LIMITED PARTNERSHIPS California Tax ASC LAW Com Form

What is the LIMITED PARTNERSHIPS California Tax ASC LAW com

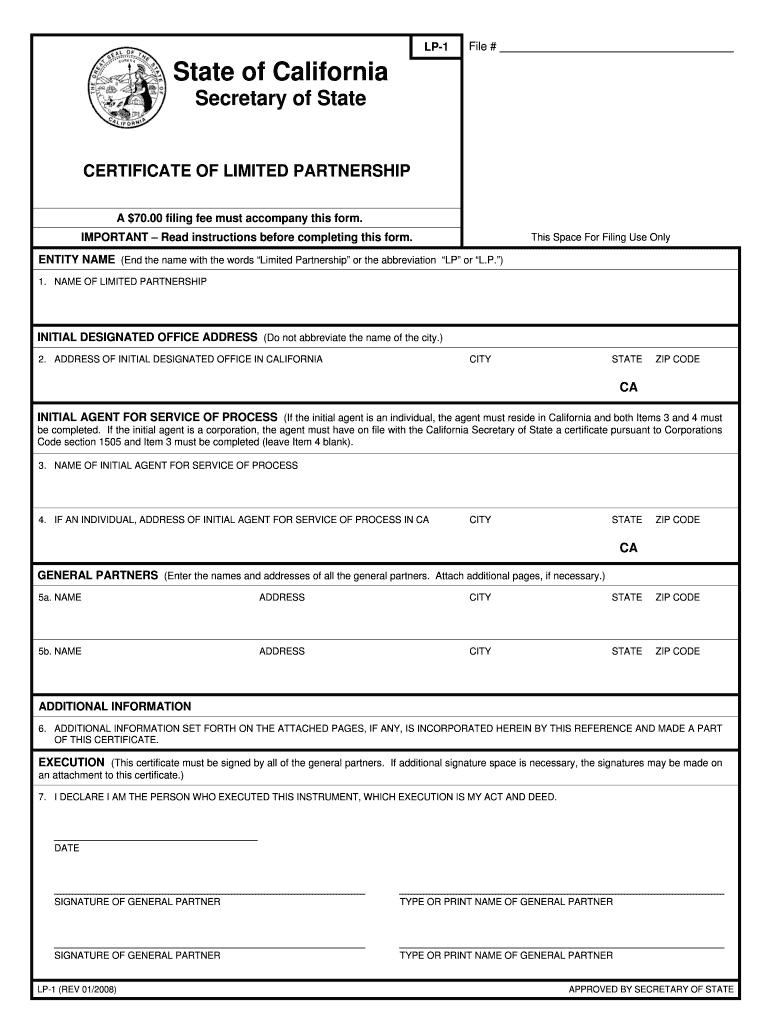

The LIMITED PARTNERSHIPS California Tax ASC LAW com refers to the specific tax regulations and requirements governing limited partnerships in California. A limited partnership is a business structure that consists of at least one general partner and one limited partner. The general partner manages the business, while the limited partner typically invests capital and has limited liability. Understanding the tax implications for limited partnerships is crucial for compliance and effective financial management.

Key elements of the LIMITED PARTNERSHIPS California Tax ASC LAW com

Several key elements define the tax landscape for limited partnerships in California. These include:

- Tax Structure: Limited partnerships are generally subject to California's franchise tax, which is a minimum tax imposed on businesses operating within the state.

- Filing Requirements: Limited partnerships must file specific tax forms, including Form 565, which details income, deductions, and credits.

- Partnership Income: Income generated by the partnership is passed through to the partners, who report it on their individual tax returns.

- Tax Rates: The tax rates applicable to limited partnerships can vary based on income levels and other factors.

Steps to complete the LIMITED PARTNERSHIPS California Tax ASC LAW com

Completing the tax obligations for a limited partnership in California involves several steps:

- Gather Financial Information: Collect all relevant financial documents, including income statements, expense records, and partner contributions.

- Complete Required Forms: Fill out Form 565, ensuring all income, deductions, and credits are accurately reported.

- Review and Verify: Double-check all entries for accuracy and ensure compliance with California tax laws.

- Submit the Forms: File the completed forms with the California Franchise Tax Board by the designated deadline.

Filing Deadlines / Important Dates

Timely filing is essential for limited partnerships to avoid penalties. Key deadlines include:

- Annual Filing: Limited partnerships must file their tax returns by the 15th day of the fourth month following the close of their tax year.

- Estimated Tax Payments: If applicable, estimated tax payments are typically due on the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year.

Required Documents

To successfully file taxes for a limited partnership in California, the following documents are generally required:

- Form 565: The primary tax form for reporting partnership income.

- Partnership Agreement: A document outlining the terms and conditions of the partnership.

- Financial Statements: Income statements and balance sheets reflecting the partnership's financial activities.

- Partner Information: Details about each partner, including their contributions and share of profits.

Legal use of the LIMITED PARTNERSHIPS California Tax ASC LAW com

Understanding the legal framework surrounding limited partnerships in California is essential for compliance. Limited partnerships must adhere to state laws regarding formation, operation, and dissolution. This includes maintaining proper records, filing necessary documents, and ensuring that all partners are aware of their rights and responsibilities. Legal compliance helps protect the partnership from potential disputes and penalties.

Quick guide on how to complete limited partnerships california tax asc law com

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to locate the right template and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and without hassle. Manage [SKS] on any device using the airSlate SignNow Android or iOS apps and streamline any document-related process today.

How to adjust and eSign [SKS] with ease

- Locate [SKS] and click Get Form to initiate.

- Utilize the features we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure confidential details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Verify the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign [SKS] to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to LIMITED PARTNERSHIPS California Tax ASC LAW com

Create this form in 5 minutes!

How to create an eSignature for the limited partnerships california tax asc law com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are LIMITED PARTNERSHIPS California Tax implications?

LIMITED PARTNERSHIPS California Tax can be complex, but understanding the basics is crucial for compliance. Generally, limited partnerships in California are subject to specific tax obligations, including franchise taxes and income taxes. Consulting with a tax professional can help clarify these obligations and ensure your partnership remains compliant.

-

How does airSlate SignNow support LIMITED PARTNERSHIPS California Tax documentation?

airSlate SignNow provides a streamlined platform for managing all your LIMITED PARTNERSHIPS California Tax documents. With features like eSigning and document templates, you can easily create, send, and store essential tax documents securely. This efficiency helps ensure that your partnership meets all necessary tax requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including those related to LIMITED PARTNERSHIPS California Tax. Each plan includes features that enhance document management and eSigning capabilities. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, you can access features like customizable templates, secure cloud storage, and real-time tracking for your LIMITED PARTNERSHIPS California Tax documents. These features simplify the process of preparing and managing tax-related paperwork, ensuring you stay organized and compliant.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your LIMITED PARTNERSHIPS California Tax documents. These integrations allow for seamless data transfer and improved workflow efficiency. This connectivity ensures that your tax processes are streamlined and effective.

-

What benefits does airSlate SignNow provide for limited partnerships?

Using airSlate SignNow for your LIMITED PARTNERSHIPS California Tax needs offers numerous benefits, including enhanced efficiency and reduced paperwork. The platform's user-friendly interface allows for quick document preparation and signing, saving you time and resources. Additionally, it helps ensure compliance with California tax regulations.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security, making it a reliable choice for managing your LIMITED PARTNERSHIPS California Tax documents. The platform employs advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe while using our services.

Get more for LIMITED PARTNERSHIPS California Tax ASC LAW com

Find out other LIMITED PARTNERSHIPS California Tax ASC LAW com

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form