Boe 1150 Form

What is the BOE 1150?

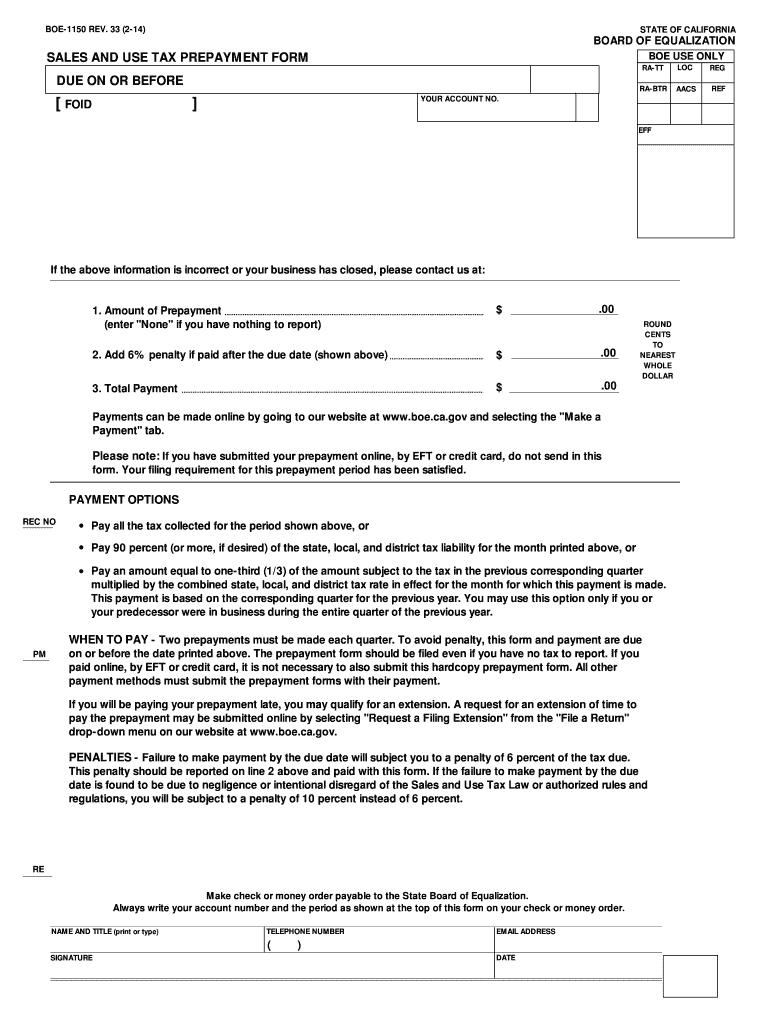

The BOE 1150 is a California form used for reporting and paying sales and use tax. This form is essential for businesses that make purchases subject to sales tax or for those who owe use tax on items purchased outside of California but used within the state. The BOE 1150 serves as a declaration of the tax owed and provides necessary details to the California Department of Tax and Fee Administration (CDTFA).

How to Use the BOE 1150

Using the BOE 1150 involves several steps to ensure accurate reporting. First, gather all relevant information regarding your purchases, including dates, amounts, and types of items. Next, fill out the form with the required details, including your business information and the total amount of sales and use tax owed. After completing the form, submit it to the CDTFA either online or by mail, depending on your preference.

Steps to Complete the BOE 1150

Completing the BOE 1150 requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including receipts and invoices.

- Fill in your business name, address, and seller's permit number.

- List all purchases subject to sales and use tax, including item descriptions and amounts.

- Calculate the total sales and use tax owed based on the applicable rates.

- Review the form for accuracy before submission.

Legal Use of the BOE 1150

The BOE 1150 must be completed accurately to comply with California tax laws. Legal use of this form ensures that businesses meet their tax obligations and avoid penalties. It is important to understand the regulations surrounding sales and use tax to ensure proper reporting and payment. Utilizing a reliable eSignature platform can enhance the legal standing of your submitted form.

Required Documents

When preparing to submit the BOE 1150, certain documents are essential. These include:

- Receipts for all taxable purchases.

- Invoices that detail the items purchased and their costs.

- Any previous correspondence with the CDTFA regarding tax matters.

Having these documents ready will facilitate a smoother completion process and ensure accuracy in reporting.

Form Submission Methods

The BOE 1150 can be submitted through various methods, allowing flexibility for businesses. Options include:

- Online submission via the CDTFA website, which is often the fastest method.

- Mailing a hard copy of the completed form to the appropriate CDTFA address.

- In-person submission at a local CDTFA office, if preferred.

Choosing the right submission method can help ensure timely processing of your form.

Quick guide on how to complete sales and use tax prepayment form due on or before

Complete Boe 1150 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the proper form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents rapidly without delays. Manage Boe 1150 across any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Boe 1150 without hassle

- Obtain Boe 1150 and then click Get Form to commence.

- Utilize the tools provided to complete your form.

- Emphasize key sections of your documents or conceal sensitive data with tools specifically offered by airSlate SignNow for such tasks.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to secure your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Boe 1150 and ensure outstanding communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax prepayment form due on or before

How to make an eSignature for the Sales And Use Tax Prepayment Form Due On Or Before online

How to make an eSignature for the Sales And Use Tax Prepayment Form Due On Or Before in Chrome

How to create an electronic signature for putting it on the Sales And Use Tax Prepayment Form Due On Or Before in Gmail

How to make an electronic signature for the Sales And Use Tax Prepayment Form Due On Or Before straight from your mobile device

How to make an eSignature for the Sales And Use Tax Prepayment Form Due On Or Before on iOS

How to make an electronic signature for the Sales And Use Tax Prepayment Form Due On Or Before on Android

People also ask

-

What is the significance of 1150 California in relation to airSlate SignNow?

1150 California is an address that many businesses associate with innovative solutions like airSlate SignNow. It represents the hub of digital transformation where companies can streamline their document processes efficiently.

-

How does airSlate SignNow pricing compare for businesses located at 1150 California?

Businesses situated at 1150 California can benefit from competitive pricing plans offered by airSlate SignNow. These plans cater to various needs, ensuring that organizations can find a solution that fits their budget while maximizing their eSigning capabilities.

-

What features does airSlate SignNow offer for businesses in 1150 California?

airSlate SignNow includes robust features such as document templates, real-time tracking, and secure cloud storage, making it ideal for businesses at 1150 California. These features help in enhancing productivity and ensuring that important documents are handled efficiently.

-

What are the benefits of using airSlate SignNow for companies near 1150 California?

Companies near 1150 California can leverage airSlate SignNow’s benefits like improved turnaround times for documents and enhanced customer satisfaction. With its user-friendly interface, businesses can simplify their eSignature processes and reduce paper waste.

-

Can airSlate SignNow integrate with other tools frequently used by businesses at 1150 California?

Yes, airSlate SignNow seamlessly integrates with a variety of tools commonly used by those in 1150 California, such as Google Drive, Salesforce, and Dropbox. This flexibility allows businesses to maintain their current workflows without interruptions.

-

Is airSlate SignNow compliant with legal standards in California?

Absolutely, airSlate SignNow complies with all applicable legal standards, including ESIGN and UETA, ensuring that electronic signatures are legally binding for businesses operating at 1150 California. This compliance provides peace of mind for users regarding the validity of their documents.

-

How can businesses at 1150 California get started with airSlate SignNow?

Getting started with airSlate SignNow is easy for businesses at 1150 California. Interested users can sign up for a free trial on the website, allowing them to explore the features and see how it can enhance their document management processes.

Get more for Boe 1150

- This form is for use in nominating or requesting determinationamp39 5 5 5l 1amp39 nationalregister sc

- Athletic individual photo identity form

- Event venue contract template form

- Snow shovel contract template form

- Sobriety contract template form

- Soccer contract template form

- Soccer coach contract template 787755433 form

- Soccer football player contract template form

Find out other Boe 1150

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online