Va5 Form

What is the VA 5 Form

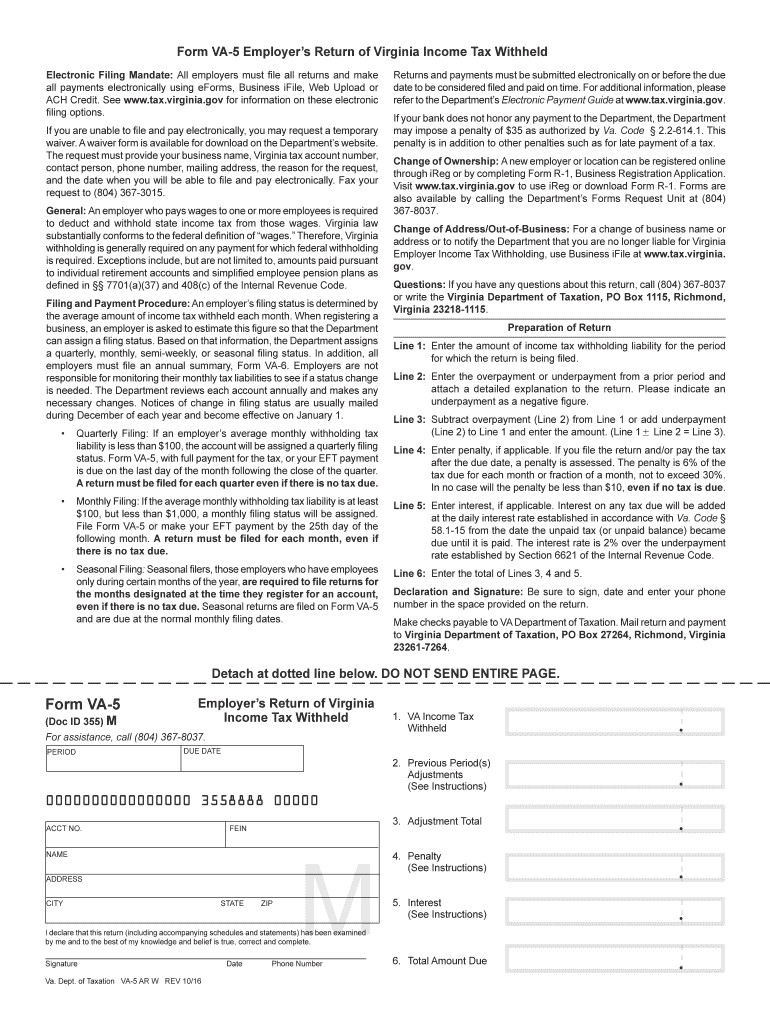

The VA 5 Form is a tax document used by employers in Virginia to report and remit state income tax withheld from employees' wages. This form is essential for ensuring compliance with state tax laws and helps maintain accurate records for both employers and employees. The VA 5 Form is specifically designed for reporting withholding tax and is typically submitted on a monthly basis, aligning with the state’s tax collection schedule.

Steps to Complete the VA 5 Form

Completing the VA 5 Form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including the employer's identification details and the total amount of state income tax withheld during the reporting period. Next, accurately fill in the form, ensuring that all figures are correctly calculated. After completing the form, review it for any errors before submission. Finally, submit the VA 5 Form to the appropriate state tax authority by the designated deadline.

How to Obtain the VA 5 Form

The VA 5 Form can be obtained through the Virginia Department of Taxation's official website or by contacting their offices directly. Employers may also find the form available at local tax offices or through accounting software that supports Virginia tax filings. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Legal Use of the VA 5 Form

The VA 5 Form is legally recognized as a valid document for reporting state income tax withholdings. To ensure its legal standing, employers must adhere to the guidelines set forth by the Virginia Department of Taxation. This includes timely submission and accurate reporting of withheld amounts. Failure to comply with these regulations can result in penalties and interest charges.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the VA 5 Form to avoid penalties. Typically, the form is due on the 15th day of the month following the reporting period. For example, the form for January withholdings would be due by February 15. It is crucial for employers to mark these dates on their calendars to ensure timely submissions.

Form Submission Methods

The VA 5 Form can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient method, allowing for immediate processing. For those opting to submit by mail, it is important to send the form to the correct address as specified by the Virginia Department of Taxation. In-person submissions can be made at local tax offices, providing an opportunity for immediate assistance if needed.

Quick guide on how to complete fillable online tax virginia form va 5 employer s return of

Complete Va5 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a sustainable alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any obstacles. Handle Va5 Form on any system using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest way to modify and eSign Va5 Form without any hassle

- Locate Va5 Form and click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form: by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Adjust and eSign Va5 Form and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online tax virginia form va 5 employer s return of

How to create an electronic signature for the Fillable Online Tax Virginia Form Va 5 Employer S Return Of online

How to make an electronic signature for your Fillable Online Tax Virginia Form Va 5 Employer S Return Of in Chrome

How to make an eSignature for signing the Fillable Online Tax Virginia Form Va 5 Employer S Return Of in Gmail

How to create an electronic signature for the Fillable Online Tax Virginia Form Va 5 Employer S Return Of straight from your mobile device

How to generate an eSignature for the Fillable Online Tax Virginia Form Va 5 Employer S Return Of on iOS devices

How to make an electronic signature for the Fillable Online Tax Virginia Form Va 5 Employer S Return Of on Android devices

People also ask

-

What is the va 5 form and how is it used?

The va 5 form is a document used for various administrative purposes, including applications for benefits and services. By utilizing airSlate SignNow, you can easily eSign and send the va 5 form online, streamlining the process and ensuring quick delivery.

-

How much does it cost to use airSlate SignNow for the va 5 form?

airSlate SignNow offers competitive pricing plans based on your specific needs. Whether you're sending a few va 5 forms or managing a high volume of documents, there's a plan that fits your budget without sacrificing features.

-

What features does airSlate SignNow provide for completing a va 5 form?

With airSlate SignNow, you can easily fill out, eSign, and track your va 5 form. The platform includes templates, reusable fields, and an intuitive interface, making the document management process seamless and efficient.

-

Are there any integrations available for the va 5 form on airSlate SignNow?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow when dealing with the va 5 form. You can sync with tools like Google Drive, Dropbox, and Zapier, ensuring easy access and management of your documents.

-

Can I use airSlate SignNow on mobile devices for the va 5 form?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to fill out and eSign the va 5 form on the go. This flexibility ensures that you can manage your documents anytime, anywhere.

-

What are the benefits of using airSlate SignNow for the va 5 form?

Using airSlate SignNow for the va 5 form provides numerous benefits, including faster turnaround times, enhanced security measures, and reduced paper waste. It simplifies the signing process, making it convenient for both senders and recipients.

-

How secure is airSlate SignNow when handling my va 5 form?

airSlate SignNow prioritizes security for all documents, including your va 5 form. The platform employs advanced encryption and complies with international security standards, ensuring that your data remains protected throughout the signing process.

Get more for Va5 Form

- Sharon k harvey memorial foundation inc zeta phi beta zphib thz form

- Contact us south central iowa community foundation form

- Wichita force dance team form

- Marley cooling tower inspections checklist form marley cooling tower inspections checklist form

- Id billing number or customer id indiana state po form

- Images template netwp contentuploadsgym fitness center membership application contract printable form

- New creations boarding school form

- Fillable online valpoymca valparaiso family ymca form

Find out other Va5 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors