Surety Bond Surety Bond Form

Understanding the Surety Bond Surety Bond

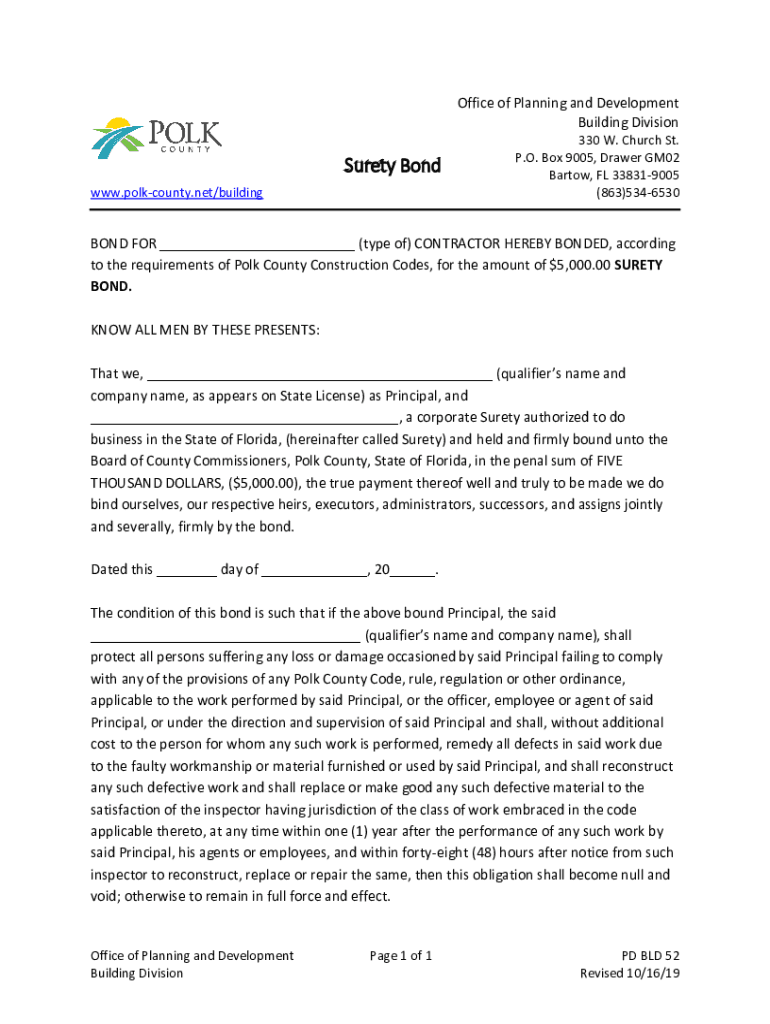

A Surety Bond is a legally binding agreement involving three parties: the principal, the obligee, and the surety. The principal is the party that purchases the bond and agrees to fulfill certain obligations, while the obligee is the entity requiring the bond as a guarantee of performance. The surety is the company that issues the bond and guarantees compensation to the obligee if the principal fails to meet their obligations. This bond is commonly used in various sectors, including construction, licensing, and court proceedings, to ensure compliance with laws and regulations.

Steps to Complete the Surety Bond Surety Bond

Completing a Surety Bond involves several key steps:

- Determine the type of bond needed: Identify the specific Surety Bond required for your situation, such as a performance bond or a license bond.

- Gather necessary information: Collect all required documentation, including personal identification, business information, and financial statements.

- Choose a surety company: Research and select a reputable surety company that offers the type of bond you need.

- Complete the application: Fill out the bond application accurately, providing all requested details.

- Review terms and conditions: Understand the bond's terms, including the premium and any obligations.

- Submit the application: Send the completed application and required documents to the surety company for review.

- Receive the bond: Upon approval, the surety company will issue the bond, which you must then submit to the obligee.

Legal Use of the Surety Bond Surety Bond

The Surety Bond serves a crucial legal function by protecting the interests of the obligee. It ensures that the principal will fulfill their contractual obligations or compensate the obligee for any losses incurred due to non-compliance. In many cases, the bond is a legal requirement for obtaining licenses or permits, particularly in industries such as construction, where compliance with local regulations is essential. Failure to comply with the terms of the bond can lead to penalties, including financial loss and legal repercussions.

Key Elements of the Surety Bond Surety Bond

Several key elements define a Surety Bond:

- Principal: The individual or business that purchases the bond and is responsible for fulfilling the obligations.

- Obligee: The party that requires the bond as a guarantee of performance.

- Surety: The company that issues the bond and guarantees payment to the obligee if the principal defaults.

- Bond amount: The monetary value of the bond, which represents the maximum amount the surety will pay in case of a claim.

- Duration: The time period for which the bond is valid, often specified in the bond agreement.

How to Obtain the Surety Bond Surety Bond

Obtaining a Surety Bond typically involves a straightforward process:

- Research requirements: Understand the specific requirements for the bond you need, including any state regulations.

- Contact a surety agent: Work with a licensed surety agent who can guide you through the process and help you find the best bond options.

- Provide documentation: Submit the necessary documents, including financial statements and business information, to the surety company.

- Undergo underwriting: The surety will assess your risk profile, which may involve a credit check and evaluation of your financial stability.

- Receive the bond: Once approved, you will receive the Surety Bond, which must be submitted to the obligee.

State-Specific Rules for the Surety Bond Surety Bond

Each state in the U.S. may have specific regulations governing Surety Bonds. These rules can include requirements for bond amounts, types of acceptable sureties, and the process for filing and maintaining the bond. It is essential to consult your state’s regulatory agency or a knowledgeable surety agent to ensure compliance with local laws. Understanding these state-specific rules can help prevent delays and complications in obtaining the necessary bond.

Quick guide on how to complete surety bond surety bond

Prepare Surety Bond Surety Bond easily on any device

Online document management has become prevalent among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Surety Bond Surety Bond on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

The easiest way to modify and eSign Surety Bond Surety Bond effortlessly

- Find Surety Bond Surety Bond and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Edit and eSign Surety Bond Surety Bond and ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the surety bond surety bond

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Surety Bond Surety Bond?

A Surety Bond Surety Bond is a legally binding agreement that ensures the fulfillment of a contract or obligation. It involves three parties: the principal, the obligee, and the surety. This bond provides financial protection to the obligee in case the principal fails to meet their contractual obligations.

-

How does airSlate SignNow facilitate the process of obtaining a Surety Bond Surety Bond?

airSlate SignNow streamlines the process of obtaining a Surety Bond Surety Bond by allowing users to easily fill out and eSign necessary documents online. Our platform simplifies document management, ensuring that all parties can access and sign documents quickly and securely. This efficiency helps businesses save time and reduce paperwork.

-

What are the pricing options for Surety Bond Surety Bond services?

Pricing for Surety Bond Surety Bond services can vary based on the type of bond and the specific requirements of your business. airSlate SignNow offers competitive pricing plans that cater to different business needs. We recommend contacting our sales team for a personalized quote based on your unique situation.

-

What features does airSlate SignNow offer for managing Surety Bond Surety Bonds?

airSlate SignNow provides a range of features for managing Surety Bond Surety Bonds, including customizable templates, secure eSigning, and real-time tracking of document status. Our platform also allows for easy collaboration among all parties involved, ensuring a smooth and efficient bonding process.

-

What are the benefits of using airSlate SignNow for Surety Bond Surety Bonds?

Using airSlate SignNow for Surety Bond Surety Bonds offers numerous benefits, including enhanced security, reduced turnaround times, and improved compliance. Our user-friendly interface makes it easy for businesses to manage their bonds effectively, while our robust security measures protect sensitive information.

-

Can airSlate SignNow integrate with other software for Surety Bond Surety Bonds?

Yes, airSlate SignNow can integrate with various software solutions to enhance the management of Surety Bond Surety Bonds. Our platform supports integrations with popular CRM and document management systems, allowing for seamless data transfer and improved workflow efficiency.

-

Is airSlate SignNow compliant with regulations for Surety Bond Surety Bonds?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations for Surety Bond Surety Bonds. We prioritize security and compliance, ensuring that your documents are handled in accordance with industry standards and legal requirements.

Get more for Surety Bond Surety Bond

- General notice of default for contract for deed delaware form

- Sellers disclosure of forfeiture rights for contract for deed delaware form

- Seller disclosure residential 497301943 form

- Delaware annual statement form

- Notice of default for past due payments in connection with contract for deed delaware form

- Final notice of default for past due payments in connection with contract for deed delaware form

- Assignment of contract for deed by seller delaware form

- Notice of assignment of contract for deed delaware form

Find out other Surety Bond Surety Bond

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney