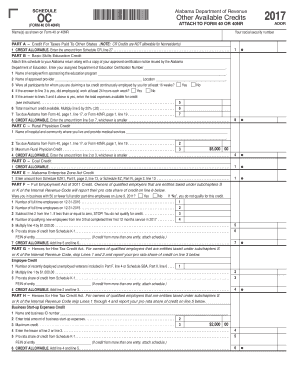

PART a Credit for Taxes Paid to Other States NOTE CR Credits Are NOT Allowable for Nonresidents Form

Understanding the PART A Credit for Taxes Paid to Other States

The PART A Credit for Taxes Paid to Other States allows taxpayers to receive a credit for income taxes paid to other states. This is particularly relevant for individuals who earn income in multiple states. However, it's important to note that CR credits are not allowable for nonresidents. This means that only residents of a state who have paid taxes to another state can claim this credit. Understanding the eligibility criteria is crucial for ensuring compliance and maximizing potential tax benefits.

Steps to Complete the PART A Credit for Taxes Paid to Other States

To successfully complete the PART A Credit for Taxes Paid to Other States, follow these steps:

- Gather all necessary documentation, including proof of taxes paid to the other state.

- Fill out the relevant sections of the form, ensuring you accurately report your income and taxes paid.

- Double-check that you are a resident of the state claiming the credit, as nonresidents are not eligible.

- Submit the completed form along with your tax return to ensure your credit is processed.

Completing these steps carefully will help in claiming the credit effectively.

Eligibility Criteria for the PART A Credit

To qualify for the PART A Credit for Taxes Paid to Other States, you must meet specific eligibility criteria:

- You must be a resident of the state where you are filing your taxes.

- Income must have been earned in another state where you paid taxes.

- Documentation proving the taxes paid to the other state must be provided.

Understanding these criteria will help ensure that you are eligible to claim the credit and avoid potential issues during tax filing.

Required Documents for Claiming the PART A Credit

When claiming the PART A Credit for Taxes Paid to Other States, it is essential to have the following documents ready:

- Tax returns from the other state showing taxes paid.

- W-2 forms or other income statements reflecting income earned in the other state.

- Any additional documentation that supports your claim for the credit.

Having these documents organized will facilitate a smoother filing process and help substantiate your claim.

Filing Deadlines for the PART A Credit

Filing deadlines for the PART A Credit for Taxes Paid to Other States typically align with the general tax filing deadlines. Generally, individual tax returns must be filed by April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these deadlines to avoid penalties.

IRS Guidelines on the PART A Credit

The IRS provides specific guidelines regarding the PART A Credit for Taxes Paid to Other States. Taxpayers should refer to IRS publications and instructions to ensure compliance with federal tax laws. Understanding these guidelines can help you accurately report your credit and avoid potential audits or penalties.

Quick guide on how to complete credit for taxes paid to other states

Easily finalize credit for taxes paid to other states on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage inc subj to tax by oth st on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest way to modify and electronically sign inc subj to tax by az effortlessly

- Locate 2017 form or 40 and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunts, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign cr credits and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs inc subj to tax by az

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

Related searches to 2017 form or 40

Create this form in 5 minutes!

How to create an eSignature for the cr credits

How to generate an electronic signature for the Part A Credit For Taxes Paid To Other States Note Cr Credits Are Not Allowable For Nonresidents online

How to generate an eSignature for your Part A Credit For Taxes Paid To Other States Note Cr Credits Are Not Allowable For Nonresidents in Chrome

How to make an eSignature for signing the Part A Credit For Taxes Paid To Other States Note Cr Credits Are Not Allowable For Nonresidents in Gmail

How to generate an eSignature for the Part A Credit For Taxes Paid To Other States Note Cr Credits Are Not Allowable For Nonresidents from your smartphone

How to generate an eSignature for the Part A Credit For Taxes Paid To Other States Note Cr Credits Are Not Allowable For Nonresidents on iOS devices

How to generate an eSignature for the Part A Credit For Taxes Paid To Other States Note Cr Credits Are Not Allowable For Nonresidents on Android

People also ask form or 40

-

What does 'inc subj to tax by oth st.' mean in the context of eSignature agreements?

'Inc subj to tax by oth st.' refers to income subject to tax by other states when businesses operate across state lines. Understanding this term is crucial for ensuring compliance with tax regulations while using airSlate SignNow for eSigning agreements.

-

How does airSlate SignNow help businesses manage 'inc subj to tax by oth st.' documentation?

airSlate SignNow provides an efficient platform to create, send, and manage documents that may be subject to tax by other states. Our solution ensures that all relevant tax stipulations are clearly outlined and signed digitally, minimizing legal risks.

-

What features does airSlate SignNow offer to handle tax-related documents effectively?

With airSlate SignNow, you can customize your documents to include specific tax language, such as 'inc subj to tax by oth st.' Additionally, our templates and smart fields allow for quick adjustments, ensuring you maintain compliance while streamlining the signing process.

-

Is there a cost associated with using airSlate SignNow for documents with tax implications?

Yes, airSlate SignNow offers various pricing plans tailored for different business needs. Regardless of the plan, our platform provides a cost-effective solution for managing documents that involve 'inc subj to tax by oth st.' ensuring you maintain compliance with minimal effort.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting systems, helping you maintain accurate records for transactions that include 'inc subj to tax by oth st.' This integration simplifies the handling of tax-related documents.

-

What benefits does airSlate SignNow provide for businesses dealing with multi-state taxation?

airSlate SignNow enhances operational efficiency by automating the document signing process, especially for agreements that involve 'inc subj to tax by oth st.' This not only saves time but also reduces paper usage and ensures that your documents are legally binding.

-

How secure is the airSlate SignNow platform for documents related to taxation?

Security is paramount at airSlate SignNow. Our platform employs advanced encryption and compliance measures to safeguard documents, including those that involve 'inc subj to tax by oth st.' You can trust that your sensitive information is protected while using our eSigning solution.

Get more for inc subj to tax by oth st

Find out other inc subj to tax by az

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word