Indiana State Form Sales Exemption

What is the Indiana State Form Sales Exemption

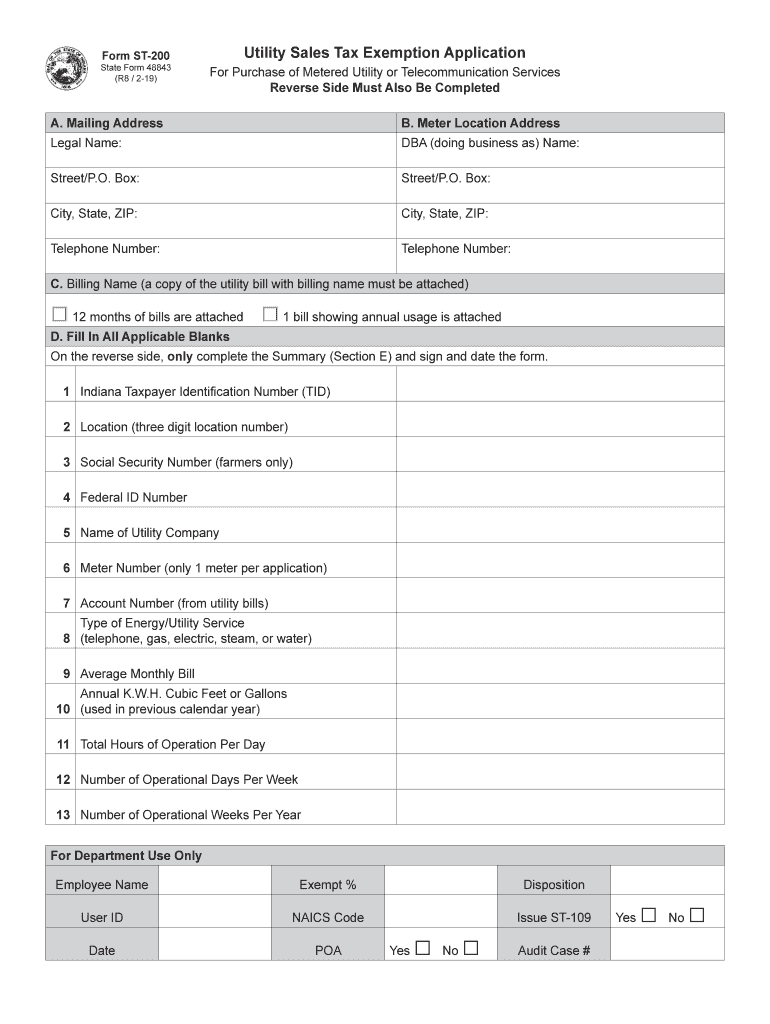

The Indiana State Form Sales Exemption, commonly referred to as the ST-109, is a document that allows eligible businesses to purchase certain goods and services without paying sales tax. This exemption is primarily designed for entities that use these purchases in their operations, such as manufacturing or resale. Understanding the specific criteria and applications of this form is essential for businesses seeking to optimize their tax obligations.

Eligibility Criteria for the Indiana State Form Sales Exemption

To qualify for the ST-109 utility sales tax exemption, applicants must meet specific eligibility criteria. Generally, the exemption is available to businesses that are engaged in manufacturing, processing, or resale of goods. Additionally, organizations that provide certain services, such as utilities, may also qualify. It is crucial for applicants to review the Indiana Department of Revenue guidelines to ensure compliance with all requirements.

Steps to Complete the Indiana State Form Sales Exemption

Completing the ST-109 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the business's tax identification number and details about the purchases intended for exemption. Next, fill out the form accurately, ensuring all sections are completed. After completing the form, it should be signed and dated by an authorized representative. Finally, submit the form to the appropriate vendor or supplier to validate the exemption during the purchase process.

How to Obtain the Indiana State Form Sales Exemption

The ST-109 form can be obtained directly from the Indiana Department of Revenue's website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to avoid any compliance issues. Once obtained, businesses can fill out the form as needed for their tax exemption purposes.

Legal Use of the Indiana State Form Sales Exemption

The legal use of the ST-109 form is governed by Indiana state tax laws. Businesses must use the form solely for qualifying purchases and must maintain accurate records of all transactions made under this exemption. Misuse of the form, such as applying it to non-qualifying purchases, can lead to penalties and interest charges from the Indiana Department of Revenue.

Form Submission Methods

The ST-109 form can be submitted in various ways, depending on the vendor's requirements. Businesses may present the completed form in person at the time of purchase, or they may need to submit it electronically or via mail, depending on the vendor's policies. It is advisable to confirm the preferred submission method with each vendor to ensure compliance and acceptance of the exemption.

Quick guide on how to complete utility sales tax exemption application

Complete Indiana State Form Sales Exemption effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Indiana State Form Sales Exemption on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign Indiana State Form Sales Exemption without hassle

- Find Indiana State Form Sales Exemption and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or save it to your PC.

Forget about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Indiana State Form Sales Exemption and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the utility sales tax exemption application

How to make an eSignature for the Utility Sales Tax Exemption Application in the online mode

How to create an electronic signature for your Utility Sales Tax Exemption Application in Google Chrome

How to generate an electronic signature for signing the Utility Sales Tax Exemption Application in Gmail

How to generate an electronic signature for the Utility Sales Tax Exemption Application right from your mobile device

How to create an electronic signature for the Utility Sales Tax Exemption Application on iOS devices

How to make an electronic signature for the Utility Sales Tax Exemption Application on Android OS

People also ask

-

What is the Indiana State Form Sales Exemption?

The Indiana State Form Sales Exemption is a tax form that allows qualifying businesses to purchase items without paying sales tax. This exemption is crucial for businesses looking to save on operational costs. By utilizing the Indiana State Form Sales Exemption, companies can streamline their procurement processes and enhance their profitability.

-

How does airSlate SignNow assist with the Indiana State Form Sales Exemption?

airSlate SignNow provides an efficient platform for businesses to complete and eSign the Indiana State Form Sales Exemption. Our user-friendly interface ensures that users can fill out the form quickly and accurately, reducing the time spent on paperwork. Plus, with secure document storage and easy sharing options, managing your sales exemption forms has never been easier.

-

Are there any costs associated with using airSlate SignNow for the Indiana State Form Sales Exemption?

Yes, while airSlate SignNow offers competitive pricing, the costs may vary based on your chosen plan. We provide flexible subscription options that cater to different business needs, ensuring that you can manage your Indiana State Form Sales Exemption without breaking the bank. Additionally, our cost-effective solution includes features like unlimited document signing and storage.

-

What features does airSlate SignNow offer for managing the Indiana State Form Sales Exemption?

airSlate SignNow offers a variety of features to simplify the management of the Indiana State Form Sales Exemption. Key features include customizable templates, eSignature capabilities, and integration with popular business tools. This makes it easy to track, sign, and store your exemption forms securely.

-

Can I integrate airSlate SignNow with other applications for handling the Indiana State Form Sales Exemption?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enabling you to manage your Indiana State Form Sales Exemption alongside your other business processes. Whether you use CRM systems, cloud storage, or project management tools, our integrations enhance your workflow and improve efficiency.

-

Is airSlate SignNow secure for handling sensitive documents like the Indiana State Form Sales Exemption?

Yes, security is a top priority at airSlate SignNow. We employ advanced encryption protocols and secure cloud storage to protect your documents, including the Indiana State Form Sales Exemption. You can trust that your sensitive information is safe with us, ensuring compliance and peace of mind.

-

How does eSigning the Indiana State Form Sales Exemption work with airSlate SignNow?

eSigning the Indiana State Form Sales Exemption with airSlate SignNow is quick and straightforward. Users can upload the form, add necessary information, and invite signers to eSign digitally. This process eliminates the need for printing and scanning, allowing for a faster turnaround time.

Get more for Indiana State Form Sales Exemption

- Ato tax file number declaration form docx original

- Receptacle testing form 1 in gov

- Consultants contract template form

- Sod installation contract template form

- Software annual maintenance contract template form

- Software consult contract template form

- Software as a service contract template form

- Software consultant contract template form

Find out other Indiana State Form Sales Exemption

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy