Ny Form Ct 222

What is the NY Form CT 222

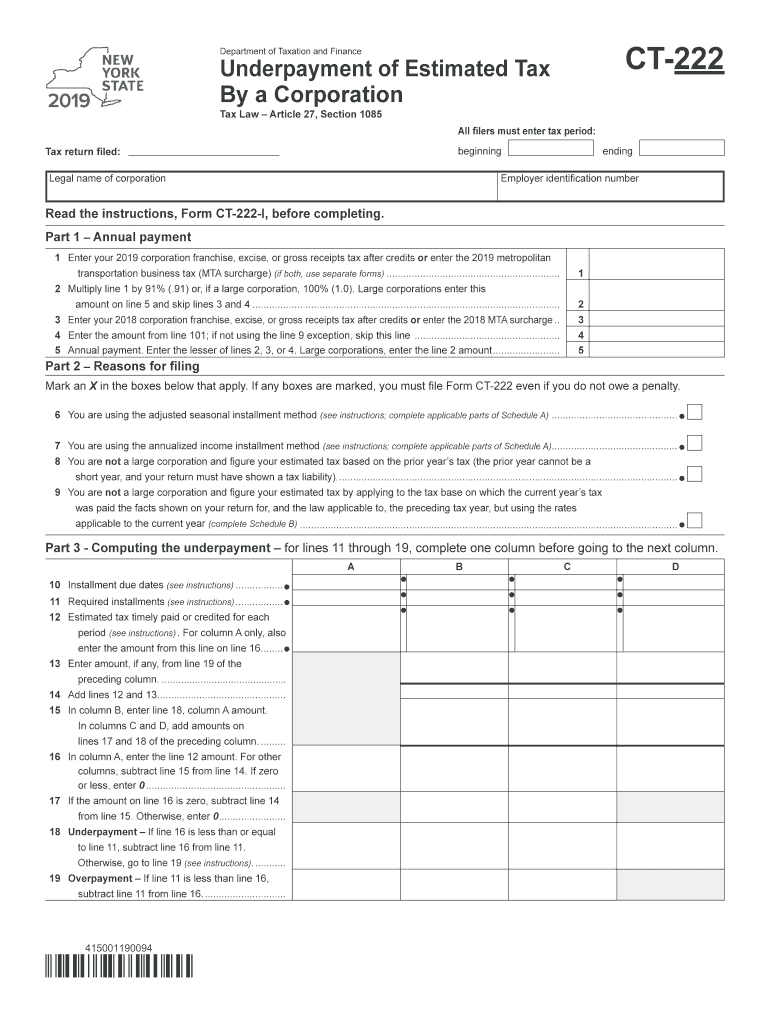

The NY Form CT 222 is a tax form used by corporations in New York State to report and pay the state’s corporate franchise tax. This form is essential for businesses operating within New York, as it helps ensure compliance with state tax regulations. It provides a structured way for corporations to calculate their tax liability based on their income, assets, and other relevant factors. Understanding the purpose and requirements of Form CT 222 is crucial for any corporation aiming to maintain good standing with the New York State Department of Taxation and Finance.

How to Use the NY Form CT 222

Using the NY Form CT 222 involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, accurately complete the form by entering your corporation's financial information as required. It is important to follow the specific instructions provided with the form to ensure compliance and avoid errors. Once completed, the form must be submitted to the appropriate tax authority by the designated deadline to avoid penalties.

Steps to Complete the NY Form CT 222

Completing the NY Form CT 222 requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including your corporation's income statements and balance sheets.

- Download the latest version of Form CT 222 from the New York State Department of Taxation and Finance website.

- Fill out the form, ensuring all income, deductions, and credits are accurately reported.

- Review the completed form for any errors or omissions.

- Submit the form by mail or electronically, following the submission guidelines provided.

Legal Use of the NY Form CT 222

The NY Form CT 222 is legally binding and must be filed in accordance with New York State tax laws. Proper use of this form ensures that corporations fulfill their tax obligations and avoid potential legal issues. Filing the form accurately and on time is crucial for maintaining compliance and preventing penalties. Corporations should also be aware of any changes in tax laws that may affect their filing requirements.

Key Elements of the NY Form CT 222

Several key elements are essential when completing the NY Form CT 222. These include:

- Corporate Identification: Ensure your corporation's name, address, and identification number are correctly stated.

- Income Reporting: Accurately report all sources of income, including sales and other revenues.

- Deductions and Credits: Include any applicable deductions and credits that can reduce your tax liability.

- Signature: The form must be signed by an authorized representative of the corporation to validate the submission.

Form Submission Methods

The NY Form CT 222 can be submitted through various methods, including:

- Online Submission: Corporations can file electronically through the New York State Department of Taxation and Finance's online portal.

- Mail: Completed forms can be mailed to the designated address provided in the form instructions.

- In-Person: Corporations may also choose to submit the form in person at local tax offices, if applicable.

Quick guide on how to complete form ct 2222018underpayment of estimated taxnygov

Effortlessly prepare Ny Form Ct 222 on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely save it online. airSlate SignNow provides all the tools required to swiftly create, modify, and electronically sign your documents without delays. Manage Ny Form Ct 222 across any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Ny Form Ct 222 with ease

- Find Ny Form Ct 222 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of document delivery, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiring form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ny Form Ct 222 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 2222018underpayment of estimated taxnygov

How to generate an electronic signature for the Form Ct 2222018underpayment Of Estimated Taxnygov in the online mode

How to make an electronic signature for your Form Ct 2222018underpayment Of Estimated Taxnygov in Chrome

How to create an eSignature for putting it on the Form Ct 2222018underpayment Of Estimated Taxnygov in Gmail

How to generate an eSignature for the Form Ct 2222018underpayment Of Estimated Taxnygov right from your smart phone

How to create an eSignature for the Form Ct 2222018underpayment Of Estimated Taxnygov on iOS

How to make an eSignature for the Form Ct 2222018underpayment Of Estimated Taxnygov on Android OS

People also ask

-

What is CT 222 in the context of airSlate SignNow?

CT 222 refers to a specific compliance requirement that some businesses may encounter when using electronic signatures. airSlate SignNow ensures that all eSignatures comply with CT 222 standards, making it easy for organizations to remain compliant with legal regulations.

-

How does airSlate SignNow support businesses in adhering to CT 222?

airSlate SignNow supports businesses by providing features that guarantee compliance with CT 222, including secure document storage and comprehensive audit trails. This ensures that every signed document meets regulatory standards, thus safeguarding your business.

-

What are the pricing options for airSlate SignNow related to CT 222 compliance?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes, while ensuring compliance with CT 222. Each plan includes features that help manage and secure documents, providing value regardless of your organization's needs.

-

Are eSignatures created through airSlate SignNow compliant with CT 222?

Yes, eSignatures created through airSlate SignNow are fully compliant with CT 222 regulations. The platform employs top-tier security protocols to ensure that every signature is legally binding and meets all compliance requirements.

-

What features does airSlate SignNow offer to make signing easier under CT 222?

airSlate SignNow includes user-friendly features such as drag-and-drop document uploads, customizable signing workflows, and automated reminders, all of which facilitate adherence to CT 222. These features boost productivity by simplifying the signing process for both senders and recipients.

-

Can airSlate SignNow integrate with other tools for CT 222 compliance?

Absolutely! airSlate SignNow offers integrations with various business tools and applications, enabling seamless data exchange while maintaining CT 222 compliance. This flexibility allows businesses to enhance their workflows and maintain compliance across different platforms.

-

What are the benefits of using airSlate SignNow in relation to CT 222?

Using airSlate SignNow offers numerous benefits in achieving CT 222 compliance, including enhanced security, faster document turnaround times, and reduced administrative overhead. By leveraging these benefits, businesses can streamline their operations and ensure they’re adhering to compliance standards.

Get more for Ny Form Ct 222

Find out other Ny Form Ct 222

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer