Form Ct 941x

What is the Form CT-941X?

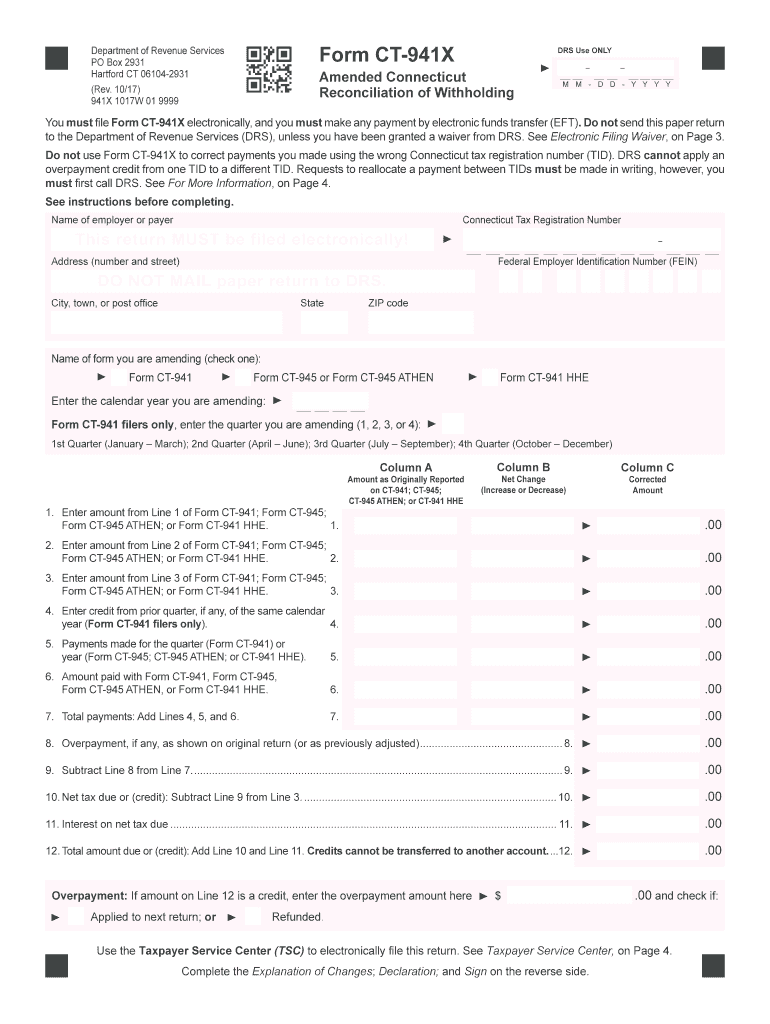

The Form CT-941X is an amended version of the Connecticut Quarterly Reconciliation of Withholding. This form is specifically designed for employers who need to correct errors made on previously filed Form CT-941. It allows businesses to adjust their withholding amounts, ensuring accurate reporting to the Connecticut Department of Revenue Services (DRS). The form is essential for compliance with state tax regulations and helps maintain accurate employee withholding records.

How to Use the Form CT-941X

Using the Form CT-941X involves several steps to ensure that corrections are made accurately. First, gather all relevant information from the original Form CT-941 that needs correction. Next, fill out the CT-941X with the corrected amounts and provide a clear explanation of the changes being made. It is important to retain copies of both the original and amended forms for your records. Once completed, the form should be submitted to the Connecticut DRS as instructed.

Steps to Complete the Form CT-941X

Completing the Form CT-941X requires careful attention to detail. Follow these steps:

- Review the original Form CT-941 for accuracy and identify the necessary corrections.

- Obtain a copy of the Form CT-941X from the Connecticut DRS website or your tax advisor.

- Fill in the required fields, including your business information and the corrected withholding amounts.

- Provide explanations for each correction in the designated section of the form.

- Double-check all entries for accuracy before submitting.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form CT-941X. Typically, the amended form should be filed as soon as errors are discovered to avoid potential penalties. Employers should check the Connecticut DRS website for specific deadlines, as they may vary based on the tax period being amended. Timely submission helps ensure compliance and reduces the risk of additional interest or penalties.

Legal Use of the Form CT-941X

The Form CT-941X is legally recognized for correcting withholding errors and is essential for compliance with state tax laws. When properly completed and submitted, it serves as an official record of the amendments made to previously filed withholding reports. Employers must ensure that all corrections are made in accordance with Connecticut tax regulations to avoid legal repercussions.

Penalties for Non-Compliance

Failure to file the Form CT-941X when necessary can result in penalties from the Connecticut DRS. Common penalties include fines for late filing, as well as interest on any unpaid withholding amounts. It is important for employers to address any discrepancies promptly to mitigate potential financial consequences and maintain good standing with state tax authorities.

Quick guide on how to complete amended connecticut

Complete Form Ct 941x effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly without delays. Handle Form Ct 941x on any device with the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to edit and electronically sign Form Ct 941x with ease

- Obtain Form Ct 941x and click on Get Form to begin.

- Make use of the tools we offer to finish your form.

- Highlight important sections of your documents or censor sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form Ct 941x and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the amended connecticut

How to create an electronic signature for your Amended Connecticut in the online mode

How to create an eSignature for your Amended Connecticut in Google Chrome

How to create an eSignature for putting it on the Amended Connecticut in Gmail

How to generate an electronic signature for the Amended Connecticut from your mobile device

How to make an eSignature for the Amended Connecticut on iOS devices

How to create an electronic signature for the Amended Connecticut on Android

People also ask

-

What is the from 1 941x form and who needs it?

The from 1 941x form is used by employers to correct errors on previously filed Form 941. It is essential for businesses needing to update or amend their payroll tax information with the IRS. Utilizing this form helps ensure compliance and accuracy in tax reporting.

-

How can airSlate SignNow help me with the from 1 941x form?

airSlate SignNow provides an easy-to-use platform that streamlines the process of completing and signing the from 1 941x form. You can fill out the form, eSign it, and send it directly to the IRS, simplifying compliance tasks and enhancing efficiency.

-

Is there a cost associated with using airSlate SignNow for the from 1 941x form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, ensuring you have access to a powerful eSignature solution for managing documents like the from 1 941x form without breaking the bank.

-

What features does airSlate SignNow offer for the from 1 941x form?

airSlate SignNow includes features such as customizable templates, secure eSigning, cloud storage, and document tracking, all of which enhance the experience of managing the from 1 941x form. These features ensure that users can efficiently create, sign, and store their tax documents.

-

Can I integrate airSlate SignNow with other software for handling the from 1 941x form?

Absolutely! airSlate SignNow offers multiple integrations with popular applications such as CRM systems, document management tools, and accounting software. These integrations can help streamline your workflow while managing documents like the from 1 941x form.

-

What are the benefits of using airSlate SignNow for tax forms like the from 1 941x?

Using airSlate SignNow to manage forms like the from 1 941x offers the benefits of convenience, speed, and security. Users can complete and sign forms quickly from any device, ensuring timely submissions and reduction in the risk of errors.

-

Is my data secure when using airSlate SignNow for the from 1 941x form?

Yes, airSlate SignNow prioritizes data security for all transactions, including those involving the from 1 941x form. The platform employs robust encryption protocols and complies with industry standards to ensure your sensitive information is protected.

Get more for Form Ct 941x

Find out other Form Ct 941x

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed