Anti Money Laundering Application Requirements Form

Understanding Anti Money Laundering Application Requirements

The Anti Money Laundering (AML) application requirements are essential for businesses and financial institutions to prevent illicit financial activities. These requirements typically include a comprehensive understanding of customer identities, transaction monitoring, and reporting suspicious activities. Organizations must implement robust compliance programs that align with federal and state regulations to effectively mitigate risks associated with money laundering.

Steps to Complete the Anti Money Laundering Application Requirements

Completing the Anti Money Laundering application requires a systematic approach. The following steps are crucial:

- Conduct a risk assessment to identify potential vulnerabilities within the organization.

- Develop and document AML policies and procedures that comply with regulatory standards.

- Train employees on AML regulations and internal procedures to ensure compliance.

- Implement a system for monitoring transactions and reporting suspicious activities to the appropriate authorities.

- Regularly review and update AML practices to adapt to changing regulations and emerging threats.

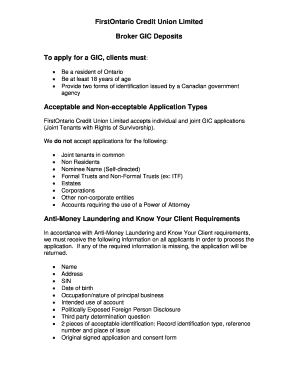

Required Documents for Anti Money Laundering Application

To successfully complete the AML application process, specific documentation is necessary. Key documents may include:

- Proof of business registration and ownership structure.

- Identification documents for all key personnel involved in the business.

- Financial records demonstrating the source of funds and transaction history.

- AML compliance program documentation, including policies and training materials.

Eligibility Criteria for Anti Money Laundering Application

Eligibility for the AML application typically hinges on several factors. Organizations must meet the following criteria:

- Be a registered business entity operating within the United States.

- Have established internal controls and procedures to prevent money laundering.

- Employ trained personnel responsible for overseeing AML compliance.

- Maintain accurate records of transactions and customer interactions.

Legal Use of the Anti Money Laundering Application Requirements

The legal framework surrounding the Anti Money Laundering application requirements is governed by various federal and state laws. Compliance with the Bank Secrecy Act (BSA) and the USA PATRIOT Act is essential. These laws mandate financial institutions to report certain transactions and maintain records to assist in the detection and prevention of money laundering activities.

Form Submission Methods for Anti Money Laundering Application

Submitting the Anti Money Laundering application can be done through various methods. Organizations may choose to:

- Submit the application online through designated regulatory portals.

- Mail physical copies of the application and supporting documents to the relevant authorities.

- Deliver the application in person at specified regulatory offices.

Quick guide on how to complete anti money laundering application requirements

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, enabling you to obtain the correct format and securely archive it online. airSlate SignNow provides all the essential tools to swiftly create, modify, and electronically sign your documents without any holdups. Manage [SKS] on any device using airSlate SignNow's apps for Android or iOS and streamline any document-related procedure today.

How to adjust and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then press the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with a few clicks from your preferred device. Modify and electronically sign [SKS] to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Anti Money Laundering Application Requirements

Create this form in 5 minutes!

How to create an eSignature for the anti money laundering application requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Anti Money Laundering Application Requirements for businesses?

The Anti Money Laundering Application Requirements for businesses typically include implementing robust customer identification processes, monitoring transactions for suspicious activity, and maintaining comprehensive records. Compliance with these requirements helps businesses mitigate risks associated with money laundering and ensures adherence to legal standards.

-

How does airSlate SignNow help with Anti Money Laundering Application Requirements?

airSlate SignNow provides tools that streamline the documentation process, making it easier for businesses to comply with Anti Money Laundering Application Requirements. With features like secure eSigning and document tracking, businesses can ensure that all necessary compliance documents are properly managed and stored.

-

What features of airSlate SignNow support Anti Money Laundering compliance?

Key features of airSlate SignNow that support Anti Money Laundering compliance include customizable workflows, secure document storage, and audit trails. These features help businesses maintain transparency and accountability, which are crucial for meeting Anti Money Laundering Application Requirements.

-

Are there any costs associated with meeting Anti Money Laundering Application Requirements using airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for document management, there may be additional costs associated with compliance tools and integrations that support Anti Money Laundering Application Requirements. It's important to evaluate your specific needs and budget to determine the overall investment.

-

Can airSlate SignNow integrate with other compliance tools for Anti Money Laundering?

Yes, airSlate SignNow can integrate with various compliance tools and software that assist in meeting Anti Money Laundering Application Requirements. These integrations enhance the functionality of airSlate SignNow, allowing businesses to create a comprehensive compliance strategy.

-

What benefits does airSlate SignNow offer for Anti Money Laundering compliance?

The benefits of using airSlate SignNow for Anti Money Laundering compliance include increased efficiency in document handling, reduced risk of errors, and improved security. By automating processes, businesses can focus more on compliance and less on administrative tasks.

-

How can I ensure my team understands the Anti Money Laundering Application Requirements?

To ensure your team understands the Anti Money Laundering Application Requirements, consider providing training sessions and resources that outline the key compliance aspects. Utilizing airSlate SignNow's document sharing capabilities can also facilitate easy access to important compliance materials.

Get more for Anti Money Laundering Application Requirements

- Should your school get rid of sports form

- Time bender pdf form

- The 10 factor candidate assessment form

- Motorcycle show judging sheet form

- Daily food diary samples pdf searches fordfit co form

- Affidavit of default for divorce sccourts form

- Msunduzi municipality customer representation form in

- Thlopthlocco tribal town enrollment form

Find out other Anti Money Laundering Application Requirements

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe