Ct 3 S Form

What is the CT-3 S?

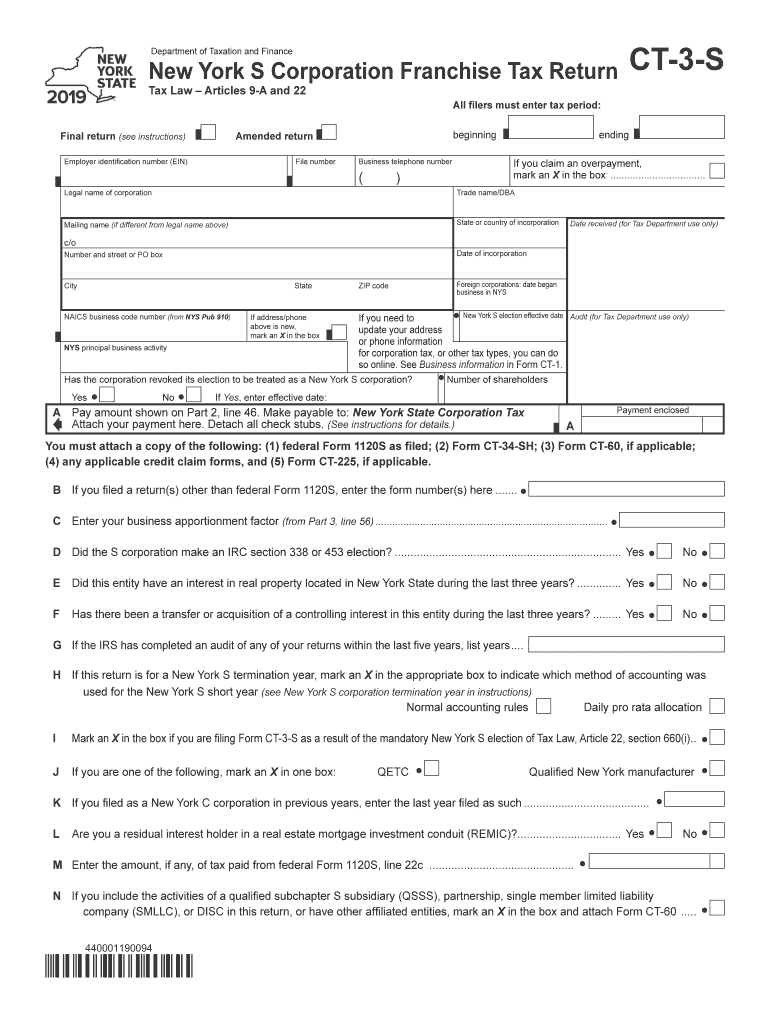

The CT-3 S is a tax form used by corporations in New York State to report their income, deductions, and credits. Specifically designed for S corporations, it allows these entities to file their taxes in a manner that reflects their unique tax status. Unlike traditional corporations, S corporations pass their income directly to shareholders, who then report it on their personal tax returns. This form ensures compliance with state tax regulations while providing a streamlined process for S corporations operating in New York.

Steps to Complete the CT-3 S

Completing the CT-3 S involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and prior year tax returns. Next, fill out the basic information section, including the corporation's name, address, and federal employer identification number. Proceed to report income and deductions, ensuring to follow the specific instructions for each line item. Finally, review the completed form for any errors, sign it, and prepare it for submission.

How to Obtain the CT-3 S

The CT-3 S form can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing for easy access and printing. Additionally, businesses can request physical copies of the form by contacting the department directly. It is important to ensure that you are using the correct version of the form for the applicable tax year to avoid any issues during filing.

Legal Use of the CT-3 S

The CT-3 S is legally binding when completed and submitted in accordance with New York State tax laws. To ensure its validity, the form must be signed by an authorized officer of the corporation. Compliance with all relevant tax regulations is essential, as failure to do so can result in penalties or audits. Utilizing a reliable eSignature solution can enhance the legal standing of the submitted form, ensuring that it meets all necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the CT-3 S are crucial for compliance. Typically, the form must be filed on or before the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is important to keep track of these dates to avoid late filing penalties and ensure timely processing of tax returns.

Form Submission Methods

The CT-3 S can be submitted through various methods to accommodate different preferences. Corporations may choose to file the form electronically through the New York State Department of Taxation and Finance's online portal. Alternatively, the form can be mailed to the appropriate address provided in the instructions or submitted in person at designated tax offices. Each method has its own processing times, so businesses should select the one that best meets their needs.

Quick guide on how to complete form ct 3 s2019new york s corporation franchise tax returnct3s

Complete Ct 3 S effortlessly on any device

Managing documents online has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Ct 3 S on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric procedures today.

How to modify and eSign Ct 3 S with ease

- Locate Ct 3 S and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign Ct 3 S and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 s2019new york s corporation franchise tax returnct3s

How to make an electronic signature for the Form Ct 3 S2019new York S Corporation Franchise Tax Returnct3s in the online mode

How to make an eSignature for the Form Ct 3 S2019new York S Corporation Franchise Tax Returnct3s in Google Chrome

How to generate an eSignature for signing the Form Ct 3 S2019new York S Corporation Franchise Tax Returnct3s in Gmail

How to make an electronic signature for the Form Ct 3 S2019new York S Corporation Franchise Tax Returnct3s right from your smart phone

How to generate an eSignature for the Form Ct 3 S2019new York S Corporation Franchise Tax Returnct3s on iOS devices

How to make an eSignature for the Form Ct 3 S2019new York S Corporation Franchise Tax Returnct3s on Android

People also ask

-

What is the NYS CT 3 2019 instructions form and why is it needed?

The NYS CT 3 2019 instructions form is essential for businesses to report their corporation franchise tax in New York State. This form ensures compliance with state tax laws and helps streamline the filing process. Understanding the requirements outlined in the NYS CT 3 2019 instructions form can save you from potential penalties.

-

How does airSlate SignNow assist in completing the NYS CT 3 2019 instructions form?

airSlate SignNow provides a user-friendly platform that allows you to complete and eSign the NYS CT 3 2019 instructions form quickly. With integrated templates and automation features, users can ensure accurate and timely submissions. This makes handling your tax forms much more efficient.

-

What are the pricing options for using airSlate SignNow for the NYS CT 3 2019 instructions form?

airSlate SignNow offers various pricing plans tailored to meet your business needs, including options suitable for occasional users and larger enterprises. Pricing structures are designed to be cost-effective, especially for managing documents like the NYS CT 3 2019 instructions form. You can choose a plan that includes advanced features necessary for your business operations.

-

Are the documents signed with airSlate SignNow legally binding?

Yes, documents signed with airSlate SignNow are legally binding, including the NYS CT 3 2019 instructions form. The platform complies with all eSignature laws, ensuring that your signed documents are recognized in court. This makes SignNow a trustworthy solution for your important tax documents.

-

Can I integrate airSlate SignNow with other software for managing the NYS CT 3 2019 instructions form?

Absolutely! airSlate SignNow can seamlessly integrate with various third-party software, enhancing your productivity when handling the NYS CT 3 2019 instructions form. This integration allows for smoother workflows, making it easier to manage documents alongside your existing tools.

-

What features does airSlate SignNow offer for efficient document management?

airSlate SignNow offers features such as customizable templates, automated reminders, and real-time tracking to improve your document management process. These features are particularly useful when working on the NYS CT 3 2019 instructions form, helping you stay organized and on track. The platform's user-friendly interface further enhances the overall experience.

-

Is there support available if I have questions about the NYS CT 3 2019 instructions form?

Yes, airSlate SignNow provides comprehensive customer support, including resources and assistance for inquiries regarding the NYS CT 3 2019 instructions form. Whether you need help with navigation or specific details about the form, our support team is ready to assist you. This ensures that you can complete your documents with confidence.

Get more for Ct 3 S

- Form it 611 claim for brownfield redevelopment tax credit tax year

- Sign off contract template form

- Sign on bonus contract template form

- Signage contract template form

- Signature block contract template form

- Signature contract template form

- Signature line contract template form

- Signature page contract template form

Find out other Ct 3 S

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile