Tr Form

What is the Tr 2000 Form?

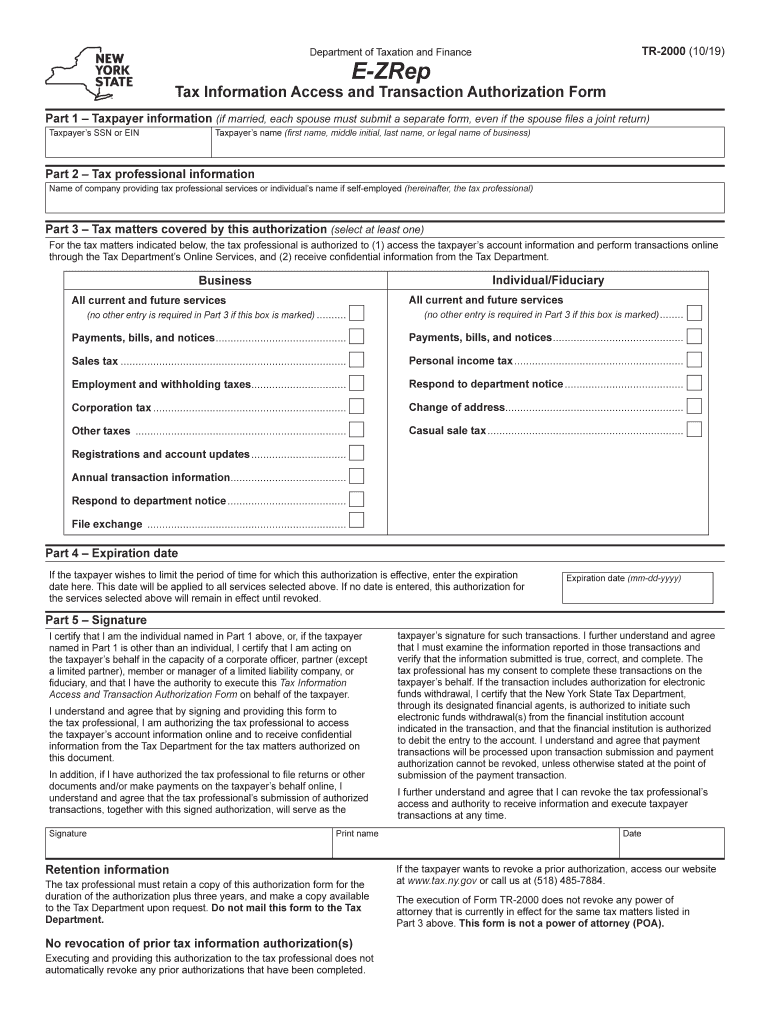

The Tr 2000 form, commonly referred to as the NYS EZ Rep Form, is a document used in New York State for tax purposes. This form allows taxpayers to report certain income and claim applicable deductions. It is specifically designed for individuals who meet specific eligibility criteria, making it a streamlined option for those who qualify. Understanding the purpose and requirements of the Tr 2000 is crucial for ensuring accurate tax reporting and compliance with state regulations.

Steps to Complete the Tr 2000 Form

Completing the Tr 2000 form involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary documents, including income statements and identification.

- Fill out personal information, such as name, address, and Social Security number.

- Report income sources, ensuring to include all relevant earnings.

- Claim deductions and credits applicable to your situation.

- Review the completed form for accuracy before submission.

Carefully following these steps will help ensure that the form is filled out correctly, reducing the risk of errors that could lead to penalties or delays.

Legal Use of the Tr 2000 Form

The Tr 2000 form is legally recognized as a valid document for tax reporting in New York State. To ensure its legal standing, it must be completed accurately and submitted within the designated deadlines. Compliance with state tax laws is essential, as failure to use the form correctly may result in penalties or audits. Utilizing a reliable eSignature platform can further enhance the legal validity of your submission by providing secure signatures and maintaining compliance with electronic signature laws.

Who Issues the Tr 2000 Form?

The Tr 2000 form is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department's official website or through authorized distribution points. Understanding the issuing authority helps taxpayers know where to seek assistance or clarification regarding the form and its requirements.

Required Documents for the Tr 2000 Form

When preparing to fill out the Tr 2000 form, it is important to gather all required documents to ensure a smooth filing process. Key documents include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Proof of any deductions or credits being claimed.

- Identification documents, such as a driver's license or Social Security card.

Having these documents ready will facilitate accurate completion of the form and help avoid delays in processing.

Filing Deadlines for the Tr 2000 Form

Timely submission of the Tr 2000 form is crucial to avoid penalties. The filing deadline typically aligns with the federal tax deadline, which is usually April fifteenth of each year. However, taxpayers should verify specific dates each year, as they may vary slightly. Awareness of these deadlines allows taxpayers to plan accordingly and ensure their forms are submitted on time.

Quick guide on how to complete form tr 20001019e zrep tax information access and transaction authorization formtr2000

Complete Tr effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Tr on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Tr with ease

- Find Tr and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tr and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tr 20001019e zrep tax information access and transaction authorization formtr2000

How to generate an electronic signature for your Form Tr 20001019e Zrep Tax Information Access And Transaction Authorization Formtr2000 online

How to make an eSignature for your Form Tr 20001019e Zrep Tax Information Access And Transaction Authorization Formtr2000 in Google Chrome

How to generate an electronic signature for putting it on the Form Tr 20001019e Zrep Tax Information Access And Transaction Authorization Formtr2000 in Gmail

How to make an electronic signature for the Form Tr 20001019e Zrep Tax Information Access And Transaction Authorization Formtr2000 straight from your smartphone

How to make an electronic signature for the Form Tr 20001019e Zrep Tax Information Access And Transaction Authorization Formtr2000 on iOS devices

How to generate an electronic signature for the Form Tr 20001019e Zrep Tax Information Access And Transaction Authorization Formtr2000 on Android

People also ask

-

What is the NYS EZ Rep Form and how does airSlate SignNow facilitate its completion?

The NYS EZ Rep Form is a simplified form used for tax purposes in New York State. airSlate SignNow enables users to fill out and eSign this form quickly and securely, ensuring compliance and reducing the chances of errors in the submission process.

-

Is there a cost associated with using airSlate SignNow for the NYS EZ Rep Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Users can choose a plan that suits their requirements for handling documents like the NYS EZ Rep Form affordably and efficiently.

-

What are the main features of airSlate SignNow for completing the NYS EZ Rep Form?

With airSlate SignNow, users can take advantage of features such as customizable templates, cloud storage, and the ability to eSign documents from any device. These features streamline the process of completing and submitting the NYS EZ Rep Form online.

-

Can I integrate airSlate SignNow with other applications for managing the NYS EZ Rep Form?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and Salesforce. This allows seamless management of the NYS EZ Rep Form alongside other essential business tools.

-

How does airSlate SignNow ensure the security of my NYS EZ Rep Form?

airSlate SignNow prioritizes security with robust encryption and secure data storage. When you complete your NYS EZ Rep Form using our platform, you can be confident that your sensitive information is protected from unauthorized access.

-

What benefits does airSlate SignNow provide for users filling out the NYS EZ Rep Form?

Using airSlate SignNow to fill out the NYS EZ Rep Form offers several benefits, including increased efficiency, reduced paperwork, and the ability to track the signing process in real-time. This allows for a smoother experience compared to traditional methods.

-

Is it easy to share the NYS EZ Rep Form with others using airSlate SignNow?

Yes, sharing the NYS EZ Rep Form with others is simple using airSlate SignNow. You can easily send the document via email or share a link, making collaboration effortless for all parties involved.

Get more for Tr

- Cosmetic interest questionnaire new age dermatology form

- Catering contract click here love amp war in texas form

- Sponsor contract template form

- Sponsorship sponsorship contract template form

- Sponsorship race car sponsorship contract template form

- Sports agent contract template form

- Sport contract template form

- Sports bet contract template form

Find out other Tr

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy