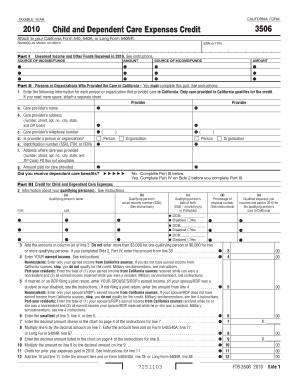

Form 3506 Child and Dependent Care Expenses Credit

What is the Form 3506 Child And Dependent Care Expenses Credit

The Form 3506 Child And Dependent Care Expenses Credit is a tax form used in the United States to claim a credit for expenses incurred for the care of qualifying children and dependents. This credit helps reduce the tax burden for families who pay for childcare while they work or look for work. Eligible taxpayers can receive a percentage of their childcare expenses back as a credit against their federal income tax.

Eligibility Criteria

To qualify for the Child And Dependent Care Expenses Credit, taxpayers must meet specific criteria:

- The taxpayer must have earned income during the tax year.

- The care must be for a child under the age of thirteen or a dependent who is physically or mentally incapable of self-care.

- The care must be provided so that the taxpayer can work or look for work.

- Expenses must be incurred for care provided to a qualifying individual, and the care provider cannot be a relative of the taxpayer.

Steps to complete the Form 3506 Child And Dependent Care Expenses Credit

Completing Form 3506 involves several steps:

- Gather necessary documentation, including receipts for childcare expenses and information about the care provider.

- Fill out personal information, including your name, Social Security number, and filing status.

- Report the total amount of qualifying expenses for each child or dependent.

- Calculate the credit by applying the appropriate percentage to your qualifying expenses.

- Transfer the calculated credit to your federal income tax return.

Required Documents

When filing Form 3506, it is essential to have the following documents ready:

- Receipts or invoices from childcare providers.

- The provider's name, address, and taxpayer identification number (TIN).

- Proof of your earned income, such as W-2 forms or pay stubs.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 3506. Taxpayers should refer to the IRS instructions for the form to ensure compliance with all requirements. The guidelines outline eligible expenses, the calculation of the credit, and any changes in tax law that may affect the filing process. It is crucial to stay updated on these guidelines to maximize your eligible credit.

Filing Deadlines / Important Dates

Form 3506 must be filed along with your federal income tax return by the annual tax deadline, typically April 15. If you are unable to file by this date, you may request an extension, but any owed taxes must still be paid by the original deadline to avoid penalties. It is important to keep track of these dates to ensure timely filing and avoid complications.

Quick guide on how to complete form 3506 child and dependent care expenses credit

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3506 Child And Dependent Care Expenses Credit

Create this form in 5 minutes!

How to create an eSignature for the form 3506 child and dependent care expenses credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3506 Child And Dependent Care Expenses Credit?

The Form 3506 Child And Dependent Care Expenses Credit is a tax credit designed to help families offset the costs of childcare while they work or look for work. This credit can signNowly reduce your tax liability, making it easier for parents to manage childcare expenses. Understanding how to properly claim this credit can lead to substantial savings.

-

How can airSlate SignNow assist with Form 3506 Child And Dependent Care Expenses Credit?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to the Form 3506 Child And Dependent Care Expenses Credit. Our solution simplifies the process of submitting necessary paperwork, ensuring that you can focus on maximizing your tax benefits. With our user-friendly interface, you can easily track and manage your documents.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Form 3506 Child And Dependent Care Expenses Credit. These features streamline the documentation process, making it easier to gather and submit necessary information. Additionally, our platform ensures compliance and security for sensitive data.

-

Is there a cost associated with using airSlate SignNow for Form 3506 Child And Dependent Care Expenses Credit?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including those who need to manage the Form 3506 Child And Dependent Care Expenses Credit. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your ability to manage the Form 3506 Child And Dependent Care Expenses Credit. This integration allows for easy data transfer and document management, ensuring that all your tax-related documents are in one place. Streamlining your workflow has never been easier.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Form 3506 Child And Dependent Care Expenses Credit, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents quickly and securely, saving you time and effort. Additionally, you can access your documents from anywhere, making tax season less stressful.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents, including those related to the Form 3506 Child And Dependent Care Expenses Credit. We utilize advanced encryption and secure cloud storage to protect your sensitive information. Our compliance with industry standards ensures that your data remains safe throughout the document management process.

Get more for Form 3506 Child And Dependent Care Expenses Credit

Find out other Form 3506 Child And Dependent Care Expenses Credit

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later