenarios, such as ongoing audits or when additional documentation is needed to clarify tax obligations. It's crucial to understand that submitting this form does not eliminate tax liabilities but rather extends the time for assessment, providing an opportunity for taxpayers to address any outstanding issues.

Eligibility Criteria

To be eligible to use the Form 144 Waiver, taxpayers must meet certain criteria. Generally, it is available to individuals and businesses facing an audit or review by the IRS. Taxpayers should also be in good standing with their tax obligations and not currently under any legal restrictions that would prevent them from filing the form. Understanding these criteria is essential to ensure that the waiver is applicable to your specific tax situation.

Filing Deadlines / Important Dates

Filing deadlines for the Form 144 Waiver are crucial to ensure compliance with tax regulations. Typically, the form must be submitted before the expiration of the standard assessment period, which is usually three years from the date of filing the tax return. However, if you are involved in an audit or other proceedings, it is advisable to submit the waiver as soon as possible to avoid any lapses in the assessment period. Keeping track of these important dates can help prevent potential penalties or complications.

Quick guide on how to complete form 144 waiver of the time period for assessment sbr gov bc

Effortlessly Prepare [SKS] on Any Device

Online document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to generate, edit, and eSign your documents quickly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS apps and enhance any document-centered task today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, cumbersome form searching, or corrections that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc

Create this form in 5 minutes!

How to create an eSignature for the form 144 waiver of the time period for assessment sbr gov bc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc?

The Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc is a legal document that allows businesses to waive the standard assessment period for certain tax obligations. This form is essential for ensuring compliance with provincial regulations while streamlining the assessment process.

-

How can airSlate SignNow help with the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc. Our user-friendly interface simplifies the document management process, ensuring that you can focus on your business operations.

-

What are the pricing options for using airSlate SignNow for the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you need basic features or advanced functionalities for the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc, we have a plan that fits your budget.

-

Are there any integrations available for managing the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc alongside your existing tools. This integration enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc?

Using airSlate SignNow for the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled efficiently and securely.

-

Is airSlate SignNow secure for handling the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc. We prioritize data security and compliance to give you peace of mind.

-

Can I track the status of my Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc

- 06mp050e notice of responsibilities regarding online training okdhs form

- Pmw certificate form

- This is not a check watermark form

- Fillable map of north america form

- Vad 20 reassignment form

- Patient registration form 62078642

- Seminole tribe of florida environmental resource management department permits form

- Adc sp 908m form

Find out other Form 144 Waiver Of The Time Period For Assessment Sbr Gov Bc

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU