Ct 34 Sh Form

What is the Ct 34 Sh

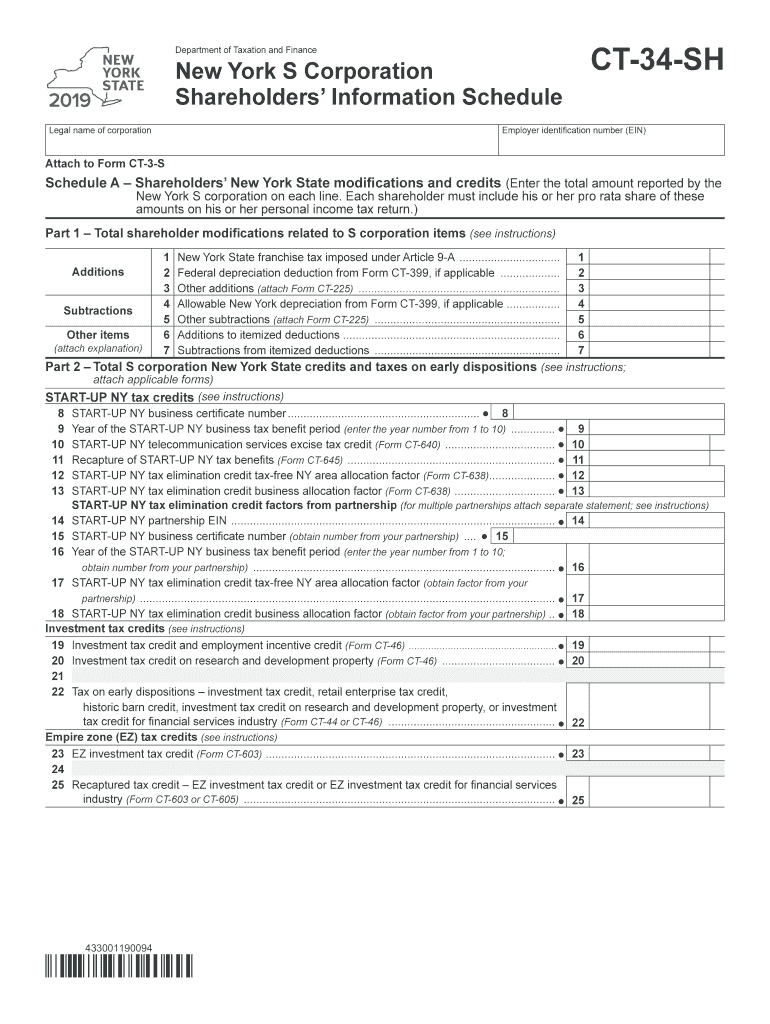

The CT 34 Sh is a New York State form designed for specific tax reporting purposes. It is primarily used by taxpayers to report certain tax credits and adjustments related to their income. This form is essential for ensuring compliance with state tax regulations and accurately calculating any potential tax liabilities or refunds. Understanding the purpose of the CT 34 Sh is crucial for individuals and businesses navigating New York's tax landscape.

How to use the Ct 34 Sh

Using the CT 34 Sh involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions provided with the form to understand the specific requirements. Fill out the form with accurate information, ensuring that all calculations are correct. Once completed, the form can be submitted electronically or by mail, depending on your preference and the specific guidelines provided by the New York State Department of Taxation and Finance.

Steps to complete the Ct 34 Sh

Completing the CT 34 Sh requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Obtain the latest version of the CT 34 Sh from the New York State Department of Taxation and Finance website.

- Review the instructions carefully to understand the information required.

- Gather all relevant financial documents, including income statements and any prior tax forms.

- Fill out the form accurately, ensuring all figures are correct and properly calculated.

- Double-check your entries for accuracy and completeness.

- Submit the form electronically through the state’s e-filing system or by mailing it to the appropriate address.

Legal use of the Ct 34 Sh

The legal use of the CT 34 Sh is governed by New York State tax laws. It is essential for taxpayers to use this form in accordance with the regulations set forth by the New York State Department of Taxation and Finance. Filing the CT 34 Sh correctly can help avoid penalties and ensure compliance with state tax obligations. Failure to use the form as intended may result in legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for those using the CT 34 Sh. Typically, the form must be submitted by the due date for the corresponding tax return. Taxpayers should check the New York State Department of Taxation and Finance website for specific deadlines, as they may vary from year to year. Being aware of these dates helps prevent late submissions and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The CT 34 Sh can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can file the form electronically through the New York State Department of Taxation and Finance’s e-filing system.

- Mail: The completed form can be printed and mailed to the designated address provided in the instructions.

- In-Person: Some taxpayers may choose to submit the form in person at local tax offices, although this option may vary based on location and current regulations.

Quick guide on how to complete form ct 34 sh2019new york s corporation shareholders information schedulect34sh

Complete Ct 34 Sh effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ct 34 Sh on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Ct 34 Sh with minimal effort

- Locate Ct 34 Sh and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Ct 34 Sh and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 34 sh2019new york s corporation shareholders information schedulect34sh

How to create an electronic signature for your Form Ct 34 Sh2019new York S Corporation Shareholders Information Schedulect34sh in the online mode

How to make an electronic signature for your Form Ct 34 Sh2019new York S Corporation Shareholders Information Schedulect34sh in Google Chrome

How to make an electronic signature for putting it on the Form Ct 34 Sh2019new York S Corporation Shareholders Information Schedulect34sh in Gmail

How to create an eSignature for the Form Ct 34 Sh2019new York S Corporation Shareholders Information Schedulect34sh right from your mobile device

How to generate an eSignature for the Form Ct 34 Sh2019new York S Corporation Shareholders Information Schedulect34sh on iOS

How to make an eSignature for the Form Ct 34 Sh2019new York S Corporation Shareholders Information Schedulect34sh on Android

People also ask

-

What is the nys 2019 ct 34 sh pdf form and why is it important?

The nys 2019 ct 34 sh pdf form is a critical document used for tax purposes in New York State. It provides essential information for self-employed individuals and small businesses to report their income. Completing this form accurately can help ensure compliance with state tax regulations.

-

How can airSlate SignNow help me with the nys 2019 ct 34 sh pdf form?

airSlate SignNow simplifies the process of filling and eSigning the nys 2019 ct 34 sh pdf form. With its intuitive interface, you can quickly upload, fill out, and electronically sign your form, ensuring a hassle-free experience in managing your tax documents.

-

Is airSlate SignNow a cost-effective solution for managing the nys 2019 ct 34 sh pdf form?

Yes, airSlate SignNow offers competitive pricing options to help businesses manage documents, including the nys 2019 ct 34 sh pdf form. By using this platform, you can save on printing, mailing, and storage costs, making it a budget-friendly choice for document management.

-

What features does airSlate SignNow provide for the nys 2019 ct 34 sh pdf form?

airSlate SignNow offers features like document templates, secure cloud storage, and real-time collaboration that are particularly beneficial when handling the nys 2019 ct 34 sh pdf form. These tools enable users to efficiently manage their tax forms and ensure accuracy in submission.

-

Can I integrate airSlate SignNow with other applications for the nys 2019 ct 34 sh pdf form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow while handling the nys 2019 ct 34 sh pdf form. Whether it's connecting your CRM or cloud storage services, these integrations enhance productivity and efficiency.

-

Is it easy to share the nys 2019 ct 34 sh pdf form with others using airSlate SignNow?

Yes, airSlate SignNow makes sharing the nys 2019 ct 34 sh pdf form straightforward. You can easily send the document via email or share a link, allowing for quick collaboration with accountants or partners while ensuring secure access and tracking.

-

What are the benefits of using airSlate SignNow for eSigning the nys 2019 ct 34 sh pdf form?

Using airSlate SignNow for eSigning the nys 2019 ct 34 sh pdf form offers numerous benefits, including enhanced security, faster turnaround times, and improved document management. The platform ensures your signatures are valid and legally binding, which is crucial for tax documents.

Get more for Ct 34 Sh

- Form it 245 claim for volunteer firefighters and ambulance workers credit tax year

- Vakil patra format in marathi pdf

- Closeout contract template form

- Construction time and material contract template form

- Construction work residential construction contract template form

- Service business contract template form

- Service delivery contract template form

- Service for service contract template form

Find out other Ct 34 Sh

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online