Indiana State Form Sales Exemption

What is the Indiana State Form Sales Exemption

The Indiana State Form Sales Exemption, commonly referred to as the ST-109, is a document that allows eligible businesses to purchase certain goods and services without paying sales tax. This exemption is primarily designed for entities that use these purchases in their operations, such as manufacturing or resale. Understanding the specific criteria and applications of this form is essential for businesses seeking to optimize their tax obligations.

Eligibility Criteria for the Indiana State Form Sales Exemption

To qualify for the ST-109 utility sales tax exemption, applicants must meet specific eligibility criteria. Generally, the exemption is available to businesses that are engaged in manufacturing, processing, or resale of goods. Additionally, organizations that provide certain services, such as utilities, may also qualify. It is crucial for applicants to review the Indiana Department of Revenue guidelines to ensure compliance with all requirements.

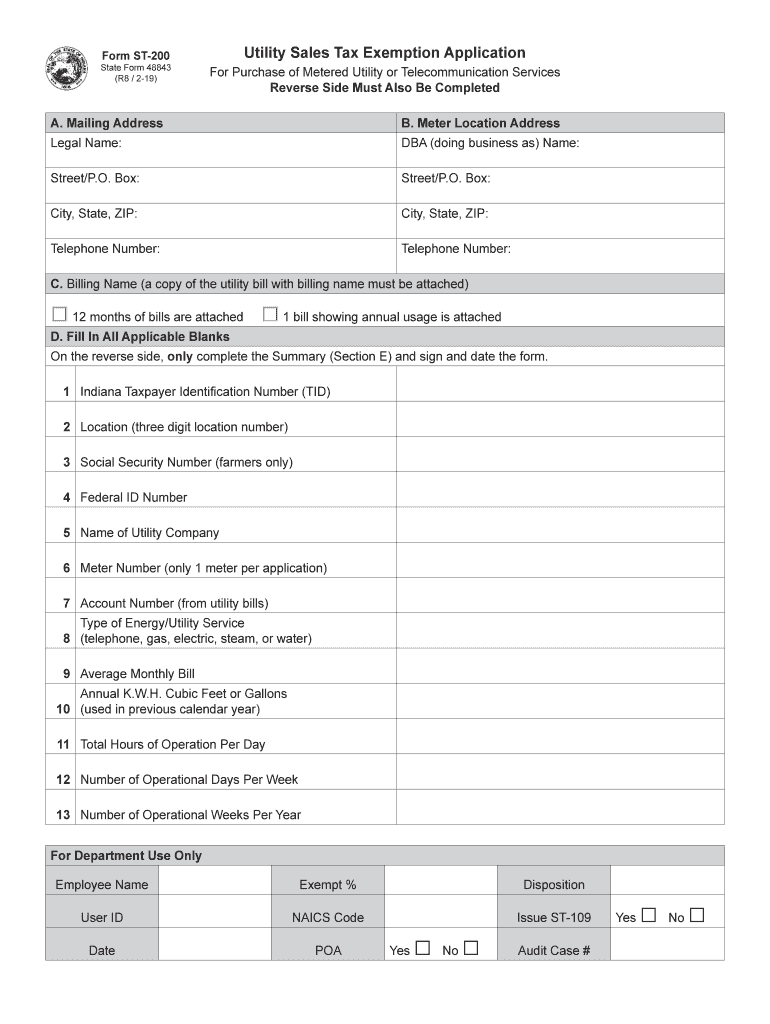

Steps to Complete the Indiana State Form Sales Exemption

Completing the ST-109 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the business's tax identification number and details about the purchases intended for exemption. Next, fill out the form accurately, ensuring all sections are completed. After completing the form, it should be signed and dated by an authorized representative. Finally, submit the form to the appropriate vendor or supplier to validate the exemption during the purchase process.

How to Obtain the Indiana State Form Sales Exemption

The ST-109 form can be obtained directly from the Indiana Department of Revenue's website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to avoid any compliance issues. Once obtained, businesses can fill out the form as needed for their tax exemption purposes.

Legal Use of the Indiana State Form Sales Exemption

The legal use of the ST-109 form is governed by Indiana state tax laws. Businesses must use the form solely for qualifying purchases and must maintain accurate records of all transactions made under this exemption. Misuse of the form, such as applying it to non-qualifying purchases, can lead to penalties and interest charges from the Indiana Department of Revenue.

Form Submission Methods

The ST-109 form can be submitted in various ways, depending on the vendor's requirements. Businesses may present the completed form in person at the time of purchase, or they may need to submit it electronically or via mail, depending on the vendor's policies. It is advisable to confirm the preferred submission method with each vendor to ensure compliance and acceptance of the exemption.

Quick guide on how to complete utility sales tax exemption application

Complete Indiana State Form Sales Exemption effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Indiana State Form Sales Exemption on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign Indiana State Form Sales Exemption without hassle

- Find Indiana State Form Sales Exemption and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or save it to your PC.

Forget about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Indiana State Form Sales Exemption and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the utility sales tax exemption application

How to make an eSignature for the Utility Sales Tax Exemption Application in the online mode

How to create an electronic signature for your Utility Sales Tax Exemption Application in Google Chrome

How to generate an electronic signature for signing the Utility Sales Tax Exemption Application in Gmail

How to generate an electronic signature for the Utility Sales Tax Exemption Application right from your mobile device

How to create an electronic signature for the Utility Sales Tax Exemption Application on iOS devices

How to make an electronic signature for the Utility Sales Tax Exemption Application on Android OS

People also ask

-

What is the st109 utility sales tax exemption?

The st109 utility sales tax exemption is a form used in specific states that allows businesses to exempt certain utility sales from sales tax. This exemption is crucial for organizations that rely heavily on utilities and want to reduce operational costs. Understanding this form can help businesses save money and remain compliant with tax regulations.

-

How does airSlate SignNow help with the st109 utility sales tax exemption process?

airSlate SignNow streamlines the completion and submission of the st109 utility sales tax exemption form. Our eSignature solution allows users to easily fill out, sign, and send documents electronically, reducing paperwork and speeding up the process. This efficiency can save you valuable time and ensure accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for the st109 utility sales tax exemption?

While airSlate SignNow offers various pricing plans, the cost will depend on the features you utilize. Our platform is generally cost-effective, and the savings you achieve through efficient handling of the st109 utility sales tax exemption can quickly offset the cost of subscription. We also offer a free trial for you to explore our services.

-

What features does airSlate SignNow offer for managing the st109 utility sales tax exemption?

airSlate SignNow provides essential features such as customizable templates, electronic signatures, and secure cloud storage optimized for handling the st109 utility sales tax exemption. These features ensure that all documents are easily accessible and manageable, making compliance and organization seamless. Additionally, you can track document status in real-time.

-

Can I integrate airSlate SignNow with other software when managing the st109 utility sales tax exemption?

Yes, airSlate SignNow offers integrations with various software solutions to enhance your workflow. This allows you to connect other financial and accounting tools for a more efficient handling of the st109 utility sales tax exemption process. Such integrations streamline your operations and provide a holistic approach to document management.

-

How secure is airSlate SignNow when handling the st109 utility sales tax exemption?

AirSlate SignNow prioritizes the security of your documents, including the st109 utility sales tax exemption. We utilize advanced encryption methods and comply with industry standards to ensure that your sensitive information is protected. This commitment to security allows businesses to confidently use our platform.

-

What are the benefits of using airSlate SignNow for the st109 utility sales tax exemption?

Using airSlate SignNow for the st109 utility sales tax exemption offers numerous benefits including reduced processing time, improved accuracy, and enhanced compliance. The ease of electronic signatures means you can finalize and send your documents quicker than traditional methods. Plus, our user-friendly interface ensures that the process is accessible for everyone in your organization.

Get more for Indiana State Form Sales Exemption

- Ato tax file number declaration form docx original

- Receptacle testing form 1 in gov

- Consultants contract template form

- Sod installation contract template form

- Software annual maintenance contract template form

- Software consult contract template form

- Software as a service contract template form

- Software consultant contract template form

Find out other Indiana State Form Sales Exemption

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement