Form St 140

What is the Form ST-140?

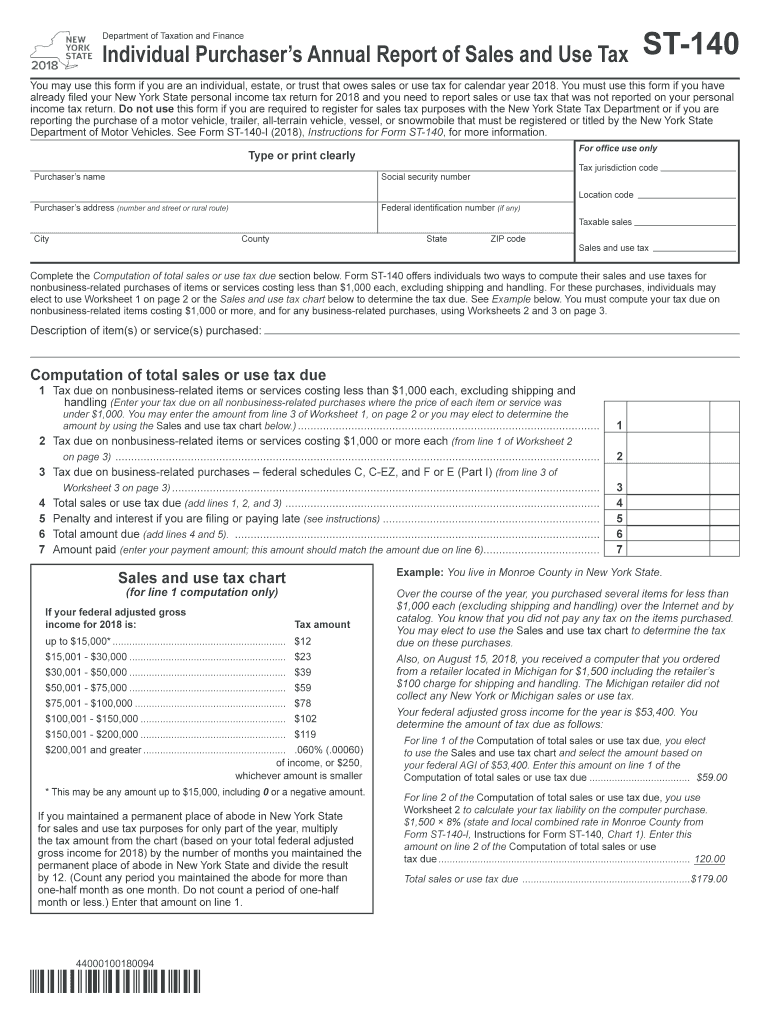

The Form ST-140, also known as the New York State Sales and Use Tax Exempt Purchase Certificate, is a crucial document used by businesses and individuals in New York to claim exemption from sales tax on certain purchases. This form is typically utilized by organizations that are exempt from sales tax, such as non-profit entities, government agencies, and certain educational institutions. By completing and submitting the ST-140, the purchaser certifies that the goods or services acquired are for exempt purposes, thereby relieving them from the obligation to pay sales tax at the point of sale.

How to Use the Form ST-140

Using the Form ST-140 involves several straightforward steps. First, the purchaser must accurately complete the form with their details, including the name, address, and type of exemption being claimed. Next, the form should specify the items being purchased and the reason for the tax exemption. Once completed, the form is presented to the seller at the time of purchase. It is important to retain a copy of the form for record-keeping purposes, as it may be required for future reference or audits.

Steps to Complete the Form ST-140

Completing the Form ST-140 requires careful attention to detail. Here are the steps to follow:

- Download the Form ST-140 from the New York State Department of Taxation and Finance website.

- Fill in the purchaser's name and address accurately.

- Indicate the type of exemption being claimed, such as a non-profit organization or government entity.

- List the specific items being purchased and their intended use.

- Sign and date the form to certify that the information provided is accurate.

Once completed, present the form to the seller during the transaction.

Key Elements of the Form ST-140

The Form ST-140 includes several key elements that are essential for its proper use. These elements consist of:

- Purchaser Information: Name and address of the individual or organization claiming the exemption.

- Type of Exemption: A clear indication of the reason for the exemption, such as non-profit status.

- Item Description: Detailed information about the items being purchased under the exemption.

- Signature: The signature of the purchaser or an authorized representative, affirming the accuracy of the information.

Legal Use of the Form ST-140

The legal use of the Form ST-140 is governed by New York State tax laws. To ensure compliance, it is important that the form is only used by eligible purchasers who meet the criteria for exemption. Misuse of the form, such as claiming exemptions for ineligible purchases, can result in penalties, including fines and back taxes owed. Therefore, users should familiarize themselves with the specific regulations surrounding sales tax exemptions in New York to avoid legal complications.

Form Submission Methods

The Form ST-140 does not require formal submission to the state; instead, it is provided directly to the seller at the time of purchase. Sellers are responsible for retaining the form in their records as proof of the tax-exempt sale. It is advisable for purchasers to keep a copy of the completed form for their own records, as it may be necessary for future reference or audits by tax authorities.

Quick guide on how to complete form st 1402018individual purchasers annual report of sales and use taxst140

Effortlessly Manage Form St 140 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly replacement for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle Form St 140 on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related workflow today.

How to Edit and Electronically Sign Form St 140 with Ease

- Find Form St 140 and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form St 140 to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 1402018individual purchasers annual report of sales and use taxst140

How to create an electronic signature for the Form St 1402018individual Purchasers Annual Report Of Sales And Use Taxst140 online

How to generate an eSignature for your Form St 1402018individual Purchasers Annual Report Of Sales And Use Taxst140 in Google Chrome

How to create an eSignature for putting it on the Form St 1402018individual Purchasers Annual Report Of Sales And Use Taxst140 in Gmail

How to generate an eSignature for the Form St 1402018individual Purchasers Annual Report Of Sales And Use Taxst140 right from your smart phone

How to make an electronic signature for the Form St 1402018individual Purchasers Annual Report Of Sales And Use Taxst140 on iOS devices

How to generate an electronic signature for the Form St 1402018individual Purchasers Annual Report Of Sales And Use Taxst140 on Android devices

People also ask

-

What is the ag markets ny form 140 03?

The ag markets ny form 140 03 is a required document for agricultural businesses in New York that need to report specific information to regulatory authorities. Utilizing airSlate SignNow simplifies the process of completing and submitting the ag markets ny form 140 03 electronically, ensuring your submissions are error-free and timely.

-

How does airSlate SignNow facilitate the completion of the ag markets ny form 140 03?

airSlate SignNow offers an intuitive platform that allows users to fill out and eSign the ag markets ny form 140 03 easily. With features like document templates and guided workflows, businesses can streamline the completion process and minimize mistakes.

-

Is there a cost associated with using airSlate SignNow for the ag markets ny form 140 03?

Yes, airSlate SignNow offers various pricing plans based on the features you need. You can choose a plan that allows you to efficiently manage your document needs, including the ag markets ny form 140 03, ensuring a cost-effective solution for your business.

-

Can I track the status of my ag markets ny form 140 03 submissions using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your documents, including the ag markets ny form 140 03. You’ll receive notifications and updates on the status of your submissions, enhancing your workflow efficiency.

-

What benefits does airSlate SignNow offer for businesses needing to file the ag markets ny form 140 03?

By using airSlate SignNow for the ag markets ny form 140 03, businesses benefit from increased efficiency, reduced paperwork, and secure document handling. The platform also helps you stay compliant with organizational regulations, making it ideal for agricultural professionals.

-

Are there integrations available with airSlate SignNow for the ag markets ny form 140 03?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage documents related to the ag markets ny form 140 03. This enables users to connect their existing tools and streamline workflows efficiently.

-

Can I customize the ag markets ny form 140 03 template in airSlate SignNow?

Yes, airSlate SignNow allows users to customize the ag markets ny form 140 03 template to fit their specific needs. You can add fields, change layouts, and personalize the document to ensure it meets your business requirements.

Get more for Form St 140

- Missouri divorce forms pdf 43387544

- Hoja de arbitrios forma sc 2042

- California residential lease agreement form

- Eviction notice for breach of contract template form

- Small construction project contract template form

- Small loan contract template form

- Small personal loan contract template form

- Small works contract template form

Find out other Form St 140

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement