Cdtfa 146 Res Form

What is the CDTFA 146 Res?

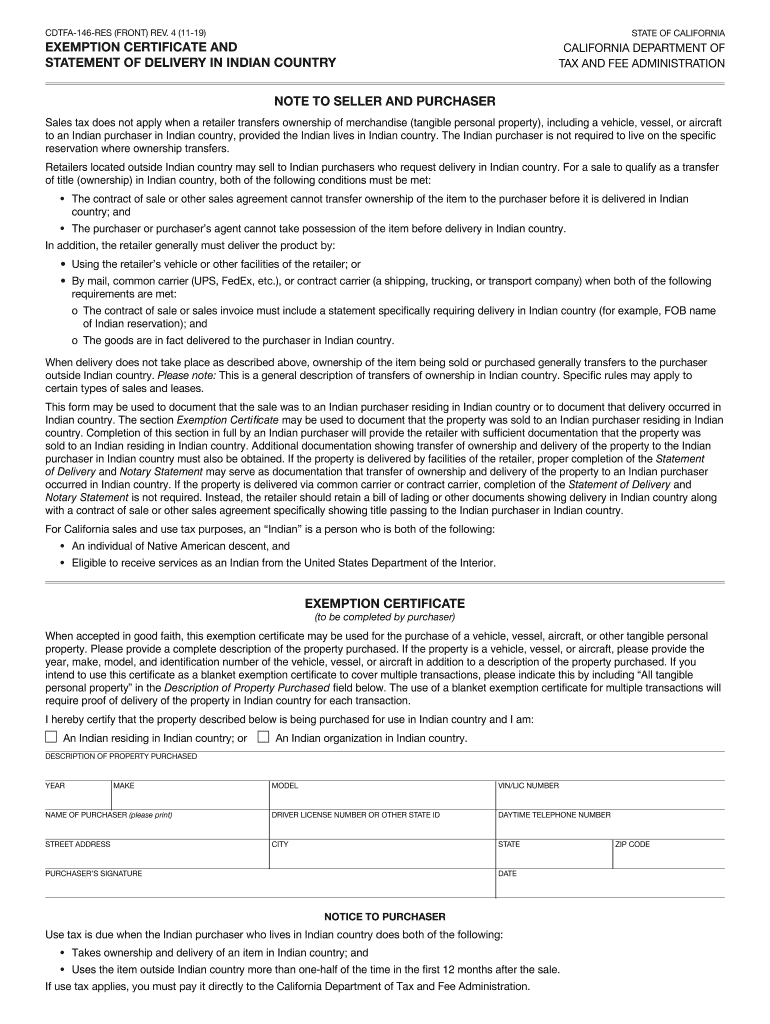

The CDTFA 146 Res, also known as the Res Certificate Number, is a form used in California for specific tax-related purposes. It is primarily utilized by businesses to document their eligibility for certain tax exemptions or reductions. This form is crucial for ensuring compliance with state tax regulations and is often required for transactions that involve sales tax considerations.

How to Use the CDTFA 146 Res

Using the CDTFA 146 Res involves several steps. First, businesses must determine their eligibility for the exemptions outlined in the form. Once eligibility is confirmed, the form must be accurately completed with the necessary information, including the business's details and the specific exemption being claimed. After filling out the form, it can be submitted to the appropriate tax authority as part of the business's tax documentation.

Steps to Complete the CDTFA 146 Res

Completing the CDTFA 146 Res requires careful attention to detail. Follow these steps:

- Gather all necessary information, including your business name, address, and tax identification number.

- Review the specific exemptions available to ensure you are claiming the correct one.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check for any errors or omissions before submission.

- Submit the completed form to the California Department of Tax and Fee Administration (CDTFA) as instructed.

Legal Use of the CDTFA 146 Res

The CDTFA 146 Res is legally binding when completed correctly and submitted to the relevant authorities. It is essential for businesses to understand the legal implications of the information provided on the form. Misrepresentation or errors may lead to penalties or loss of exemptions. Therefore, it is advisable to consult with a tax professional if there are uncertainties regarding the form's use or requirements.

Key Elements of the CDTFA 146 Res

Several key elements are essential for the CDTFA 146 Res to be valid:

- Business Information: Accurate details about the business claiming the exemption.

- Exemption Reason: A clear statement of the specific exemption being claimed.

- Signature: The form must be signed by an authorized representative of the business.

- Date: The date of completion is crucial for compliance and record-keeping.

Who Issues the Form

The CDTFA 146 Res is issued by the California Department of Tax and Fee Administration (CDTFA). This agency is responsible for administering California's sales and use tax laws, as well as other tax-related programs. Businesses must ensure they are using the most current version of the form, as updates may occur periodically.

Quick guide on how to complete cdtfa 146 res exemption certificate and statement of delivery in indian country exemption certificate and statement of delivery

Prepare Cdtfa 146 Res effortlessly on any device

Digital document handling has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to find the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Cdtfa 146 Res on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Cdtfa 146 Res with ease

- Find Cdtfa 146 Res and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Cdtfa 146 Res to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 146 res exemption certificate and statement of delivery in indian country exemption certificate and statement of delivery

How to make an eSignature for the Cdtfa 146 Res Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery online

How to create an eSignature for the Cdtfa 146 Res Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery in Google Chrome

How to make an electronic signature for putting it on the Cdtfa 146 Res Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery in Gmail

How to generate an eSignature for the Cdtfa 146 Res Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery right from your mobile device

How to make an electronic signature for the Cdtfa 146 Res Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery on iOS devices

How to create an eSignature for the Cdtfa 146 Res Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery on Android devices

People also ask

-

What is a res cert number?

A res cert number is a unique identifier associated with your certificate of residency or compliance. This number is crucial for validating your residency status in various applications and processes, enabling seamless transactions.

-

How can I obtain my res cert number using airSlate SignNow?

Using airSlate SignNow, you can easily access your res cert number through our electronic signature solutions. Simply upload the relevant document, and our platform will assist you in generating and eSigning your residency certificate for instant retrieval.

-

Is there a cost involved for obtaining a res cert number with airSlate SignNow?

airSlate SignNow offers cost-effective solutions for document management, including the generation of your res cert number. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you get great value while managing your compliance needs.

-

What features does airSlate SignNow provide for managing res cert numbers?

airSlate SignNow offers features like secure document storage, tracking, and automated workflows specifically for managing your res cert number. Our platform ensures that you can easily send, sign, and store your residency documents in one convenient place.

-

Can I integrate airSlate SignNow with other tools to manage my res cert number?

Yes, airSlate SignNow integrates seamlessly with a variety of third-party applications, allowing you to efficiently manage your res cert number along with other documentation. This integration enhances your workflow and boosts productivity, ensuring better compliance management.

-

What are the benefits of using airSlate SignNow for res cert number management?

Using airSlate SignNow for your res cert number management streamlines the process of obtaining, signing, and storing important documents. It enhances security with eSignature technology, reduces turnaround time, and improves overall efficiency in managing compliance-related tasks.

-

How does airSlate SignNow ensure the security of my res cert number?

AirSlate SignNow employs state-of-the-art encryption and security protocols to safeguard your res cert number and other sensitive information. Our platform ensures that only authorized users have access to your documents, providing peace of mind and compliance with industry standards.

Get more for Cdtfa 146 Res

- Fl 140 declaration of disclosure family law ex parte petition for final discharge and order probate decedents estates adn form

- Pastors recommendation letter sample form

- Ea 120 form

- Newfoundland screech certificate form

- Sale commission contract template form

- Sale consultant contract template form

- Sale contract template form

- Sale employee contract template form

Find out other Cdtfa 146 Res

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement