Tn Form

What is the TN Form?

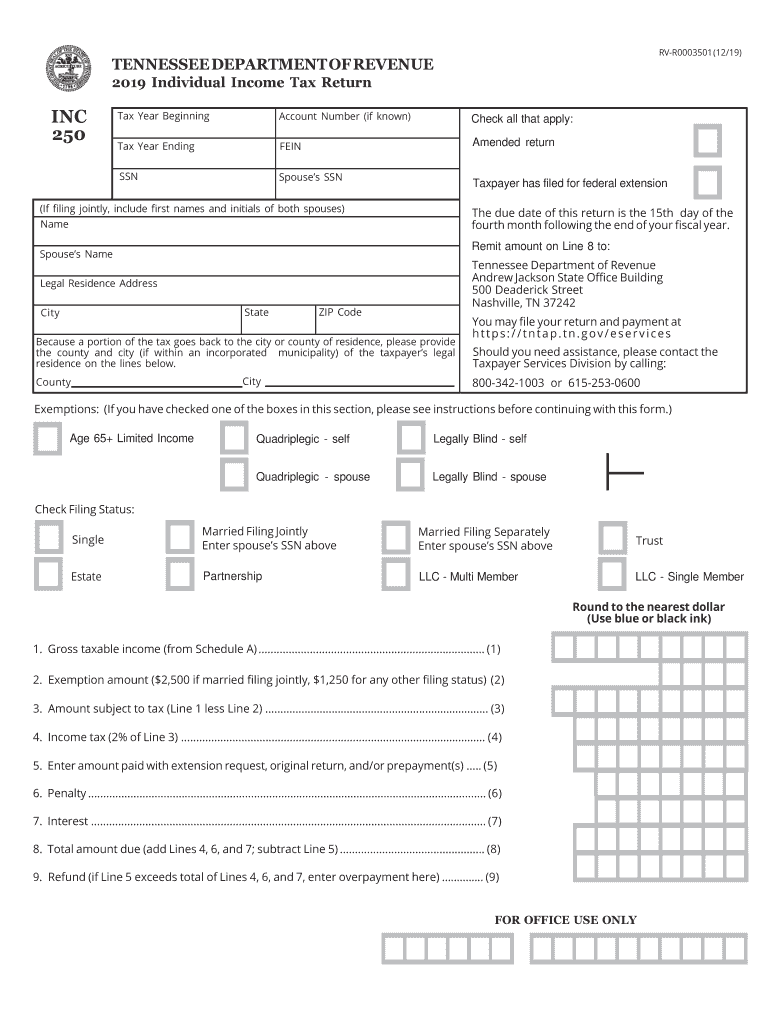

The TN Form, specifically the Form INC 250, is a revenue form utilized in Tennessee for reporting and calculating income tax obligations. This form is essential for individuals and businesses to ensure compliance with state tax laws. The form collects pertinent information regarding income and deductions, allowing taxpayers to determine their tax liability accurately. Understanding the purpose of the TN Form is crucial for anyone subject to Tennessee's tax regulations.

Steps to Complete the TN Form

Completing the TN Form INC 250 involves several key steps:

- Gather necessary documentation, including income statements, deduction records, and any relevant financial information.

- Fill out the personal identification section with your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment earnings, and any other taxable income.

- Detail any applicable deductions, such as business expenses or tax credits, to reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy and ensure all required signatures are included.

Legal Use of the TN Form

The Form INC 250 is legally binding when filled out correctly and submitted to the appropriate state authorities. To ensure its legal standing, it must comply with the regulations set forth by the Tennessee Department of Revenue. This includes accurate reporting of income, proper documentation of deductions, and adherence to filing deadlines. Utilizing a reliable electronic signature solution can further enhance the legal validity of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the TN Form INC 250 are crucial for compliance. Typically, the form must be submitted by April 15 for individual taxpayers, aligning with federal tax deadlines. However, businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these deadlines to avoid penalties.

Required Documents

When completing the TN Form INC 250, certain documents are essential to support your income claims and deductions. Required documents may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready can streamline the completion process and ensure accurate reporting.

Form Submission Methods

The TN Form INC 250 can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online using secure electronic submission systems, which often provide immediate confirmation of receipt. Alternatively, the form can be mailed to the designated state revenue office or delivered in person. Each method has its advantages, and selecting the right one can depend on individual circumstances.

Quick guide on how to complete 2019 individual income tax return 2019 individual income tax return

Effortlessly manage Tn Form on any device

Digital document management has become increasingly preferred by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Manage Tn Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign Tn Form with ease

- Obtain Tn Form and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to deliver your form via email, text message (SMS), or referral link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tn Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 individual income tax return 2019 individual income tax return

How to generate an eSignature for the 2019 Individual Income Tax Return 2019 Individual Income Tax Return in the online mode

How to make an electronic signature for the 2019 Individual Income Tax Return 2019 Individual Income Tax Return in Google Chrome

How to generate an eSignature for putting it on the 2019 Individual Income Tax Return 2019 Individual Income Tax Return in Gmail

How to create an electronic signature for the 2019 Individual Income Tax Return 2019 Individual Income Tax Return straight from your smart phone

How to generate an eSignature for the 2019 Individual Income Tax Return 2019 Individual Income Tax Return on iOS devices

How to generate an eSignature for the 2019 Individual Income Tax Return 2019 Individual Income Tax Return on Android

People also ask

-

What is the purpose of the form inc 250 revenue?

The form inc 250 revenue is crucial for businesses to report their revenue accurately. It serves as a comprehensive document for tax purposes, ensuring compliance with federal regulations and providing clarity on financial activities.

-

How does airSlate SignNow help with filing the form inc 250 revenue?

airSlate SignNow simplifies the process of preparing and submitting the form inc 250 revenue. Our platform allows you to create, edit, and eSign documents quickly, ensuring that your submission is accurate and timely.

-

What features does airSlate SignNow offer for managing the form inc 250 revenue?

Our platform includes features like customizable templates, secure eSignature capabilities, and real-time collaboration tools for managing the form inc 250 revenue. These features enhance efficiency and reduce the likelihood of errors during submission.

-

Is airSlate SignNow cost-effective for businesses that need to file the form inc 250 revenue?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to file the form inc 250 revenue. Our pricing plans are designed to accommodate various business sizes, ensuring that you get the best value for your document management needs.

-

Can I integrate airSlate SignNow with my existing accounting software for the form inc 250 revenue?

Absolutely! airSlate SignNow provides seamless integrations with various accounting and financial software. This allows you to manage the form inc 250 revenue efficiently alongside your other financial documentation.

-

What are the benefits of using airSlate SignNow for the form inc 250 revenue?

By using airSlate SignNow for the form inc 250 revenue, you gain increased accuracy, enhanced security, and a user-friendly experience. This leads to faster processing times and reduced stress during tax season.

-

Is it easy to collaborate with team members on the form inc 250 revenue using airSlate SignNow?

Yes, collaboration is a key feature of airSlate SignNow. Team members can easily work together on the form inc 250 revenue in real-time, ensuring that everyone is on the same page and all necessary information is included.

Get more for Tn Form

Find out other Tn Form

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form