Illinois State Tax Forms

What is the Illinois State Tax Form?

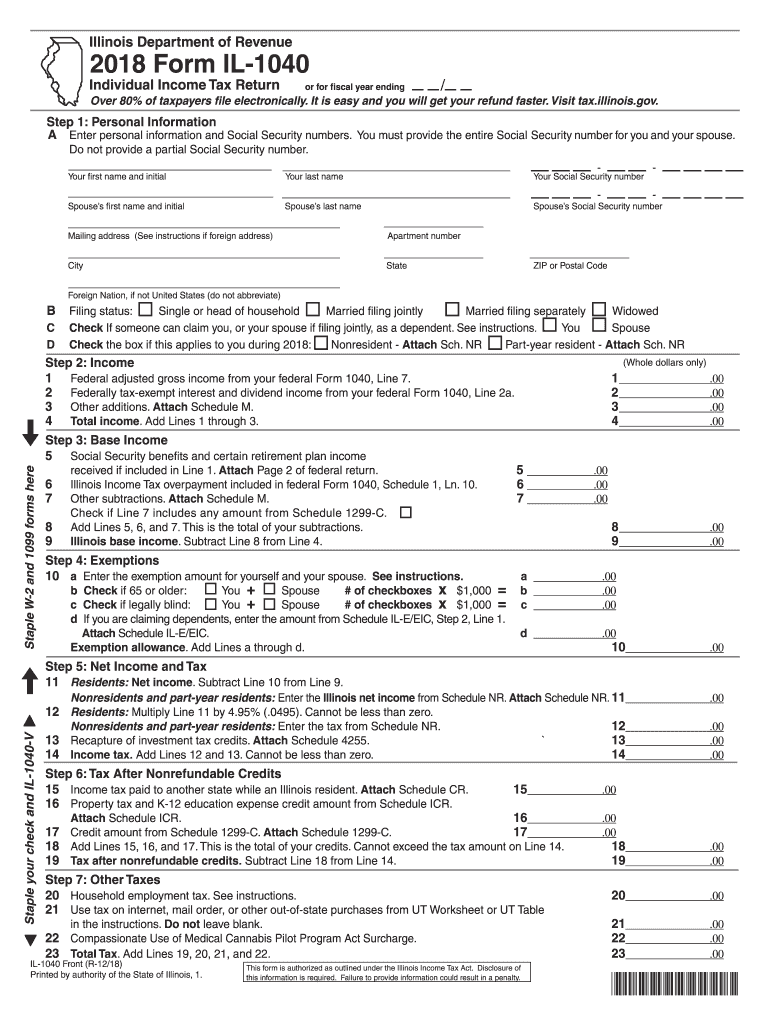

The Illinois State Tax Form, commonly referred to as the IL-1040, is the official document used by residents of Illinois to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it helps determine the amount of state tax owed based on various income sources, deductions, and credits. The IL-1040 form must be completed accurately to ensure compliance with state tax laws and to avoid penalties.

How to Obtain the Illinois State Tax Form

To obtain the Illinois State Tax Form, individuals can visit the official website of the Illinois Department of Revenue. The form is available for download in PDF format, allowing taxpayers to print it for completion. Additionally, physical copies of the form can often be found at local libraries, post offices, and tax assistance centers. It is advisable to ensure that you are using the correct version of the form for the tax year you are filing.

Steps to Complete the Illinois State Tax Form

Completing the Illinois State Tax Form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring that you include all taxable earnings.

- Claim any eligible deductions or credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Review the completed form for accuracy before submission.

Legal Use of the Illinois State Tax Form

The Illinois State Tax Form is legally binding when completed and submitted in accordance with state regulations. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies can lead to audits or penalties. The use of e-signatures is permitted, provided that the electronic submission complies with the legal standards set forth by the Illinois Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois State Tax Form typically align with federal tax deadlines. For most taxpayers, the due date is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes in deadlines, especially for special circumstances such as extensions or changes in tax law.

Form Submission Methods

Taxpayers in Illinois have several options for submitting their completed state tax forms:

- Online Submission: Many individuals choose to file electronically through the Illinois Department of Revenue's online portal.

- Mail: Completed forms can be mailed to the appropriate address listed on the form, ensuring that they are postmarked by the filing deadline.

- In-Person: Some taxpayers may prefer to submit their forms in person at designated tax offices or during tax assistance events.

Quick guide on how to complete il 1040 individual income tax return income tax forms illinoisgov

Prepare Illinois State Tax Forms effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, as you can locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Illinois State Tax Forms on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Illinois State Tax Forms with ease

- Find Illinois State Tax Forms and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign function, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Alter and eSign Illinois State Tax Forms and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1040 individual income tax return income tax forms illinoisgov

How to make an eSignature for the Il 1040 Individual Income Tax Return Income Tax Forms Illinoisgov online

How to make an electronic signature for your Il 1040 Individual Income Tax Return Income Tax Forms Illinoisgov in Chrome

How to create an electronic signature for signing the Il 1040 Individual Income Tax Return Income Tax Forms Illinoisgov in Gmail

How to make an eSignature for the Il 1040 Individual Income Tax Return Income Tax Forms Illinoisgov right from your smart phone

How to make an eSignature for the Il 1040 Individual Income Tax Return Income Tax Forms Illinoisgov on iOS devices

How to create an electronic signature for the Il 1040 Individual Income Tax Return Income Tax Forms Illinoisgov on Android devices

People also ask

-

What is an Illinois state tax form?

An Illinois state tax form is a document that residents must complete and submit to the Illinois Department of Revenue to report their income and calculate taxes owed. It's essential for accurate tax reporting and compliance with state laws. eSigning your Illinois state tax form can streamline the process, making it easier for you to submit your taxes on time.

-

How can airSlate SignNow help me with my Illinois state tax form?

airSlate SignNow enables you to easily send, receive, and eSign your Illinois state tax form all in one platform. With user-friendly features, you can complete the form electronically, which saves time and reduces the risk of errors. This is especially beneficial during tax season when deadlines are critical.

-

What features does airSlate SignNow offer for eSigning Illinois state tax forms?

airSlate SignNow offers a range of features for eSigning Illinois state tax forms, including customizable templates, secure cloud storage, and mobile compatibility. These functionalities ensure that you can fill out and eSign your forms from anywhere, on any device, making tax filing more convenient than ever.

-

Is airSlate SignNow a cost-effective solution for handling Illinois state tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing your Illinois state tax forms. With affordable pricing plans, you can save money compared to traditional paper-based processes. Plus, the time saved through eSigning can lead to even greater savings, enhancing the overall value of the service.

-

Can I integrate airSlate SignNow with other software for my Illinois state tax forms?

Absolutely! airSlate SignNow supports several integrations with popular software platforms, allowing you to streamline your workflow when preparing Illinois state tax forms. By connecting your existing tools, you can automate processes and improve efficiency, making tax filing even smoother.

-

What are the benefits of eSigning my Illinois state tax form with airSlate SignNow?

eSigning your Illinois state tax form with airSlate SignNow offers numerous benefits such as speed, convenience, and enhanced security. The electronic signature is legally binding and allows for quick submission, reducing processing time. Additionally, all your documents are stored securely, giving you peace of mind regarding your sensitive information.

-

Is my information secure when using airSlate SignNow for Illinois state tax forms?

Yes, your information is secure when using airSlate SignNow for Illinois state tax forms. The platform employs advanced encryption and secure data storage to protect your sensitive information. With airSlate SignNow, you can file your tax documents confidently, knowing that your data is safeguarded.

Get more for Illinois State Tax Forms

- Volunteer information form smyth county public schools scsb

- Highline christian church youth group permission and release highlinechristian form

- Order of the eastern star petition for membership form

- Rodeo sponsorship form

- Oswego hospital lifeline application oswego health oswegohealth form

- Sports coach contract template form

- Sports contract template 787755879 form

- Sports event contract template form

Find out other Illinois State Tax Forms

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template