Form 8596 Rev November Internal Revenue Service

What is the Form 8596 Rev November Internal Revenue Service

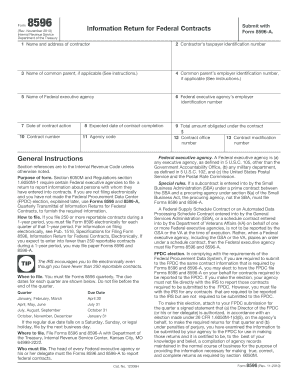

The Form 8596, revised in November by the Internal Revenue Service (IRS), is a tax form used primarily for reporting specific financial information related to certain tax obligations. This form is essential for individuals and businesses that need to comply with IRS requirements regarding income reporting, deductions, or credits. It serves as a formal declaration of financial activities and is crucial for accurate tax filings.

How to use the Form 8596 Rev November Internal Revenue Service

Using the Form 8596 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents that pertain to the reporting period. Next, fill out the form with accurate information, ensuring that all fields are completed as required. Once the form is filled out, it should be reviewed for any errors before submission. Understanding the specific instructions provided by the IRS for this form is vital to ensure compliance and avoid any potential issues.

Steps to complete the Form 8596 Rev November Internal Revenue Service

Completing the Form 8596 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website or a trusted source.

- Read the instructions carefully to understand the requirements for each section.

- Fill in your personal or business information accurately.

- Report all relevant financial data as required by the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

Key elements of the Form 8596 Rev November Internal Revenue Service

The Form 8596 includes several key elements that must be accurately reported. These elements typically consist of:

- Your name and taxpayer identification number.

- Details of the financial transactions being reported.

- Any applicable deductions or credits.

- Signature and date to certify the information provided.

Each of these components plays a critical role in ensuring that the form is processed correctly by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8596 are crucial to avoid penalties. Typically, the form must be submitted by the tax return due date, which varies depending on whether you are an individual or a business entity. It is important to stay informed about any changes in deadlines, especially in light of updates from the IRS. Mark your calendar with these dates to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 8596 can be submitted through various methods. You may choose to file it online using the IRS e-filing system, which is often faster and more efficient. Alternatively, you can mail the completed form to the appropriate IRS address specified in the instructions. In some cases, in-person submission may be available at designated IRS offices. Each method has its own processing times and requirements, so choose the one that best suits your needs.

Quick guide on how to complete form 8596 rev november internal revenue service

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly prevalent among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centered workflow today.

The Easiest Way to Modify and Electronically Sign [SKS] Seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow supplies specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to preserve your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and electronically sign [SKS] to ensure excellent communication throughout every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8596 Rev November Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 8596 rev november internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8596 Rev November Internal Revenue Service?

Form 8596 Rev November Internal Revenue Service is a tax form used for specific reporting requirements. It is essential for businesses to understand its purpose to ensure compliance with IRS regulations. Using airSlate SignNow can simplify the process of filling out and submitting this form electronically.

-

How can airSlate SignNow help with Form 8596 Rev November Internal Revenue Service?

airSlate SignNow provides an efficient platform for businesses to eSign and send Form 8596 Rev November Internal Revenue Service. Our solution streamlines the document management process, ensuring that your forms are completed accurately and submitted on time. This reduces the risk of errors and enhances overall productivity.

-

What are the pricing options for using airSlate SignNow for Form 8596 Rev November Internal Revenue Service?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while allowing you to manage Form 8596 Rev November Internal Revenue Service efficiently. Visit our pricing page for detailed information on each plan.

-

Are there any integrations available for airSlate SignNow when handling Form 8596 Rev November Internal Revenue Service?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to manage Form 8596 Rev November Internal Revenue Service more effectively. These integrations help streamline document handling and improve collaboration.

-

What features does airSlate SignNow offer for managing Form 8596 Rev November Internal Revenue Service?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for Form 8596 Rev November Internal Revenue Service. These tools make it easy to create, send, and manage your documents while ensuring compliance with IRS requirements. Our user-friendly interface simplifies the entire process.

-

Can I use airSlate SignNow on mobile devices for Form 8596 Rev November Internal Revenue Service?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage Form 8596 Rev November Internal Revenue Service on the go. Whether you are in the office or traveling, you can easily access, sign, and send your documents from your smartphone or tablet.

-

What are the benefits of using airSlate SignNow for Form 8596 Rev November Internal Revenue Service?

Using airSlate SignNow for Form 8596 Rev November Internal Revenue Service offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform ensures that your documents are handled with care and compliance, allowing you to focus on your core business activities without worrying about paperwork.

Get more for Form 8596 Rev November Internal Revenue Service

Find out other Form 8596 Rev November Internal Revenue Service

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast