Form 1 ES, Wisconsin Estimated Tax Voucher PDF FormSend

What is the Form 1 ES, Wisconsin Estimated Tax Voucher

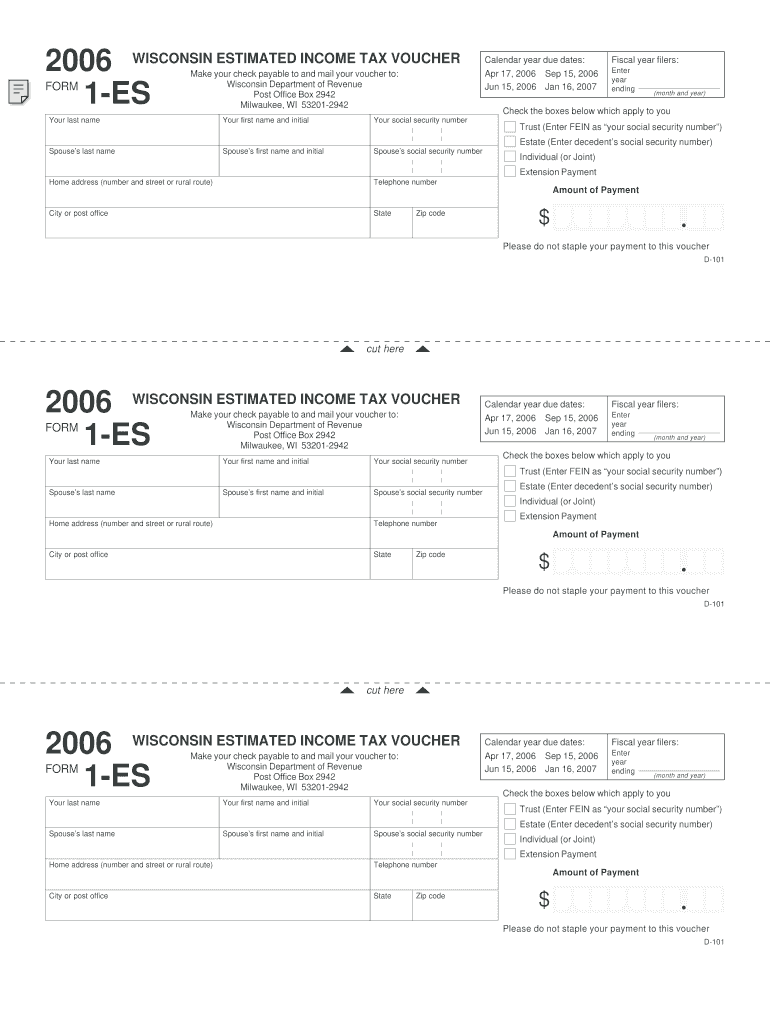

The Form 1 ES is an essential document used by taxpayers in Wisconsin to report and pay estimated income taxes. This form is specifically designed for individuals who expect to owe tax of $500 or more when they file their annual return. The estimated tax voucher allows taxpayers to make quarterly payments throughout the year, ensuring they meet their tax obligations and avoid penalties. It is crucial for self-employed individuals, freelancers, and those with significant income not subject to withholding.

How to use the Form 1 ES, Wisconsin Estimated Tax Voucher

Using the Form 1 ES involves a straightforward process. Taxpayers need to calculate their estimated tax liability based on their expected income for the year. After determining the amount, they can fill out the form, providing necessary personal information and the calculated payment amount. The completed form can be submitted with a payment, either by mail or electronically, depending on the chosen submission method. It is important to keep a copy of the form for personal records and future reference.

Steps to complete the Form 1 ES, Wisconsin Estimated Tax Voucher

Completing the Form 1 ES requires several steps:

- Gather necessary financial information, including income sources and deductions.

- Calculate your estimated tax liability for the year using the appropriate tax rates.

- Fill out the Form 1 ES with your personal details, including name, address, and Social Security number.

- Indicate the estimated payment amount for each quarter.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Timely filing of the Form 1 ES is crucial to avoid penalties. The estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. It is essential to mark these dates on your calendar to ensure compliance. If a due date falls on a weekend or holiday, the deadline is extended to the next business day.

Required Documents

To complete the Form 1 ES, taxpayers should have the following documents ready:

- Previous year’s tax return for reference on income and deductions.

- Current year income estimates, including wages, self-employment income, and any other earnings.

- Information on any applicable deductions or credits that may affect your tax liability.

Who Issues the Form

The Form 1 ES is issued by the Wisconsin Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department’s website or through authorized tax preparation services.

Quick guide on how to complete form 1 es wisconsin estimated tax voucher pdf formsend

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, since you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend

Create this form in 5 minutes!

How to create an eSignature for the form 1 es wisconsin estimated tax voucher pdf formsend

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend?

The Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend is a document used by individuals and businesses to submit estimated tax payments to the state of Wisconsin. This form helps ensure that taxpayers meet their tax obligations throughout the year, avoiding penalties and interest.

-

How can I fill out the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend?

Filling out the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend is straightforward with airSlate SignNow. You can easily input your information directly into the PDF, ensuring all required fields are completed accurately before submission.

-

Is there a cost associated with using airSlate SignNow for the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that streamline the process of sending and eSigning documents, including the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend.

-

What features does airSlate SignNow offer for managing the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This means you can easily connect your existing tools to streamline the process of handling the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend.

-

What are the benefits of using airSlate SignNow for the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend?

Using airSlate SignNow for the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform simplifies the eSigning process, making it more efficient for users.

-

Is the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend legally binding?

Yes, the Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend signed through airSlate SignNow is legally binding. The platform complies with eSignature laws, ensuring that your signed documents hold up in court.

Get more for Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend

- Ph d regulation along with forms berhampur university

- Lesetexte a2 pdf form

- Application for dangerous goods storage facility portal dm gov form

- Sample proof of debt form malaysia

- Irrational square roots worksheet form

- Kop flex coupling grease sds form

- Globalglazeinbengaliallpdf file form

- Printable tree removal contract template 428776174 form

Find out other Form 1 ES, Wisconsin Estimated Tax Voucher pdf FormSend

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template