Fl Sales Tax Form

What is the Florida Sales Tax Form?

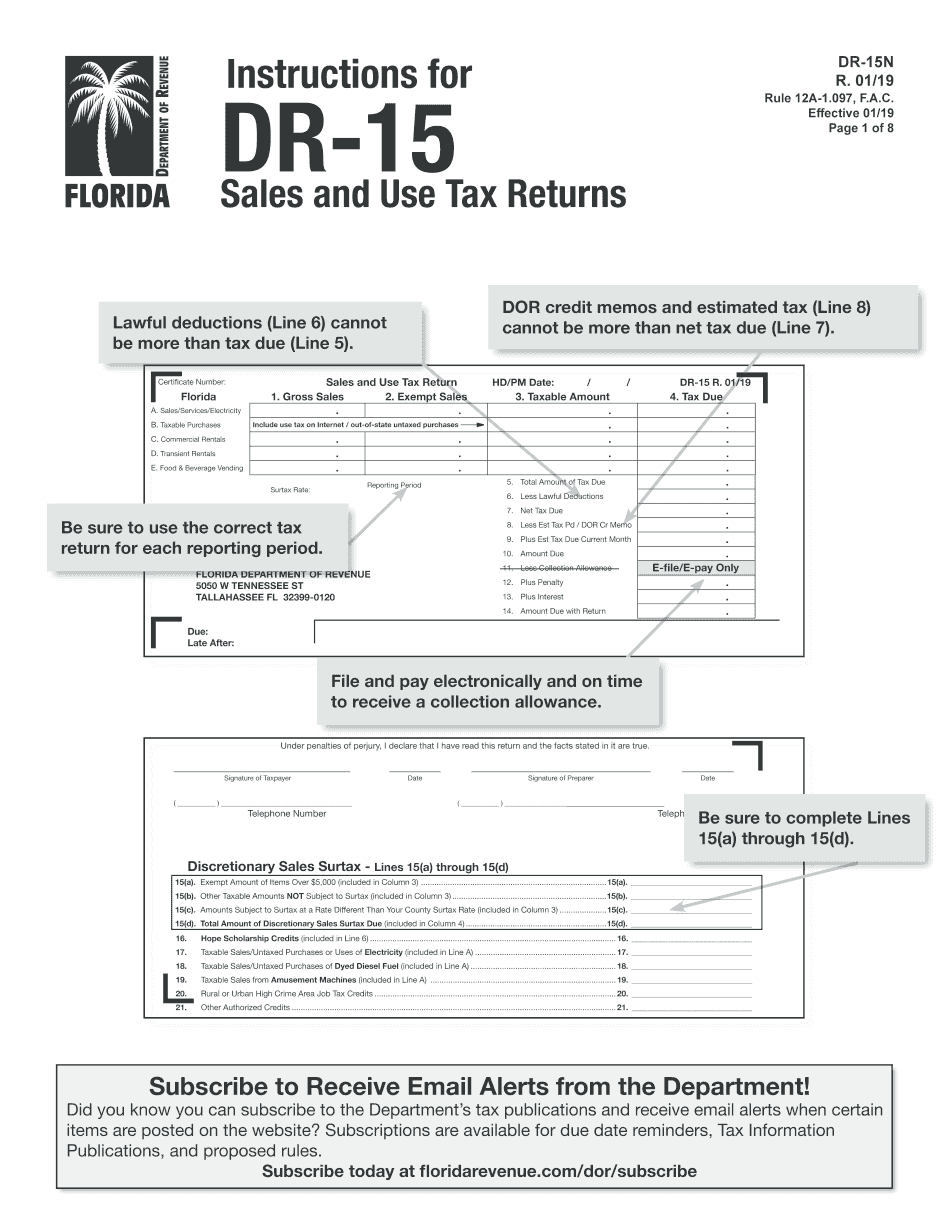

The Florida Sales Tax Form, commonly referred to as the DR-15, is an essential document used by businesses in Florida to report and remit sales tax collected from customers. This form is required for all entities that make taxable sales, leases, or rentals of tangible personal property within the state. The DR-15 form includes sections for reporting gross sales, exempt sales, and the total sales tax due, ensuring compliance with Florida state tax regulations. Understanding the purpose and requirements of this form is crucial for maintaining proper tax records and fulfilling state obligations.

Steps to Complete the Florida Sales Tax Form

Completing the Florida Sales Tax Form involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records, including invoices and receipts, to determine your gross sales for the reporting period. Next, identify any exempt sales that qualify for exclusion from taxable sales. Then, calculate the total sales tax due by applying the appropriate Florida sales tax rate to your taxable sales. Finally, fill out the DR-15 form with the calculated figures, ensuring all information is accurate before submission.

Legal Use of the Florida Sales Tax Form

The Florida Sales Tax Form is legally binding when completed correctly and submitted in accordance with state regulations. To be considered valid, the form must include accurate financial information and be signed by an authorized representative of the business. Electronic submissions of the DR-15 form are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, allowing for a legal digital signature. Ensuring compliance with these legal requirements protects businesses from potential penalties and audits.

Filing Deadlines / Important Dates

Filing deadlines for the Florida Sales Tax Form are crucial for businesses to avoid penalties. Generally, the DR-15 form must be filed monthly, quarterly, or annually, depending on the volume of sales. Monthly filers must submit the form by the 20th of the month following the reporting period, while quarterly and annual filers have different deadlines. It is important to stay informed about these dates to ensure timely submissions and maintain compliance with Florida state tax laws.

Form Submission Methods

The Florida Sales Tax Form can be submitted through various methods to accommodate different business needs. Businesses can file the DR-15 form online through the Florida Department of Revenue's website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed to the appropriate address provided by the state or submitted in person at designated offices. Each submission method has specific guidelines, so it is essential to follow the instructions carefully to ensure proper processing.

Key Elements of the Florida Sales Tax Form

The DR-15 form includes several key elements that must be accurately completed to ensure compliance with Florida state tax regulations. These elements typically include sections for reporting gross sales, exempt sales, and the total sales tax collected. Additionally, the form requires the business's name, address, and sales tax registration number. Accurate completion of these sections is vital for determining the correct amount of sales tax owed and avoiding potential discrepancies during audits.

Penalties for Non-Compliance

Failing to comply with the requirements of the Florida Sales Tax Form can result in significant penalties for businesses. Common penalties include fines for late submissions, interest on unpaid sales tax, and potential audits by the Florida Department of Revenue. Businesses that consistently fail to file or remit sales tax may face more severe consequences, including the suspension of their sales tax certificate. Understanding these penalties emphasizes the importance of timely and accurate filing of the DR-15 form.

Quick guide on how to complete dor credit memos and estimated tax line 8

Set Up Fl Sales Tax Form Effortlessly on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, modify, and eSign your documents quickly without interruptions. Manage Fl Sales Tax Form on any device using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest method to modify and eSign Fl Sales Tax Form effortlessly

- Acquire Fl Sales Tax Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choice. Edit and eSign Fl Sales Tax Form while ensuring seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dor credit memos and estimated tax line 8

How to create an eSignature for your Dor Credit Memos And Estimated Tax Line 8 online

How to generate an electronic signature for your Dor Credit Memos And Estimated Tax Line 8 in Google Chrome

How to make an eSignature for putting it on the Dor Credit Memos And Estimated Tax Line 8 in Gmail

How to make an electronic signature for the Dor Credit Memos And Estimated Tax Line 8 from your mobile device

How to generate an electronic signature for the Dor Credit Memos And Estimated Tax Line 8 on iOS devices

How to generate an eSignature for the Dor Credit Memos And Estimated Tax Line 8 on Android

People also ask

-

What is the FL Sales Tax Form and why is it important?

The FL Sales Tax Form is a crucial document that businesses in Florida must file to report and pay sales tax to the state. Properly completing this form ensures compliance with state tax regulations, avoiding penalties and interest charges. Using airSlate SignNow simplifies the process of signing and submitting your FL Sales Tax Form electronically, making it quick and efficient.

-

How can airSlate SignNow help me with the FL Sales Tax Form?

airSlate SignNow provides an easy-to-use platform that allows businesses to create, send, and eSign the FL Sales Tax Form securely. Our tool streamlines the entire process, enabling you to fill out the form digitally and obtain necessary signatures promptly. This ensures that your FL Sales Tax Form is completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for filing the FL Sales Tax Form?

Yes, airSlate SignNow offers a cost-effective solution for filing the FL Sales Tax Form. Our competitive pricing plans cater to businesses of all sizes, allowing you to manage your document signing needs without breaking the bank. With airSlate SignNow, you can save both time and money while ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for managing the FL Sales Tax Form?

airSlate SignNow includes features designed specifically for managing the FL Sales Tax Form, such as customizable templates, automated reminders, and secure eSigning. Additionally, our platform allows you to track the status of your documents in real time, ensuring you never miss a deadline. These features make completing and submitting your FL Sales Tax Form hassle-free.

-

Can I integrate airSlate SignNow with other software for submitting the FL Sales Tax Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to streamline the submission of your FL Sales Tax Form. By connecting your existing tools with airSlate SignNow, you can enhance your workflow and ensure that all necessary data is included in your tax filings.

-

What are the benefits of using airSlate SignNow for the FL Sales Tax Form?

Using airSlate SignNow for the FL Sales Tax Form offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. Our platform eliminates the need for printing and scanning, allowing you to eSign documents from anywhere. This convenience ultimately leads to timely submissions and peace of mind regarding your tax obligations.

-

Is airSlate SignNow secure for handling the FL Sales Tax Form?

Yes, airSlate SignNow prioritizes security when handling sensitive documents like the FL Sales Tax Form. We use advanced encryption and secure cloud storage to protect your data throughout the signing process. You can trust that your information is safe with airSlate SignNow, allowing you to focus on your business.

Get more for Fl Sales Tax Form

Find out other Fl Sales Tax Form

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter