Form 40N, Oregon Individual Income Tax Return for

What is the Form 40N, Oregon Individual Income Tax Return For

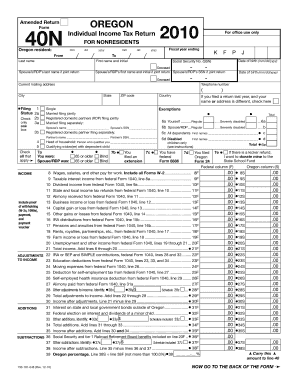

The Form 40N is the Oregon Individual Income Tax Return designed specifically for non-residents filing their income tax in Oregon. This form is essential for individuals who earn income from Oregon sources but do not reside in the state. It allows non-residents to report their Oregon-sourced income and calculate any tax owed to the state, ensuring compliance with Oregon tax laws.

How to use the Form 40N, Oregon Individual Income Tax Return For

Using the Form 40N involves several steps. Initially, gather all necessary financial documents, including W-2s, 1099s, and any other income statements related to your Oregon earnings. Next, accurately fill out the form by entering your income, deductions, and credits applicable to your situation. Finally, review your completed form for accuracy before submitting it to the Oregon Department of Revenue.

Steps to complete the Form 40N, Oregon Individual Income Tax Return For

Completing the Form 40N requires careful attention to detail. Follow these steps:

- Begin with your personal information, including your name, address, and Social Security number.

- Report your total income earned from Oregon sources on the appropriate lines.

- Claim any deductions or credits you qualify for, which may reduce your taxable income.

- Calculate your total tax liability based on the income reported.

- Sign and date the form to certify its accuracy.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Form 40N to avoid penalties. Typically, the deadline for submitting the Form 40N aligns with the federal income tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Always check for any updates or changes to the tax calendar that may affect your filing.

Required Documents

When preparing to file the Form 40N, ensure you have the following documents ready:

- W-2 forms from employers for income earned in Oregon.

- 1099 forms for any freelance or contract work completed in the state.

- Documentation for any deductions you plan to claim, such as receipts or statements.

- Any prior year tax returns that may assist in completing your current return.

Penalties for Non-Compliance

Failing to file the Form 40N or submitting it late can result in penalties. The Oregon Department of Revenue may impose a late filing penalty, which typically amounts to five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest may accrue on any unpaid tax amount, further increasing the total owed. It is crucial to file on time to avoid these financial consequences.

Quick guide on how to complete form 40n oregon individual income tax return for

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a superior eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional signed paper.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 40N, Oregon Individual Income Tax Return For

Create this form in 5 minutes!

How to create an eSignature for the form 40n oregon individual income tax return for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 40N, Oregon Individual Income Tax Return For?

The Form 40N, Oregon Individual Income Tax Return For, is a tax form used by residents of Oregon to report their income and calculate their state tax liability. It is essential for individuals who earn income in Oregon to file this form accurately to comply with state tax laws.

-

How can airSlate SignNow help with the Form 40N, Oregon Individual Income Tax Return For?

airSlate SignNow provides an efficient platform for electronically signing and sending the Form 40N, Oregon Individual Income Tax Return For. With its user-friendly interface, you can easily manage your tax documents and ensure they are submitted on time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Each plan provides access to features that simplify the process of managing documents like the Form 40N, Oregon Individual Income Tax Return For, ensuring you get the best value for your investment.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the Form 40N, Oregon Individual Income Tax Return For, and automated reminders for filing deadlines. These features help streamline your tax preparation process and reduce the risk of errors.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easy to manage your financial documents, including the Form 40N, Oregon Individual Income Tax Return For. This integration allows for seamless data transfer and enhances your overall workflow.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing, including the Form 40N, Oregon Individual Income Tax Return For, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are safely stored and easily accessible whenever you need them.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and employs advanced encryption methods to protect your sensitive tax information, including the Form 40N, Oregon Individual Income Tax Return For. You can trust that your data is safe while using our platform.

Get more for Form 40N, Oregon Individual Income Tax Return For

- Aims reference sheet form

- Tceq form 10423

- Crichton college form

- Landlord identity registration form

- Escort service license 474451943 form

- Oklahoma board of nursing employment verification form

- Idaho transportation department satisfaction of lien form itd 3726 itd idaho

- Proof of enrollment ryerson form

Find out other Form 40N, Oregon Individual Income Tax Return For

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast