Form 9465 Rev December EndTaxProblems Com

What is the Form 9465 Rev December EndTaxProblems com

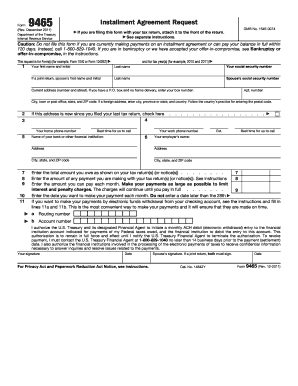

The Form 9465, officially known as the Installment Agreement Request, is a tax form used by individuals to request a payment plan with the Internal Revenue Service (IRS) when they cannot pay their tax bill in full. This form is particularly useful for taxpayers who find themselves in financial hardship and need to spread their payments over time. By submitting Form 9465, taxpayers can propose a monthly payment amount that fits their budget, making it easier to manage their tax obligations without incurring additional penalties.

How to use the Form 9465 Rev December EndTaxProblems com

Using Form 9465 involves several straightforward steps. First, gather your financial information, including your total tax liability and your ability to pay. Next, fill out the form, providing details such as your personal information, the amount owed, and the proposed monthly payment. Once completed, review the form for accuracy. After that, submit the form to the IRS either electronically or by mail, depending on your preference. It is important to keep a copy of the submitted form for your records and to follow up with the IRS if you do not receive confirmation of your request.

Steps to complete the Form 9465 Rev December EndTaxProblems com

Completing Form 9465 requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Next, indicate the total amount you owe and the amount you can afford to pay each month. You will also need to specify how you wish to make your payments. After filling out all required sections, double-check the information for accuracy. Finally, sign and date the form before submitting it to the IRS. Timeliness is essential, as submitting the form promptly can help avoid additional penalties and interest.

Eligibility Criteria

To qualify for an installment agreement using Form 9465, taxpayers must meet certain criteria. Generally, you should owe less than $50,000 in combined tax, penalties, and interest. Additionally, you must have filed all required tax returns and not have an existing installment agreement. If you meet these conditions, you can request a monthly payment plan that aligns with your financial situation. It is advisable to review your financial capacity to ensure that the proposed payment amount is manageable.

Form Submission Methods

Form 9465 can be submitted to the IRS through various methods. Taxpayers have the option to file the form electronically using the IRS e-file system, which is a quick and efficient way to submit your request. Alternatively, you can print the completed form and mail it to the appropriate address listed in the form instructions. In some cases, taxpayers may also submit the form in person at a local IRS office. Each submission method has its own processing times, so it is essential to choose the one that best fits your needs.

Required Documents

When submitting Form 9465, it is important to include any necessary supporting documents to strengthen your request. This may include copies of your most recent tax returns, proof of income, and any documentation that demonstrates your financial hardship. Providing this information can help the IRS better understand your situation and may facilitate a quicker approval process. Ensure that all documents are clear and legible to avoid delays in processing your request.

Quick guide on how to complete form 9465 rev december endtaxproblems com

Complete [SKS] easily on any device

Digital document management has become increasingly popular with both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, through email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 9465 Rev December EndTaxProblems com

Create this form in 5 minutes!

How to create an eSignature for the form 9465 rev december endtaxproblems com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 9465 Rev December EndTaxProblems com?

Form 9465 Rev December EndTaxProblems com is an IRS form that allows taxpayers to request a monthly installment plan for paying their tax liabilities. This form is essential for individuals who cannot pay their taxes in full and need a structured payment plan. By using this form, you can avoid penalties and interest on unpaid taxes.

-

How can airSlate SignNow help with Form 9465 Rev December EndTaxProblems com?

airSlate SignNow simplifies the process of completing and submitting Form 9465 Rev December EndTaxProblems com by providing an easy-to-use platform for eSigning and sending documents. Our solution ensures that your form is securely signed and submitted, streamlining your tax payment process. This efficiency can save you time and reduce stress during tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Our plans are designed to be cost-effective, ensuring that you can manage documents like Form 9465 Rev December EndTaxProblems com without breaking the bank. Each plan includes features that enhance your document management experience.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including eSigning, document templates, and secure cloud storage. These features make it easy to manage important documents like Form 9465 Rev December EndTaxProblems com efficiently. Additionally, our platform allows for real-time collaboration, ensuring that all stakeholders can access and sign documents seamlessly.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your documents, including Form 9465 Rev December EndTaxProblems com, are protected. We use advanced encryption and adhere to industry standards to safeguard your data. You can trust our platform to handle sensitive information securely.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow. You can easily connect with tools like Google Drive, Salesforce, and more, allowing for seamless management of documents like Form 9465 Rev December EndTaxProblems com across platforms.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like Form 9465 Rev December EndTaxProblems com offers numerous benefits, including time savings and improved accuracy. Our platform reduces the risk of errors associated with manual processes and ensures that your documents are processed quickly. This efficiency can lead to a smoother tax filing experience.

Get more for Form 9465 Rev December EndTaxProblems com

- Jv 710s juvenile fitness hearing order welfare california courts courts ca form

- Jv 223 s order regarding application for california courts courts ca form

- Fl 692s minutes and order or judgment spanish california courts courts ca form

- Jv421 2014 form

- Fl342 2012 form

- Fl 306 s request and order to continue california courts courts ca form

- Ea 120 2014 form

- Form cr 141 info california courts cagov

Find out other Form 9465 Rev December EndTaxProblems com

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed