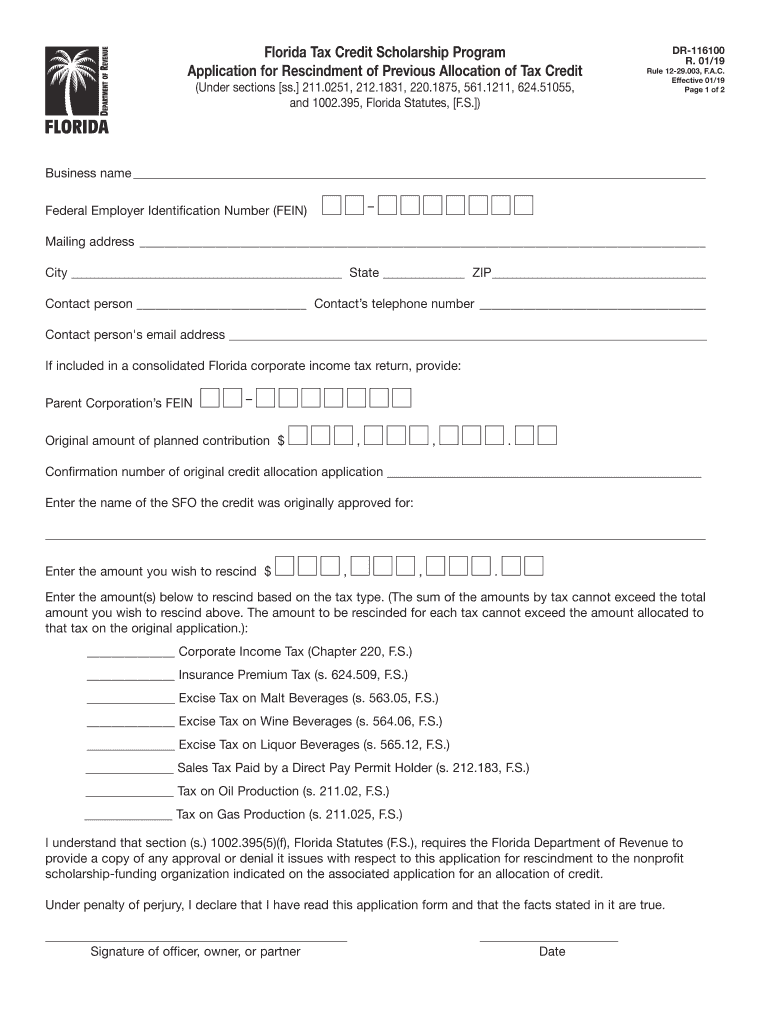

Application for Rescindment of Previous Allocation of Tax Credit Form

What is the application for rescindment of previous allocation of tax credit?

The application for rescindment of previous allocation of tax credit is a formal request made by taxpayers to revoke or cancel a previously claimed tax credit. This process is essential when a taxpayer realizes that the credit was claimed in error or if there are changes in eligibility. Understanding this application is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

Steps to complete the application for rescindment of previous allocation of tax credit

Completing the application involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including previous tax returns and any supporting evidence for the rescindment.

- Fill out the application form accurately, ensuring all information is current and reflects the reasons for rescindment.

- Review the completed application for any errors or omissions.

- Submit the application through the appropriate channels, which may include online submission or mailing to the relevant tax authority.

Legal use of the application for rescindment of previous allocation of tax credit

The application must adhere to legal standards set forth by the IRS and state tax authorities. This includes providing accurate information and adhering to deadlines. Proper legal use ensures that the rescindment is recognized and processed without complications, safeguarding the taxpayer from potential legal issues.

Filing deadlines / important dates

Timeliness is crucial when submitting the application for rescindment. Key deadlines typically align with tax filing periods. Taxpayers should be aware of specific dates to ensure that their application is filed within the required timeframe to avoid penalties or complications with their tax status.

Required documents

To successfully complete the application, certain documents are typically required:

- Previous tax returns that reflect the allocation of the tax credit.

- Any correspondence from the IRS or state tax authority regarding the credit.

- Supporting documentation that justifies the rescindment request.

Eligibility criteria

Eligibility for rescindment of a tax credit varies based on the specific credit and circumstances surrounding the claim. Generally, taxpayers must demonstrate that the credit was claimed erroneously or that their eligibility has changed. It is important to review the criteria set forth by the IRS or state tax authorities to ensure compliance.

Application process & approval time

The application process involves submitting the completed form along with any required documentation. Approval times can vary based on the complexity of the case and the volume of applications being processed by the tax authority. Taxpayers should allow adequate time for processing and follow up if necessary.

Quick guide on how to complete application for rescindment of previous allocation of tax credit

Effortlessly Prepare Application For Rescindment Of Previous Allocation Of Tax Credit on Any Device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the correct template and securely archive it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents swiftly without complications. Handle Application For Rescindment Of Previous Allocation Of Tax Credit on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Edit and eSign Application For Rescindment Of Previous Allocation Of Tax Credit with Ease

- Locate Application For Rescindment Of Previous Allocation Of Tax Credit and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Application For Rescindment Of Previous Allocation Of Tax Credit to ensure seamless communication at any point during the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for rescindment of previous allocation of tax credit

How to make an eSignature for the Application For Rescindment Of Previous Allocation Of Tax Credit online

How to generate an electronic signature for your Application For Rescindment Of Previous Allocation Of Tax Credit in Google Chrome

How to create an eSignature for putting it on the Application For Rescindment Of Previous Allocation Of Tax Credit in Gmail

How to generate an electronic signature for the Application For Rescindment Of Previous Allocation Of Tax Credit straight from your smartphone

How to generate an eSignature for the Application For Rescindment Of Previous Allocation Of Tax Credit on iOS devices

How to create an electronic signature for the Application For Rescindment Of Previous Allocation Of Tax Credit on Android OS

People also ask

-

What is rescindment tax and how does it apply to my business?

Rescindment tax refers to the tax implications that can arise when a signed contract is annulled or rescinded. Understanding this tax is essential for businesses as it can affect their financial reporting and obligations. By comprehending the nuances of rescindment tax, you can better navigate your contract management process and avoid unexpected liabilities.

-

How can airSlate SignNow help manage rescindment tax documentation?

AirSlate SignNow simplifies the process of managing documents that may be subject to rescindment tax. With our easy-to-use platform, you can securely eSign, store, and manage all necessary contracts while staying compliant with tax regulations. This efficiency allows businesses to focus on growth rather than getting bogged down by paperwork.

-

What features does airSlate SignNow offer for managing rescindment tax?

Our platform includes customizable templates, real-time tracking, and audit trails that are invaluable for managing rescindment tax situations. These features ensure that all parties are aware of the potential tax implications of contract rescindment. Additionally, our integration options allow you to keep track of documents across various applications.

-

Is airSlate SignNow cost-effective for small businesses dealing with rescindment tax?

Yes, airSlate SignNow provides a cost-effective solution for small businesses, especially in navigating challenges like rescindment tax. With flexible pricing plans, you can choose the options that best suit your needs without compromising on essential features. Investing in our platform can ultimately save money by streamlining your document management processes.

-

Can I integrate airSlate SignNow with my existing tools to manage rescindment tax?

Absolutely, airSlate SignNow offers seamless integrations with popular business tools which can enhance your ability to manage rescindment tax-related documents. Whether you're using CRM software, accounting programs, or other applications, integrating SignNow can streamline your workflows. This connectivity ensures that you maintain comprehensive records while simplifying the management of your contracts.

-

What benefits can I expect from using airSlate SignNow for rescindment tax documentation?

Using airSlate SignNow for rescindment tax documentation provides several benefits including enhanced compliance, reduced errors, and increased efficiency in document handling. Our user-friendly platform ensures that you can quickly prepare and eSign documents, thereby minimizing the risk of penalties related to rescindment tax. This leads to better focus on your core business activities.

-

How does airSlate SignNow ensure compliance with rescindment tax laws?

AirSlate SignNow prioritizes compliance by offering features that allow for secure storage and easy retrieval of eSigned documents that may need to be reviewed under rescindment tax laws. Our platform regularly updates to accommodate changing regulations, giving you peace of mind. By maintaining accurate documentation, you can navigate rescindment tax laws effectively.

Get more for Application For Rescindment Of Previous Allocation Of Tax Credit

- We present the following information in order to obtain the aforesaid renewal of our license ocs gobierno

- Iuclangref doc form

- Claim form 1details of main memberguardian member

- Tenant from landlord contract template form

- Termination clause contract template form

- Termination contract template form

- Termination notice contract template form

- Termination of by mutual consent contract template form

Find out other Application For Rescindment Of Previous Allocation Of Tax Credit

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed