Form Withholding

What is the Form Withholding

The 2020 form withholding, often referred to as the W-4 form, is a crucial document used by employees in the United States to inform their employers about the amount of federal income tax to withhold from their paychecks. This form plays a significant role in ensuring that the correct amount of tax is deducted, helping to avoid underpayment or overpayment of taxes throughout the year. The information provided on the form includes personal details, filing status, and any additional allowances or deductions the employee wishes to claim.

How to obtain the Form Withholding

To obtain the 2020 form withholding, individuals can visit the official IRS website where the form is available for download in PDF format. Additionally, many employers provide the form directly to their employees during the onboarding process or upon request. It is important to ensure that you are using the correct version of the form, as tax regulations can change from year to year.

Steps to complete the Form Withholding

Completing the 2020 form withholding involves several steps:

- Enter your personal information, including your name, address, and Social Security number.

- Select your filing status, such as single, married, or head of household.

- Indicate the number of allowances you are claiming based on your tax situation.

- Provide any additional amounts you wish to withhold from your paycheck.

- Sign and date the form to validate it.

Once completed, the form should be submitted to your employer for processing.

Legal use of the Form Withholding

The 2020 form withholding is legally binding when filled out correctly and submitted to your employer. It is essential to provide accurate information, as false claims can lead to penalties from the IRS. Employers are required to keep this form on file and use it to calculate the appropriate tax withholdings for each employee. Compliance with IRS regulations ensures that both the employee and employer meet their tax obligations.

Filing Deadlines / Important Dates

While the 2020 form withholding does not have a specific filing deadline like tax returns, it is crucial to submit it to your employer as soon as you start a new job or experience a change in your financial situation. Changes in personal circumstances, such as marriage or the birth of a child, may also necessitate a new form submission to adjust withholding accordingly. Keeping your information up to date helps avoid potential tax liabilities at the end of the year.

IRS Guidelines

The IRS provides clear guidelines on how to fill out the 2020 form withholding. It is recommended to refer to the IRS instructions that accompany the form for detailed explanations of each section. The IRS also offers a withholding calculator on its website, which can help individuals determine the correct number of allowances to claim based on their specific financial situation. Following these guidelines ensures compliance with tax laws and helps in accurate tax withholding.

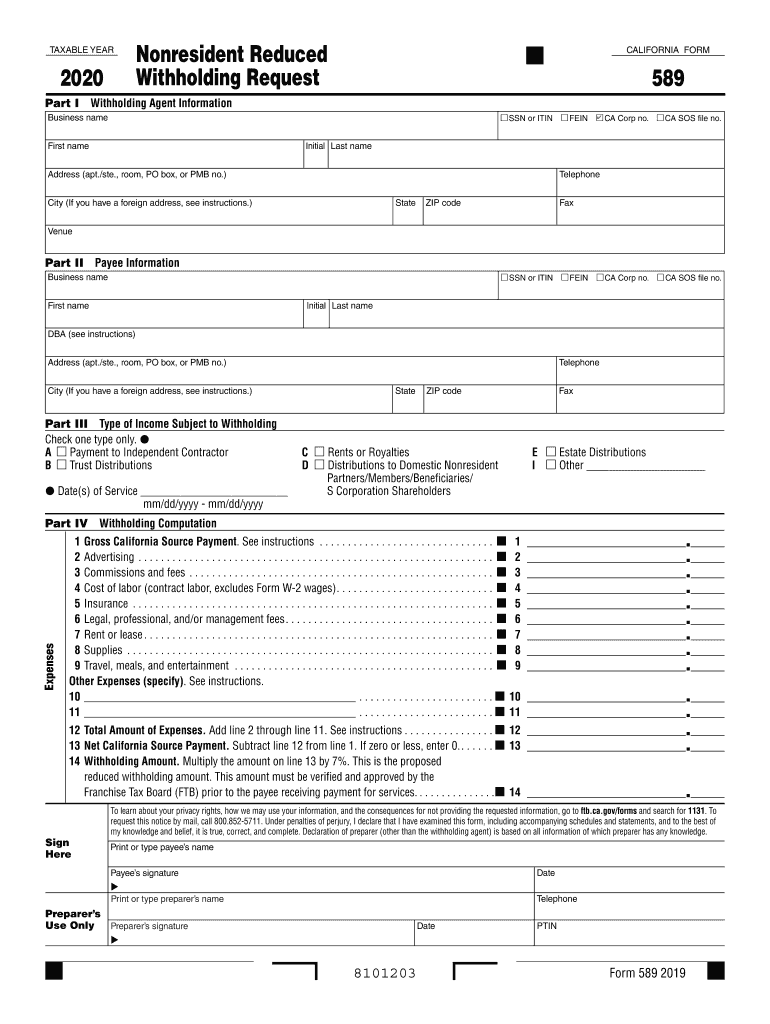

Quick guide on how to complete 2020 california form 589 nonresident reduced withholding request 2020 california form 589 nonresident reduced withholding

Effortlessly Prepare Form Withholding on Any Device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Manage Form Withholding on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The Easiest Way to Edit and eSign Form Withholding Seamlessly

- Locate Form Withholding and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your adjustments.

- Select your preferred method for sharing your form—via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, the hassle of searching for forms, or mistakes that require printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form Withholding to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 california form 589 nonresident reduced withholding request 2020 california form 589 nonresident reduced withholding

How to make an electronic signature for your 2020 California Form 589 Nonresident Reduced Withholding Request 2020 California Form 589 Nonresident Reduced Withholding online

How to generate an electronic signature for your 2020 California Form 589 Nonresident Reduced Withholding Request 2020 California Form 589 Nonresident Reduced Withholding in Chrome

How to make an electronic signature for signing the 2020 California Form 589 Nonresident Reduced Withholding Request 2020 California Form 589 Nonresident Reduced Withholding in Gmail

How to generate an electronic signature for the 2020 California Form 589 Nonresident Reduced Withholding Request 2020 California Form 589 Nonresident Reduced Withholding right from your smartphone

How to create an electronic signature for the 2020 California Form 589 Nonresident Reduced Withholding Request 2020 California Form 589 Nonresident Reduced Withholding on iOS

How to generate an eSignature for the 2020 California Form 589 Nonresident Reduced Withholding Request 2020 California Form 589 Nonresident Reduced Withholding on Android devices

People also ask

-

What is the 2020 form withholding and why is it important?

The 2020 form withholding is a key document for employees to determine how much federal income tax should be withheld from their paychecks. It is important as it ensures accurate tax deductions, preventing underpayment or overpayment to the IRS. Understanding this form helps employees maintain financial health throughout the year.

-

How can airSlate SignNow simplify the process of managing the 2020 form withholding?

airSlate SignNow provides an efficient way to send and eSign the 2020 form withholding, streamlining the entire signing process. With our user-friendly interface, businesses can quickly manage documents, ensuring that forms are completed accurately and returned promptly. This enhances compliance and minimizes administrative burdens.

-

What features does airSlate SignNow offer for handling the 2020 form withholding?

Our platform includes features like customizable templates, real-time tracking, and notifications for the 2020 form withholding. These tools help ensure that all necessary signatures are collected in a timely manner. Additionally, the cloud-based solution allows easy access to forms from any device, enhancing convenience.

-

Is there a cost associated with using airSlate SignNow for the 2020 form withholding?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including the option to handle the 2020 form withholding efficiently. Each plan includes features that facilitate eSigning and document management. Users can choose a plan that best suits their frequency and volume of document transactions.

-

Can airSlate SignNow integrate with other platforms for managing the 2020 form withholding?

Absolutely! airSlate SignNow offers seamless integrations with popular tools like Google Drive, Dropbox, and CRM systems. This allows businesses to easily manage and store the 2020 form withholding alongside other important documents. Integrations enhance workflow efficiency and ensure that all relevant data is synchronized.

-

How does airSlate SignNow ensure the security of the 2020 form withholding?

Security is a priority at airSlate SignNow. We use encryption and secure cloud storage to protect sensitive information in the 2020 form withholding. Our platform complies with industry standards and regulations, assuring users that their documents are safe from unauthorized access.

-

What benefits can businesses expect from using airSlate SignNow for the 2020 form withholding?

Using airSlate SignNow for the 2020 form withholding enhances efficiency, compliance, and accuracy in document management. The ability to eSign documents eliminates the need for physical paperwork and reduces turnaround times. Additionally, with real-time tracking, businesses can manage the signing process more effectively.

Get more for Form Withholding

- County of los angeles department of mental health adult form

- Romantic love contract template form

- Roof construction contract template form

- Roof contract template form

- Roof maintenance contract template form

- Roof repair contract template form

- Roof replacement contract template form

- Roof residential contract template form

Find out other Form Withholding

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now