Instructions for Alaska Electric Cooperative Gross Revenue Tax Form

What is the Instructions For Alaska Electric Cooperative Gross Revenue Tax

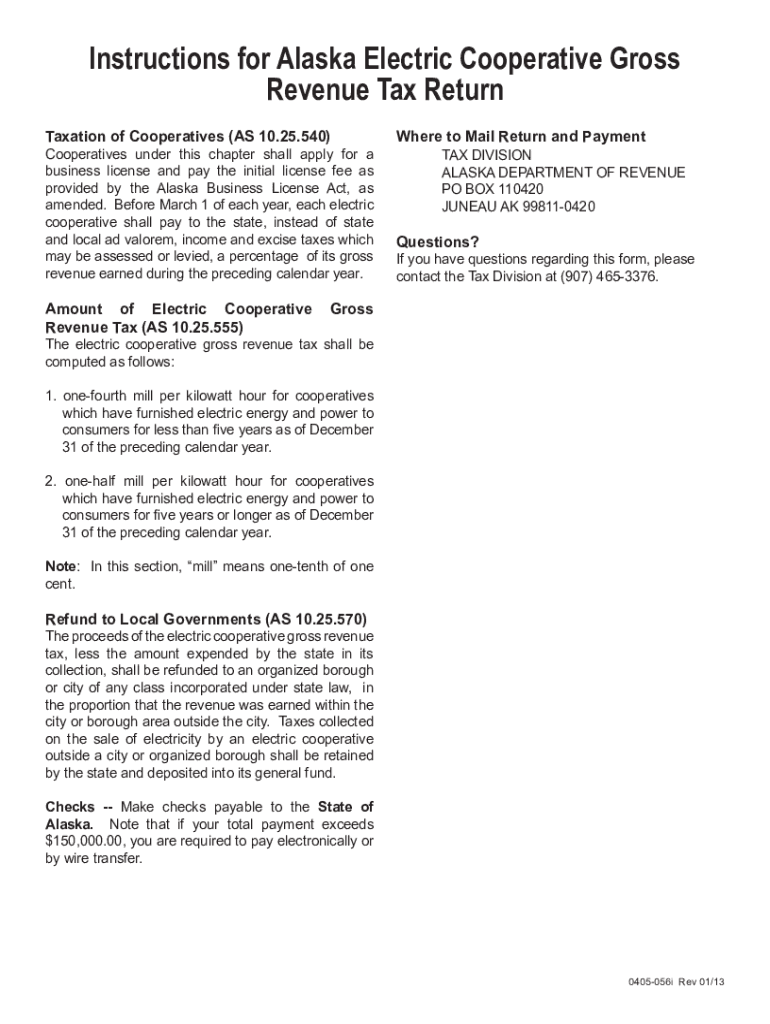

The Instructions For Alaska Electric Cooperative Gross Revenue Tax provide essential guidelines for electric cooperatives in Alaska to comply with state tax regulations. This document outlines the requirements for reporting gross revenue and ensuring accurate tax calculations. It is crucial for cooperatives to understand these instructions to maintain compliance and avoid penalties.

Steps to complete the Instructions For Alaska Electric Cooperative Gross Revenue Tax

Completing the Instructions For Alaska Electric Cooperative Gross Revenue Tax involves several key steps:

- Gather all necessary financial documents, including revenue statements and expense reports.

- Review the specific tax rates applicable to your cooperative based on the latest state regulations.

- Calculate the gross revenue by summing all income sources, ensuring to exclude any non-taxable revenue.

- Fill out the required forms accurately, following the guidelines provided in the instructions.

- Submit the completed forms by the specified deadline, ensuring that all information is correct to avoid delays.

Filing Deadlines / Important Dates

It is important for electric cooperatives to be aware of the filing deadlines associated with the Gross Revenue Tax. Typically, the tax forms must be submitted annually by a specific date, which is set by the state. Cooperatives should mark these dates on their calendars to ensure timely submission and avoid late fees.

Required Documents

To successfully complete the Instructions For Alaska Electric Cooperative Gross Revenue Tax, several documents are typically required:

- Financial statements detailing gross revenue.

- Expense reports that may affect taxable income.

- Any previous tax returns that provide context for current filings.

- Supporting documentation for any deductions claimed.

Legal use of the Instructions For Alaska Electric Cooperative Gross Revenue Tax

The legal use of the Instructions For Alaska Electric Cooperative Gross Revenue Tax ensures that cooperatives adhere to state laws regarding tax obligations. Understanding these legalities helps prevent non-compliance, which can lead to penalties or legal repercussions. Cooperatives should regularly review the instructions to stay updated on any changes in legislation.

Who Issues the Form

The form associated with the Instructions For Alaska Electric Cooperative Gross Revenue Tax is issued by the Alaska Department of Revenue. This agency is responsible for overseeing tax collection and ensuring that cooperatives fulfill their tax responsibilities according to state laws.

Quick guide on how to complete instructions for alaska electric cooperative gross revenue tax

Complete Instructions For Alaska Electric Cooperative Gross Revenue Tax effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Instructions For Alaska Electric Cooperative Gross Revenue Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Instructions For Alaska Electric Cooperative Gross Revenue Tax with ease

- Find Instructions For Alaska Electric Cooperative Gross Revenue Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link—or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Instructions For Alaska Electric Cooperative Gross Revenue Tax and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for alaska electric cooperative gross revenue tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Alaska Electric Cooperative Gross Revenue Tax?

The Instructions For Alaska Electric Cooperative Gross Revenue Tax provide detailed guidelines on how to calculate and report gross revenue taxes for electric cooperatives in Alaska. These instructions help ensure compliance with state regulations and simplify the tax filing process.

-

How can airSlate SignNow assist with the Instructions For Alaska Electric Cooperative Gross Revenue Tax?

airSlate SignNow offers a streamlined platform for managing documents related to the Instructions For Alaska Electric Cooperative Gross Revenue Tax. Users can easily create, send, and eSign necessary forms, ensuring that all tax-related documents are handled efficiently and securely.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These features are particularly beneficial for managing the Instructions For Alaska Electric Cooperative Gross Revenue Tax, making the process faster and more organized.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing tax documents, including the Instructions For Alaska Electric Cooperative Gross Revenue Tax. With various pricing plans available, businesses can choose an option that fits their budget while still accessing powerful document management tools.

-

Can airSlate SignNow integrate with other accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing users to manage their financial documents alongside the Instructions For Alaska Electric Cooperative Gross Revenue Tax. This integration helps streamline workflows and ensures that all tax-related information is easily accessible.

-

What are the benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow for tax compliance, including the Instructions For Alaska Electric Cooperative Gross Revenue Tax, offers numerous benefits. These include enhanced document security, reduced processing time, and improved accuracy in tax filings, ultimately leading to a more efficient compliance process.

-

How does airSlate SignNow ensure the security of tax documents?

airSlate SignNow prioritizes the security of all documents, including those related to the Instructions For Alaska Electric Cooperative Gross Revenue Tax. The platform employs advanced encryption, secure cloud storage, and compliance with industry standards to protect sensitive information.

Get more for Instructions For Alaska Electric Cooperative Gross Revenue Tax

- Control number tx sdeed 8 33 form

- Control number tx sdeed8 34 form

- 23 printable warranty deed form templates fillable

- Life estate wikipedia form

- Individuals to city form

- I affiant do solemnly swear or affirm that i have not directly or indirectly paid form

- Statement of electedappointed officer texas dshs form

- Dwc form 001 employers first report of injury or illness

Find out other Instructions For Alaska Electric Cooperative Gross Revenue Tax

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple