Authorization or Cancellation of a Representative Form Fin 146 for the Speculation and Vacancy Tax 2016-2026

What is the Authorization or Cancellation of a Representative Form FIN 146?

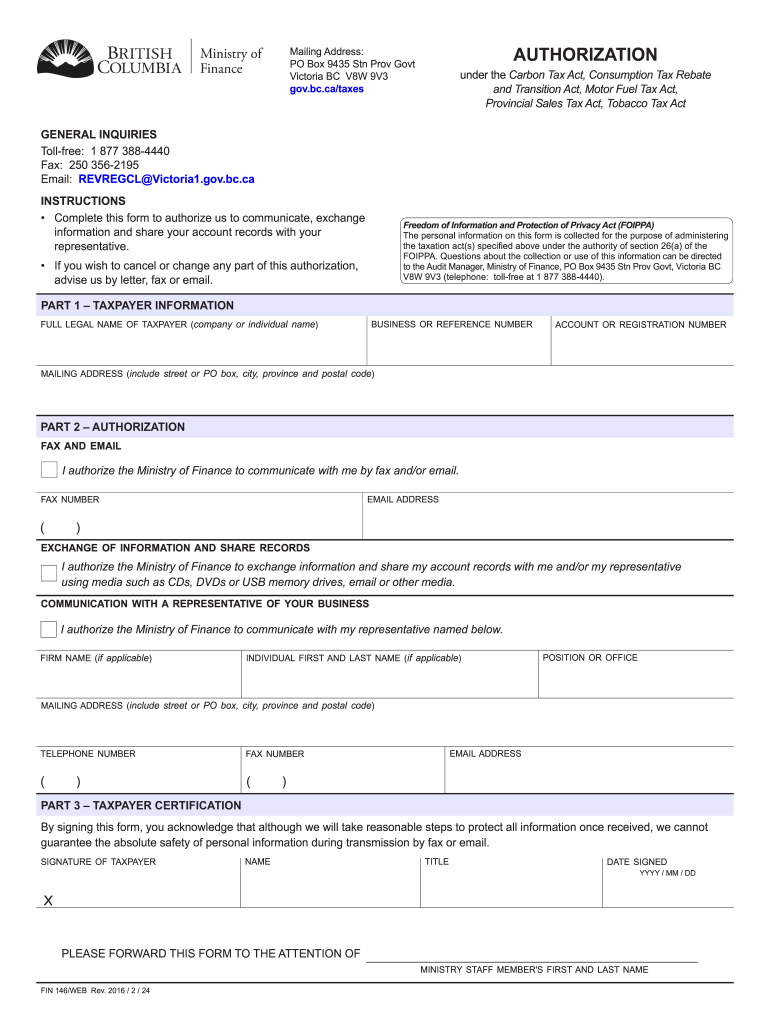

The Authorization or Cancellation of a Representative Form FIN 146 is a crucial document for individuals involved in the Speculation and Vacancy Tax in British Columbia. This form allows taxpayers to authorize a representative to communicate with the Ministry of Finance on their behalf. It ensures that the ministry can reach out regarding tax matters, including inquiries about provincial sales tax collection. Additionally, it facilitates the sharing of account records between the taxpayer and their authorized representative, streamlining communication and ensuring compliance with tax obligations.

Steps to Complete the Authorization or Cancellation of a Representative Form FIN 146

Completing the FIN 146 form involves several key steps:

- Open the FIN 146 form in a digital format, such as a PDF.

- Fill in the taxpayer's information, including their full legal name, account or registration number, and postal address.

- Provide authorization details, including the representative's name, position, and contact information.

- Certify the form by signing it, confirming that all information is accurate.

- Submit the completed form to the Ministry of Finance as instructed.

Key Elements of the Authorization or Cancellation of a Representative Form FIN 146

The FIN 146 form consists of several critical components:

- Taxpayer Information: This section requires the taxpayer's full legal name and contact details.

- Authorization Details: Here, the taxpayer grants permission for their representative to act on their behalf.

- Certification: The taxpayer must sign the form to validate the information provided.

Legal Use of the Authorization or Cancellation of a Representative Form FIN 146

The FIN 146 form is legally recognized as a means for taxpayers to appoint representatives for tax-related matters. It is essential for ensuring that the Ministry of Finance can communicate effectively with authorized individuals. The use of this form is governed by provincial tax regulations, making it a vital component for compliance with the Speculation and Vacancy Tax in British Columbia.

How to Obtain the Authorization or Cancellation of a Representative Form FIN 146

The FIN 146 form can be obtained directly from the Ministry of Finance's official website or through authorized tax service providers. It is available in a fillable PDF format, allowing taxpayers to complete it digitally. Ensuring that you have the most current version of the form is important for compliance and accuracy.

Examples of Using the Authorization or Cancellation of a Representative Form FIN 146

Common scenarios for utilizing the FIN 146 form include:

- A taxpayer who is unable to manage their tax affairs due to time constraints may authorize a tax professional to handle their filings.

- Individuals who have moved out of the province but need to address tax obligations can appoint a local representative.

Quick guide on how to complete fin 146 authorization use this form to authorize how the ministy of finance will communicate and exchange information with you

A concise manual on how to create your Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax

Finding the correct template can be a hurdle when you need to present formal international documentation. Even if you have the necessary form, it might be cumbersome to swiftly prepare it according to all the specifications if you rely on physical copies instead of completing everything digitally. airSlate SignNow is the online electronic signature solution that assists you in overcoming these obstacles. It enables you to obtain your Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax and efficiently fill it out and sign it on-site without needing to reprint documents whenever you make a mistake.

Here are the steps you must follow to create your Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax using airSlate SignNow:

- Press the Get Form button to instantly add your document to our editor.

- Begin with the first blank field, input your information, and continue with the Next feature.

- Complete the empty sections utilizing the Cross and Check options from the toolbar above.

- Select the Highlight or Line features to emphasize the key information.

- Click on Image and upload one if your Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax requires it.

- Use the right-side panel to add additional fields for you or others to fill out if necessary.

- Review your responses and approve the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete editing by pressing the Done button and selecting your file-sharing preferences.

Once your Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax is ready, you can share it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your preferences. Don’t waste time on manual document filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fin 146 authorization use this form to authorize how the ministy of finance will communicate and exchange information with you

How to make an eSignature for your Fin 146 Authorization Use This Form To Authorize How The Ministy Of Finance Will Communicate And Exchange Information With You online

How to generate an eSignature for your Fin 146 Authorization Use This Form To Authorize How The Ministy Of Finance Will Communicate And Exchange Information With You in Google Chrome

How to make an electronic signature for putting it on the Fin 146 Authorization Use This Form To Authorize How The Ministy Of Finance Will Communicate And Exchange Information With You in Gmail

How to generate an eSignature for the Fin 146 Authorization Use This Form To Authorize How The Ministy Of Finance Will Communicate And Exchange Information With You right from your mobile device

How to create an electronic signature for the Fin 146 Authorization Use This Form To Authorize How The Ministy Of Finance Will Communicate And Exchange Information With You on iOS

How to create an eSignature for the Fin 146 Authorization Use This Form To Authorize How The Ministy Of Finance Will Communicate And Exchange Information With You on Android

People also ask

-

What is the Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax?

The Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax is a crucial document that allows property owners to appoint a representative for tax-related matters. This form is essential for managing your obligations under the Speculation and Vacancy Tax in a streamlined manner. Understanding its purpose can help ensure compliance and proper handling of your tax affairs.

-

How can airSlate SignNow assist with the Authorization Or Cancellation Of A Representative Form Fin 146?

airSlate SignNow simplifies the process of completing and eSigning the Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax. With our user-friendly platform, you can quickly fill out, send, and manage your forms securely, ensuring you stay compliant with tax regulations.

-

What are the pricing options for using airSlate SignNow for the Authorization Or Cancellation Of A Representative Form Fin 146?

airSlate SignNow offers competitive pricing plans that cater to different business needs, making it cost-effective for handling the Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax. You can choose from flexible monthly or annual plans, providing the best value based on your usage.

-

Can I integrate airSlate SignNow with other applications for managing the Authorization Or Cancellation Of A Representative Form Fin 146?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow when managing the Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax. This allows you to connect with your existing systems, making document management more efficient.

-

What are the benefits of using airSlate SignNow for tax-related documents, specifically the Authorization Or Cancellation Of A Representative Form Fin 146?

Using airSlate SignNow for the Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax provides several benefits, including faster processing times, enhanced security, and easy collaboration with representatives. Our platform ensures that your documents are handled efficiently, minimizing the risk of delays.

-

Is it easy to eSign the Authorization Or Cancellation Of A Representative Form Fin 146 with airSlate SignNow?

Absolutely! airSlate SignNow offers an intuitive eSigning process for the Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax. Users can quickly sign documents from any device, ensuring a hassle-free experience for both property owners and their representatives.

-

What support does airSlate SignNow provide for completing the Authorization Or Cancellation Of A Representative Form Fin 146?

airSlate SignNow provides comprehensive support to help you navigate the Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax. Our customer support team is available to assist with any questions you may have, ensuring you can complete your forms accurately and efficiently.

Get more for Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax

- Earth science seasons test name per date form

- District golf flyer gavfw form

- A step by step guide to the schedule se tax form

- 1099 c form

- What is form 944 irs payroll tax guide for employers

- Irs form 8854 beginner039s guide to the tax expatriation

- Guide to schedule r tax credit for elderly or disabled form

- Form 5329 additional taxes on qualified plans including

Find out other Authorization Or Cancellation Of A Representative Form Fin 146 For The Speculation And Vacancy Tax

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now