Ct 941 Form

What is the Ct 941

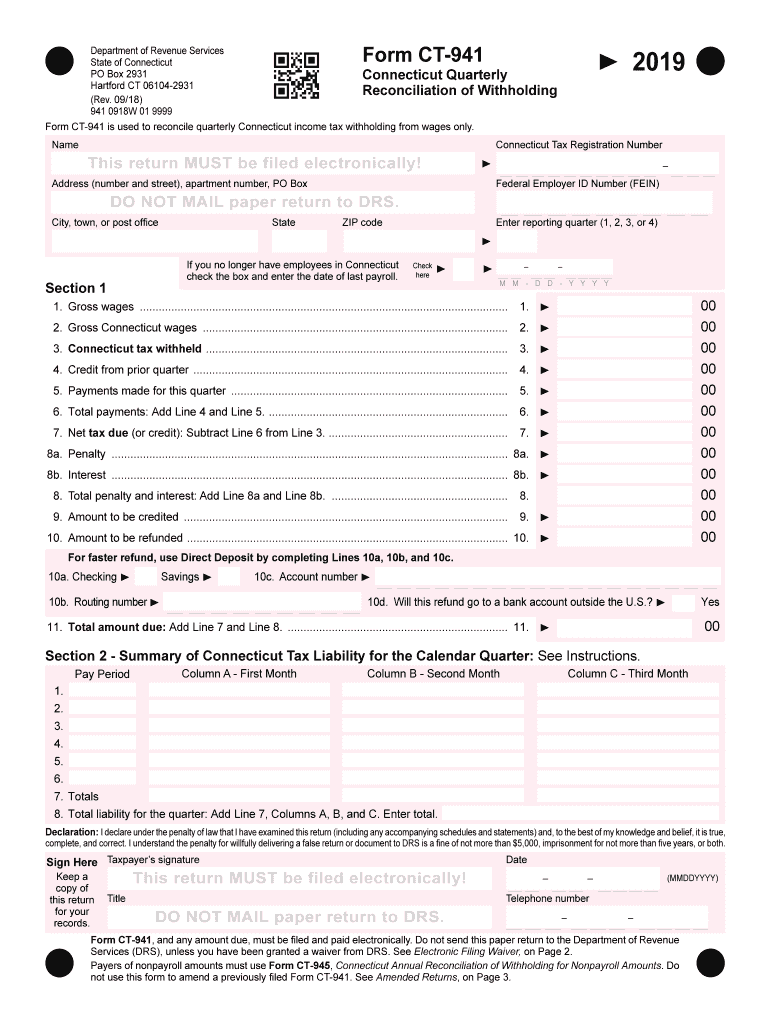

The Ct 941, also known as the Connecticut Quarterly Reconciliation of Withholding, is a tax form used by employers in Connecticut to report income tax withheld from employees' wages. This form is essential for ensuring compliance with state tax regulations and is filed quarterly. The information provided on the Ct 941 helps the Connecticut Department of Revenue Services (DRS) track withholding amounts and verify that employers are meeting their tax obligations. It is crucial for employers to understand the requirements associated with this form to avoid potential penalties.

Steps to complete the Ct 941

Completing the Ct 941 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary payroll records for the quarter, including total wages paid and the amount of state income tax withheld. Next, follow these steps:

- Enter the total wages paid to employees during the quarter.

- Report the total amount of state income tax withheld.

- Calculate any adjustments for prior quarters, if applicable.

- Review all entries for accuracy before submission.

Once completed, the form can be submitted electronically or by mail, depending on the employer's preference and the DRS guidelines.

Legal use of the Ct 941

The Ct 941 serves a legal purpose in the context of state tax compliance. It is a binding document that employers must file to report their withholding activities accurately. Failure to file the Ct 941 can result in penalties and interest on unpaid taxes. Additionally, the form must be signed by an authorized representative of the business, affirming that the information provided is true and complete. Employers should keep copies of submitted forms for their records, as they may be required for audits or other verification processes.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the Ct 941 to avoid penalties. The form is due on the last day of the month following the end of each quarter. The quarterly deadlines are as follows:

- First quarter (January - March): Due by April 30

- Second quarter (April - June): Due by July 31

- Third quarter (July - September): Due by October 31

- Fourth quarter (October - December): Due by January 31 of the following year

It is important for employers to mark these dates on their calendars to ensure timely filing and avoid any potential penalties.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Ct 941. The Connecticut Department of Revenue Services allows for electronic filing, which is often the most efficient method. Employers can also submit the form by mail or in person at designated DRS offices. When filing online, employers should ensure they have a secure method of submission and retain confirmation of their filing. If submitting by mail, it is advisable to use certified mail to confirm delivery.

Key elements of the Ct 941

The Ct 941 contains several key elements that employers must accurately complete. These include:

- Total wages paid during the quarter.

- Total Connecticut income tax withheld.

- Adjustments for any prior quarters.

- Signature of the authorized representative.

Each of these components is critical for ensuring the form is processed correctly and that employers remain compliant with state tax laws.

Who Issues the Form

The Ct 941 is issued by the Connecticut Department of Revenue Services (DRS). This state agency is responsible for administering tax laws in Connecticut, including the collection of income tax withheld from employees. Employers should refer to the DRS for any updates or changes to the form and its requirements, as well as for guidance on filing and compliance.

Quick guide on how to complete address number and street apartment number po box

Effortlessly Prepare Ct 941 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-conscious alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Ct 941 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The Easiest Way to Edit and Electronically Sign Ct 941 Stress-Free

- Locate Ct 941 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Ct 941 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the address number and street apartment number po box

How to generate an eSignature for your Address Number And Street Apartment Number Po Box in the online mode

How to create an electronic signature for your Address Number And Street Apartment Number Po Box in Chrome

How to generate an electronic signature for signing the Address Number And Street Apartment Number Po Box in Gmail

How to create an electronic signature for the Address Number And Street Apartment Number Po Box right from your mobile device

How to make an electronic signature for the Address Number And Street Apartment Number Po Box on iOS devices

How to make an electronic signature for the Address Number And Street Apartment Number Po Box on Android OS

People also ask

-

What is the 2018 ct form and how is it used?

The 2018 ct form is a tax form used by businesses in Connecticut for reporting income and business activity. It is essential for ensuring compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and send this form securely, streamlining the filing process.

-

How can airSlate SignNow help me with the 2018 ct form?

airSlate SignNow provides a simple and efficient platform for businesses to prepare, eSign, and send the 2018 ct form. With features like templates and mobile access, you can complete and manage your tax forms seamlessly, saving time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the 2018 ct form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses at differing sizes. These plans provide access to powerful features for managing the 2018 ct form and other documents. You can choose a plan that suits your budget and requirements.

-

Can I integrate airSlate SignNow with my existing accounting software for the 2018 ct form?

Absolutely! airSlate SignNow supports integrations with many popular accounting software solutions, making it easy to sync the data needed for the 2018 ct form. This integration enhances efficiency by allowing you to import and send forms directly from your accounting platform.

-

What are the key benefits of using airSlate SignNow for the 2018 ct form?

Using airSlate SignNow for the 2018 ct form provides businesses with a secure, easy-to-use solution for electronic signatures and document management. The platform improves turnaround times and audit trails, ensuring you stay compliant while reducing administrative burdens.

-

How do I start using airSlate SignNow for the 2018 ct form?

Getting started with airSlate SignNow for the 2018 ct form is simple. Sign up for an account, choose a pricing plan that fits your needs, and you can begin creating and managing your forms right away. The user-friendly interface guides you through every step.

-

What security measures does airSlate SignNow implement for the 2018 ct form?

airSlate SignNow ensures that your 2018 ct form and other documents are protected with top-tier security measures. This includes data encryption, secure cloud storage, and compliance with industry standards to safeguard sensitive information throughout the eSigning process.

Get more for Ct 941

- Instructions for form it 602 claim for ez capital tax credit

- Instructions for schedule b form 941 rev march instructions for schedule b form 941 report of tax liability for semiweekly

- Unincorporated business tax fill out and sign printable form

- Form 8854

- Room hire contract template form

- Room rent contract template form

- Room leas contract template form

- Room sublet contract template form

Find out other Ct 941

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now