Uben 106 Form

What is the Uben 106

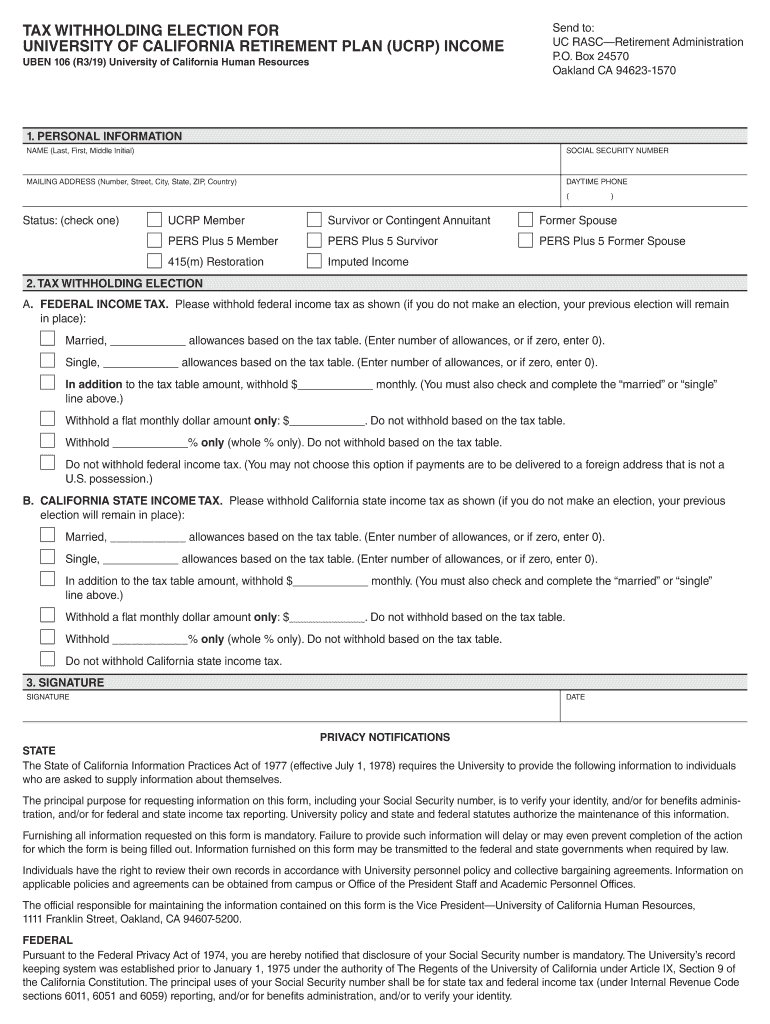

The Uben 106 is a specific form used primarily for tax purposes, particularly in relation to withholding elections. This form is essential for employees who wish to adjust their tax withholding status with their employer. By completing the Uben 106, individuals can ensure that the correct amount of federal income tax is withheld from their paychecks. This is particularly important for those who may have multiple income sources or wish to avoid underpayment penalties at the end of the tax year.

Steps to complete the Uben 106

Completing the Uben 106 involves several straightforward steps. First, gather all necessary personal information, including your Social Security number and details about your current employment. Next, accurately fill out the form by indicating your desired withholding allowances. It is crucial to review the instructions provided with the form to ensure all sections are completed correctly. Once filled out, submit the form to your employer, who will process your request and adjust your withholding accordingly.

Legal use of the Uben 106

The Uben 106 is legally recognized as a valid document for tax withholding purposes when completed correctly. To ensure its legal standing, it must comply with IRS guidelines, which dictate how the form should be filled out and submitted. Additionally, maintaining accurate records of your submission and any changes made is important for compliance and future reference. Using a reliable eSignature solution, such as signNow, can help ensure that your submission is secure and legally binding.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Uben 106 is essential for compliance. Typically, this form should be submitted to your employer as soon as you start a new job or when you wish to change your withholding status. It is advisable to check with your employer for any specific internal deadlines they may have. Additionally, being aware of the overall tax filing deadlines can help you plan your finances and avoid any potential penalties.

Required Documents

To complete the Uben 106 effectively, you will need several key documents. These typically include your Social Security number, previous tax returns, and any other forms related to your income and deductions. Having these documents on hand will facilitate the accurate completion of the form and ensure that your withholding elections are based on the most current information.

Form Submission Methods (Online / Mail / In-Person)

The Uben 106 can be submitted through various methods, depending on your employer's preferences. Many employers now accept electronic submissions, allowing you to fill out and submit the form online. Alternatively, you may also choose to print the form and submit it by mail or in person. It is important to confirm with your employer which submission method they prefer to ensure timely processing of your request.

Quick guide on how to complete special tax notice for uc retirement plan distributions ucnet

Complete Uben 106 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Uben 106 on any platform using airSlate SignNow Android or iOS apps and simplify any document-related task today.

The easiest way to modify and eSign Uben 106 without hassle

- Locate Uben 106 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Uben 106 and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the special tax notice for uc retirement plan distributions ucnet

How to generate an electronic signature for the Special Tax Notice For Uc Retirement Plan Distributions Ucnet online

How to make an electronic signature for the Special Tax Notice For Uc Retirement Plan Distributions Ucnet in Google Chrome

How to generate an electronic signature for signing the Special Tax Notice For Uc Retirement Plan Distributions Ucnet in Gmail

How to generate an eSignature for the Special Tax Notice For Uc Retirement Plan Distributions Ucnet straight from your smartphone

How to create an eSignature for the Special Tax Notice For Uc Retirement Plan Distributions Ucnet on iOS

How to create an electronic signature for the Special Tax Notice For Uc Retirement Plan Distributions Ucnet on Android devices

People also ask

-

What is the ucrays login process for airSlate SignNow?

To access airSlate SignNow, simply visit the official website and locate the ucrays login section. Enter your registered email and password to log in. If you’ve forgotten your password, click on the 'Forgot password?' link to reset it easily.

-

Is there a cost associated with ucrays login for airSlate SignNow?

Creating an account and accessing the ucrays login is free. However, while the initial features can be used at no charge, premium functionalities and higher volume usage come with subscription plans. Review our pricing page for detailed options that fit your needs.

-

What features can I access after ucrays login on airSlate SignNow?

Upon ucrays login, users can access a variety of features including document creation, eSigning, and template management. Additional capabilities such as advanced analytics and integration with other platforms are available based on your subscription level. Explore all features to maximize productivity.

-

How secure is my information with ucrays login?

Your data security is a top priority at airSlate SignNow. The ucrays login process utilizes encryption and secure authentication methods to protect your information. We're committed to maintaining high-security standards to ensure your documents and data are safe.

-

Can I integrate airSlate SignNow with other applications after ucrays login?

Yes, airSlate SignNow allows for seamless integration with various applications, enhancing your workflow post-ucrays login. Integrate with platforms like Google Drive, Dropbox, and Salesforce to streamline document management and eSigning processes. Check our integrations page for a complete list.

-

What benefits can I expect from using airSlate SignNow after ucrays login?

After ucrays login, users enjoy benefits such as increased efficiency in document handling and enhanced collaboration features. The platform is designed to reduce turnaround times for documents, making it easier to close deals faster. Experience a user-friendly interface that improves productivity.

-

Is there customer support available for ucrays login issues?

Yes, airSlate SignNow provides dedicated customer support for any ucrays login issues you might encounter. Our support team is available via chat, email, or phone to assist you with login challenges or account-related questions. We are here to ensure a smooth experience for all users.

Get more for Uben 106

- Daily behavior chart dcm 9en form

- Form tn ct 0025 9557 blount county fill online

- Shipbuild contract template form

- Short contract template form

- Short sale contract template 787755373 form

- Short term contract template form

- Short term let contract template form

- Short term investment contract template form

Find out other Uben 106

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free