Application for EIN TUG Form

What is the Application For EIN TUG

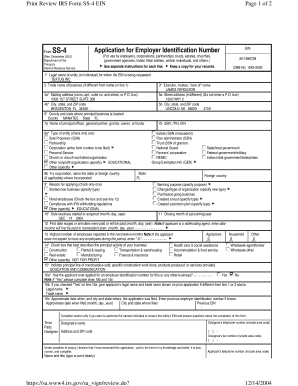

The Application For EIN TUG is a crucial document used by businesses and organizations in the United States to apply for an Employer Identification Number (EIN). This number, issued by the Internal Revenue Service (IRS), serves as a unique identifier for tax purposes. It is essential for various business activities, including opening a bank account, filing tax returns, and hiring employees. The EIN is often required for corporations, partnerships, and limited liability companies (LLCs), making the application process a fundamental step in establishing a business entity.

Steps to complete the Application For EIN TUG

Completing the Application For EIN TUG involves several straightforward steps:

- Gather necessary information, such as the legal name of the business, address, and type of entity.

- Determine the reason for applying for an EIN, as this will guide the application process.

- Access the application form through the IRS website or other authorized platforms.

- Fill out the form accurately, ensuring all information is complete and correct.

- Submit the application online, by mail, or in person, depending on your preference.

After submission, the IRS will process the application and issue the EIN, typically within a few days if submitted online.

Required Documents

To successfully complete the Application For EIN TUG, specific documents and information are necessary:

- The legal name of the business entity.

- The business address, including the state and ZIP code.

- The type of entity (e.g., LLC, corporation, partnership).

- The name and Social Security Number (SSN) of the principal officer or owner.

- Reason for applying for the EIN, such as starting a new business or hiring employees.

Having these documents ready can streamline the application process and help avoid delays.

IRS Guidelines

The IRS provides specific guidelines for completing the Application For EIN TUG. These guidelines emphasize the importance of accuracy and completeness in the application. Applicants should ensure that all required fields are filled out and that the information matches official records. The IRS also advises applicants to double-check their entries to prevent errors that could lead to processing delays. Understanding these guidelines can facilitate a smoother application experience.

Application Process & Approval Time

The application process for obtaining an EIN through the Application For EIN TUG is generally efficient. Once the application is submitted, the IRS typically processes it within four to six weeks if filed by mail. However, applications submitted online can receive immediate approval, allowing businesses to obtain their EIN almost instantly. It is advisable to apply for an EIN as early as possible, especially when planning to hire employees or open a business bank account.

Eligibility Criteria

Eligibility for applying for an EIN using the Application For EIN TUG is primarily based on the type of business entity. Any business entity operating in the United States, including sole proprietorships, partnerships, corporations, and non-profits, can apply for an EIN. Additionally, individuals who are required to file certain tax returns or who have employees must obtain an EIN. Understanding these eligibility criteria is essential for ensuring compliance with IRS regulations.

Quick guide on how to complete application for ein tug

Prepare [SKS] effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents promptly without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to adjust and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form hunts, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For EIN TUG

Create this form in 5 minutes!

How to create an eSignature for the application for ein tug

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For EIN TUG?

The Application For EIN TUG is a streamlined process provided by airSlate SignNow that allows businesses to easily apply for an Employer Identification Number (EIN). This tool simplifies the paperwork involved, ensuring that users can complete their applications efficiently and accurately.

-

How much does the Application For EIN TUG cost?

The Application For EIN TUG is part of airSlate SignNow's cost-effective solutions, with pricing plans designed to fit various business needs. Users can choose from different subscription tiers, ensuring they only pay for the features they require while benefiting from the ease of eSigning and document management.

-

What features does the Application For EIN TUG offer?

The Application For EIN TUG includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features help streamline the EIN application process, making it easier for businesses to manage their documentation efficiently.

-

How can the Application For EIN TUG benefit my business?

Using the Application For EIN TUG can signNowly reduce the time and effort required to apply for an EIN. By automating the process and providing a user-friendly interface, airSlate SignNow empowers businesses to focus on their core operations while ensuring compliance with IRS requirements.

-

Is the Application For EIN TUG easy to use?

Yes, the Application For EIN TUG is designed with user experience in mind. Its intuitive interface allows users to navigate through the application process effortlessly, making it accessible even for those who may not be tech-savvy.

-

Can I integrate the Application For EIN TUG with other tools?

Absolutely! The Application For EIN TUG can be integrated with various business tools and software, enhancing your workflow. This integration capability allows for seamless document management and eSigning, ensuring that your EIN application process fits smoothly into your existing systems.

-

What support is available for the Application For EIN TUG?

airSlate SignNow offers comprehensive support for users of the Application For EIN TUG. Whether you have questions about the application process or need technical assistance, our dedicated support team is available to help you navigate any challenges you may encounter.

Get more for Application For EIN TUG

Find out other Application For EIN TUG

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now