D 40 Form

What is the D 40?

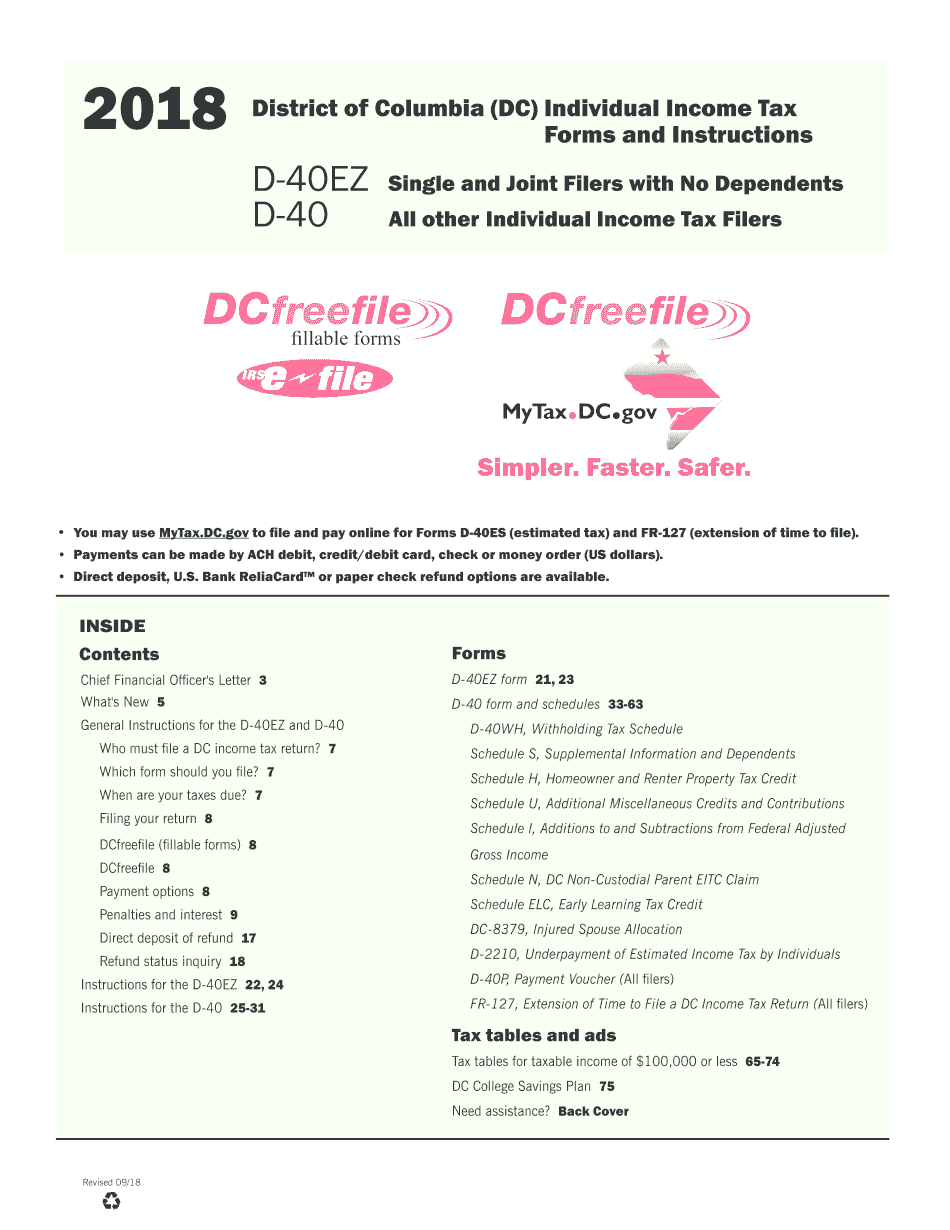

The D 40 is the District of Columbia's individual income tax return form. It is used by residents to report their income and calculate their tax liability to the District of Columbia. This form is essential for individuals who earn income within the district, including wages, salaries, and other sources of income. Understanding the D 40 is crucial for ensuring compliance with local tax laws and for accurately reporting financial information to the government.

Steps to complete the D 40

Completing the D 40 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, carefully fill out the form, reporting all sources of income and applicable deductions. It is important to follow the instructions provided with the form to avoid errors. After completing the form, review it thoroughly for accuracy before submitting it. Finally, choose a submission method—either electronically or via mail—to file your tax return.

Legal use of the D 40

The D 40 is legally binding when completed and submitted according to the guidelines set by the District of Columbia. To ensure that the form is legally recognized, it must include accurate information and the appropriate signatures. Utilizing a reliable electronic signature tool can enhance the legal validity of the submission. Compliance with local tax laws, including timely filing and payment of any owed taxes, is essential to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the D 40 are typically aligned with federal tax deadlines. Generally, individual income tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes in deadlines, especially for extensions or special circumstances. Keeping track of these important dates helps ensure timely compliance and avoids potential penalties.

Required Documents

To complete the D 40, several documents are necessary. Taxpayers should gather their W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation for any other income sources. Additionally, records of deductions, such as mortgage interest statements or medical expenses, should be compiled. Having these documents ready will streamline the completion process and help ensure that all income is accurately reported.

Form Submission Methods (Online / Mail / In-Person)

The D 40 can be submitted through various methods, providing flexibility for taxpayers. Electronic filing is available and often recommended for its speed and efficiency. Taxpayers can also choose to mail their completed forms to the appropriate tax office or submit them in person. Each method has its own set of guidelines and requirements, so it is important to follow the instructions specific to the chosen submission method to ensure successful filing.

Key elements of the D 40

The D 40 includes several key elements that are essential for accurate tax reporting. These elements typically consist of personal information, such as the taxpayer's name, address, and Social Security number. The form also requires detailed reporting of income sources, deductions, and credits. Understanding these components is vital for completing the form correctly and ensuring compliance with District of Columbia tax laws.

Quick guide on how to complete bank reliacard or paper check refund options are available

Effortlessly Prepare D 40 on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage D 40 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The Simplest Way to Modify and Electronically Sign D 40

- Obtain D 40 and select Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign D 40 to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank reliacard or paper check refund options are available

How to make an eSignature for your Bank Reliacard Or Paper Check Refund Options Are Available online

How to generate an eSignature for your Bank Reliacard Or Paper Check Refund Options Are Available in Chrome

How to generate an electronic signature for signing the Bank Reliacard Or Paper Check Refund Options Are Available in Gmail

How to make an electronic signature for the Bank Reliacard Or Paper Check Refund Options Are Available from your smartphone

How to make an electronic signature for the Bank Reliacard Or Paper Check Refund Options Are Available on iOS

How to create an electronic signature for the Bank Reliacard Or Paper Check Refund Options Are Available on Android OS

People also ask

-

What are the dc tax instructions provided by airSlate SignNow?

The dc tax instructions offered by airSlate SignNow guide users through the process of electronically signing and submitting tax-related documents. The platform ensures compliance with local regulations, making it easier for businesses to manage their tax responsibilities effectively.

-

How does airSlate SignNow simplify dc tax instructions for businesses?

airSlate SignNow simplifies dc tax instructions by providing an intuitive interface that allows users to send, sign, and store tax documents securely. This streamlining of document management helps businesses save time and focus on their core operations while ensuring compliance with tax regulations.

-

What are the pricing options for airSlate SignNow when handling dc tax instructions?

airSlate SignNow offers several pricing tiers to accommodate varying business needs when it comes to dc tax instructions. The flexible subscription plans allow businesses to choose the option that best fits their budget and document volume, ensuring a cost-effective solution for tax document management.

-

Does airSlate SignNow integrate with accounting software for dc tax instructions?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, allowing for efficient management of dc tax instructions. This integration enhances workflow by automating document sharing and signing, reducing the risk of errors and missed deadlines.

-

What features does airSlate SignNow offer for managing dc tax instructions?

airSlate SignNow includes features such as secure eSignature capabilities, document templates, and collaborative tools that streamline the dc tax instructions process. These tools ensure that businesses can easily create, send, and track tax documents while maintaining security and compliance.

-

How can airSlate SignNow enhance productivity when dealing with dc tax instructions?

By leveraging airSlate SignNow for dc tax instructions, businesses can signNowly enhance productivity. The platform reduces the time spent on paperwork, facilitates fast turnarounds on document signing, and minimizes errors, allowing teams to focus more on strategic work.

-

Is airSlate SignNow user-friendly for those unfamiliar with dc tax instructions?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals who may be unfamiliar with dc tax instructions. The straightforward layout, guided workflows, and support resources ensure that all users can navigate the platform effectively.

Get more for D 40

- Wv code chapter 06b the west virginia ethics commission ethics wv form

- Wheel estate camper rental llc palomino puma 27 fkq bb form

- Fillable online leeclerk general summons form

- General summons form lee county clerk of courts leeclerk

- Guidance for licensed financial institutions on the risks form

- Newfoundland vehicle inspection checklist form

- Sell horse contract template form

- Sell dog contract template form

Find out other D 40

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now