Form Dr 659

What is the Form DR 659?

The Form DR 659 is a document used primarily for Florida sales tax purposes. It is essential for businesses operating within the state to report and remit sales tax accurately. This form serves as a declaration of sales tax collected and is crucial for compliance with Florida tax regulations. Understanding the purpose of Form DR 659 helps ensure that businesses fulfill their tax obligations and avoid potential penalties.

How to Use the Form DR 659

Using Form DR 659 involves several key steps. First, businesses must gather all necessary sales data for the reporting period. This includes total sales, taxable sales, and any exemptions. Once the data is collected, it should be entered into the appropriate fields on the form. After completing the form, businesses can submit it electronically or via mail, depending on their preference and compliance requirements. Ensuring accuracy in this process is vital for maintaining good standing with Florida tax authorities.

Steps to Complete the Form DR 659

Completing Form DR 659 requires careful attention to detail. Here are the essential steps:

- Gather sales records for the reporting period.

- Determine the total sales and taxable sales amounts.

- Fill in the required fields on the form accurately.

- Review the completed form for errors or omissions.

- Submit the form electronically or by mail by the due date.

Following these steps helps ensure that the form is completed correctly and submitted on time, reducing the risk of penalties.

Legal Use of the Form DR 659

The legal use of Form DR 659 is governed by Florida state tax laws. This form must be filed accurately to comply with the Florida Department of Revenue regulations. Failure to file the form or inaccuracies can lead to penalties, including fines and interest on unpaid taxes. Businesses should familiarize themselves with the legal implications of using this form to ensure compliance and avoid potential legal issues.

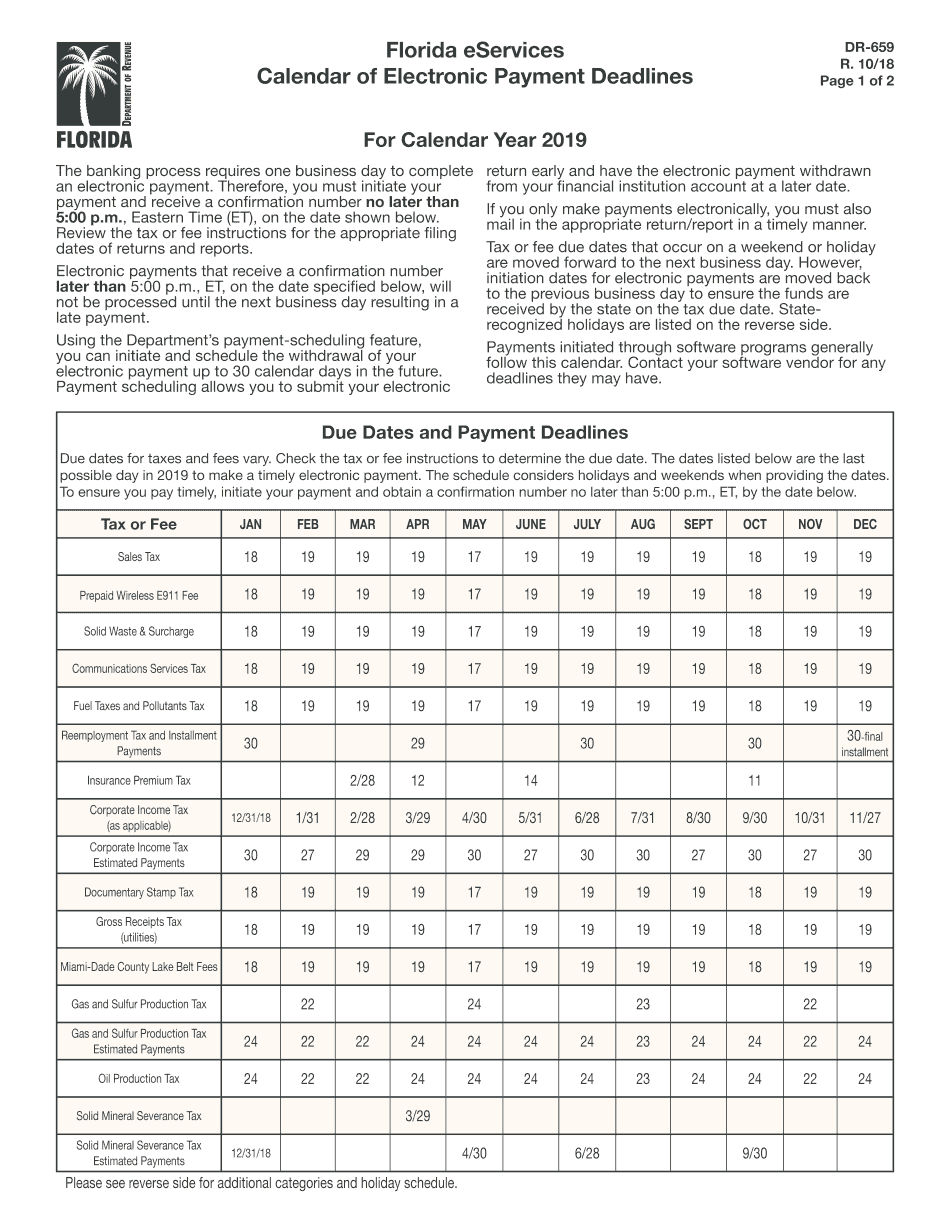

Filing Deadlines / Important Dates

Filing deadlines for Form DR 659 are crucial for businesses to avoid penalties. Typically, the form must be submitted on a monthly basis, with specific due dates set by the Florida Department of Revenue. It is essential for businesses to keep track of these deadlines to ensure timely submission. Missing a deadline can result in late fees and interest charges, impacting overall business finances.

Form Submission Methods

Form DR 659 can be submitted through various methods, providing flexibility for businesses. The primary submission methods include:

- Online Submission: Businesses can file electronically through the Florida Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the state.

- In-Person Submission: Businesses may also choose to deliver the form in person at designated state offices.

Choosing the right submission method can streamline the filing process and ensure compliance.

Quick guide on how to complete dr 659 r 10 18indd

Complete Form Dr 659 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly and without issues. Manage Form Dr 659 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest method to alter and eSign Form Dr 659 with ease

- Find Form Dr 659 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive data with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, exhausting form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you select. Modify and eSign Form Dr 659 to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 659 r 10 18indd

How to generate an eSignature for your Dr 659 R 10 18indd online

How to make an electronic signature for the Dr 659 R 10 18indd in Chrome

How to create an eSignature for putting it on the Dr 659 R 10 18indd in Gmail

How to create an electronic signature for the Dr 659 R 10 18indd straight from your smart phone

How to create an eSignature for the Dr 659 R 10 18indd on iOS devices

How to create an electronic signature for the Dr 659 R 10 18indd on Android OS

People also ask

-

What is Form Dr 659 and how does it work with airSlate SignNow?

Form Dr 659 is a specific document used for certain regulatory purposes. With airSlate SignNow, you can easily complete and eSign Form Dr 659 online, ensuring that your submission is efficient and compliant. The platform's user-friendly interface simplifies the entire process, allowing you to focus on what matters most.

-

How can I integrate Form Dr 659 into my existing workflow using airSlate SignNow?

Integrating Form Dr 659 into your workflow with airSlate SignNow is seamless. Our platform allows you to upload, edit, and share Form Dr 659 directly within your document management system. Additionally, you can automate notifications and reminders to streamline the signing process.

-

What are the pricing options for using airSlate SignNow to manage Form Dr 659?

airSlate SignNow offers flexible pricing plans that cater to various business needs. You can access essential features for managing Form Dr 659 at a competitive rate, making it a cost-effective solution for eSigning documents. Check our website for detailed pricing tiers and choose the one that best fits your requirements.

-

Are there any benefits to using airSlate SignNow for Form Dr 659?

Using airSlate SignNow for Form Dr 659 provides numerous benefits, including enhanced security features and compliance with legal regulations. The platform ensures that your documents are securely stored and easily accessible, promoting efficiency in your signing process. Moreover, real-time tracking allows you to monitor the status of your Form Dr 659 effortlessly.

-

Can I customize Form Dr 659 templates in airSlate SignNow?

Yes, you can customize Form Dr 659 templates within airSlate SignNow to meet your specific needs. The platform allows you to add branding elements, specify required fields, and adjust the layout, providing a tailored approach to your document management. This customization helps you maintain professionalism and consistency across all your documents.

-

What types of documents can I manage alongside Form Dr 659 using airSlate SignNow?

In addition to Form Dr 659, airSlate SignNow supports a wide variety of document types, including contracts, agreements, and other legal forms. This versatility allows you to streamline all your document management processes in one platform. By using airSlate SignNow, you can enhance productivity and keep all essential documents organized.

-

Is airSlate SignNow compliant with legal standards for eSigning Form Dr 659?

Absolutely! airSlate SignNow complies with all legal standards for electronic signatures, ensuring that your Form Dr 659 is valid and legally binding. The platform adheres to regulations such as the ESIGN Act and UETA, providing peace of mind that your eSigned documents will hold up in legal contexts.

Get more for Form Dr 659

- Request for legal assistance new york civil liberties union nyclu form

- Supplier retailer contract template form

- Supplier contract template form

- Supplier supply contract template form

- Supply and installation contract template form

- Suppliers contract template form

- Supply contract template form

- Supply of goods contract template form

Find out other Form Dr 659

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free