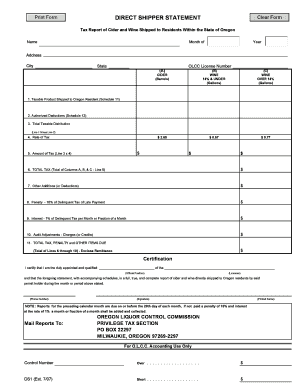

DIRECT SHIPPER STATEMENT Oregon Gov Oregon Form

What is the DS1 Form?

The DS1 form, also known as the Direct Shipper Statement, is a document required for businesses engaged in shipping alcoholic beverages directly to consumers in Oregon. This form is essential for compliance with state regulations governing the direct shipment of alcohol, ensuring that businesses adhere to legal requirements while facilitating the shipping process. It serves as a declaration of the shipment and includes details about the sender, recipient, and the type of alcohol being shipped.

How to Use the DS1 Form

Using the DS1 form involves several key steps. First, businesses must accurately fill out the form with relevant information, including the sender's and recipient's details, the quantity and type of alcohol, and any applicable licenses. Once completed, the form must be submitted to the appropriate state authority to ensure compliance with Oregon's alcohol shipping regulations. This process helps maintain transparency and accountability in the direct shipment of alcoholic beverages.

Steps to Complete the DS1 Form

Completing the DS1 form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary information, including sender and recipient names, addresses, and contact details.

- Specify the type and quantity of alcohol being shipped.

- Include any relevant licensing information for both the shipper and recipient.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate state agency, either online or via mail.

Legal Use of the DS1 Form

The DS1 form is legally mandated for businesses that wish to ship alcohol directly to consumers in Oregon. It ensures that all shipments comply with state laws and regulations, helping to prevent illegal distribution and underage sales. Failure to use the DS1 form correctly can result in penalties, including fines or revocation of shipping privileges.

Key Elements of the DS1 Form

When filling out the DS1 form, several key elements must be included to ensure compliance:

- Sender Information: Name, address, and contact details of the business shipping the alcohol.

- Recipient Information: Name, address, and age verification of the person receiving the shipment.

- Alcohol Details: Type of alcohol, quantity, and any specific product identifiers.

- Licensing Information: Relevant licenses held by both the sender and recipient.

State-Specific Rules for the DS1 Form

Oregon has specific regulations governing the use of the DS1 form. Businesses must be aware of these rules, which include restrictions on the types of alcohol that can be shipped, the maximum quantities allowed, and the age verification process for recipients. Compliance with these state-specific rules is crucial for legal and successful alcohol shipments.

Quick guide on how to complete direct shipper statement oregon gov oregon

Complete DIRECT SHIPPER STATEMENT Oregon gov Oregon effortlessly on any gadget

Digital document management has become a favored choice for businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage DIRECT SHIPPER STATEMENT Oregon gov Oregon on any gadget using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest method to edit and electronically sign DIRECT SHIPPER STATEMENT Oregon gov Oregon without difficulty

- Obtain DIRECT SHIPPER STATEMENT Oregon gov Oregon and click on Get Form to begin.

- Make use of the tools we provide to fill in your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Recheck all the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow manages your document handling needs in just a few clicks from any device you prefer. Edit and electronically sign DIRECT SHIPPER STATEMENT Oregon gov Oregon and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the direct shipper statement oregon gov oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a DS1 form and how is it used?

The DS1 form is a document used to confirm the satisfaction of a debt or obligation. In the context of airSlate SignNow, it can be easily created, sent, and eSigned, ensuring that all parties have a clear record of the transaction. This streamlines the process and enhances the efficiency of document management.

-

How can I create a DS1 form using airSlate SignNow?

Creating a DS1 form with airSlate SignNow is straightforward. Simply log in to your account, select the document template for the DS1 form, fill in the necessary details, and send it for eSignature. Our user-friendly interface makes it easy for anyone to generate professional documents quickly.

-

Is there a cost associated with using the DS1 form feature?

airSlate SignNow offers competitive pricing plans that include the ability to create and manage DS1 forms. Depending on your chosen plan, you can access various features that enhance your document workflow. We recommend checking our pricing page for detailed information on costs and available features.

-

What are the benefits of using airSlate SignNow for DS1 forms?

Using airSlate SignNow for DS1 forms provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform allows for quick eSigning and tracking of documents, ensuring that you can manage your agreements efficiently. Additionally, it helps reduce paper usage, contributing to a more sustainable business practice.

-

Can I integrate airSlate SignNow with other applications for managing DS1 forms?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage your DS1 forms alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our integrations help streamline your workflow. This flexibility enhances productivity and ensures that all your documents are easily accessible.

-

How secure is the eSigning process for DS1 forms?

The eSigning process for DS1 forms on airSlate SignNow is highly secure. We utilize advanced encryption and authentication methods to protect your documents and signatures. This ensures that your sensitive information remains confidential and that all transactions are legally binding.

-

Can I track the status of my DS1 forms in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your DS1 forms. You can easily monitor when a document is sent, viewed, and signed, giving you complete visibility over your document workflow. This feature helps you stay organized and ensures timely follow-ups.

Get more for DIRECT SHIPPER STATEMENT Oregon gov Oregon

Find out other DIRECT SHIPPER STATEMENT Oregon gov Oregon

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure