It 203 New York State Department of Taxation and Finance Nonresident and Part Year Resident Income Tax Return New York State New Form

Understanding the IT 203 Nonresident and Part-Year Resident Income Tax Return

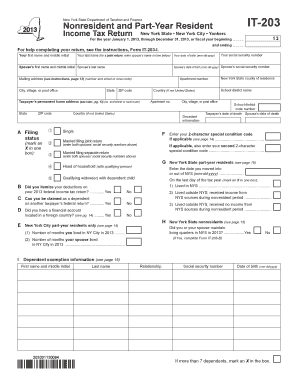

The IT 203 form is designed for nonresidents and part-year residents of New York State who need to report their income earned within the state. This form is essential for individuals who do not reside in New York for the entire tax year but have income sourced from the state. The IT 203 allows these taxpayers to accurately calculate their tax obligations based on the income earned while residing in New York. It is crucial for compliance with state tax laws and helps ensure that individuals pay the correct amount of tax owed.

Steps to Complete the IT 203 Form

Completing the IT 203 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your income earned in New York, making sure to differentiate between income earned while a resident and while a nonresident. Finally, calculate your tax liability, apply any credits or deductions, and sign the form before submission.

Obtaining the IT 203 Form

The IT 203 form can be easily obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Alternatively, the form can be completed electronically using compatible tax software that supports New York State tax forms. Ensure you have the most current version of the form to avoid any issues during filing.

Required Documents for Filing

When filing the IT 203 form, several documents are necessary to support your income claims and deductions. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Proof of residency status, if applicable

- Documentation for any deductions or credits claimed

Having these documents ready will streamline the filing process and help ensure accuracy in reporting.

Filing Deadlines for the IT 203 Form

It is important to be aware of the filing deadlines for the IT 203 form to avoid penalties. Generally, the form is due on April 15 of the year following the tax year. If you are unable to file by this date, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. Always check for any changes to deadlines or specific instructions from the New York State Department of Taxation and Finance.

Penalties for Non-Compliance

Failing to file the IT 203 form or submitting it inaccurately can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to ensure that the form is completed accurately and submitted on time to avoid these consequences. Taxpayers should also be aware that New York State may conduct audits to verify the information provided on tax returns.

Quick guide on how to complete it 203 new york state department of taxation and finance nonresident and part year resident income tax return new york state

Prepare [SKS] effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you prefer to share your form – by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IT 203 New York State Department Of Taxation And Finance Nonresident And Part Year Resident Income Tax Return New York State New

Create this form in 5 minutes!

How to create an eSignature for the it 203 new york state department of taxation and finance nonresident and part year resident income tax return new york state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 203 New York State Department Of Taxation And Finance Nonresident And Part Year Resident Income Tax Return?

The IT 203 New York State Department Of Taxation And Finance Nonresident And Part Year Resident Income Tax Return is a tax form used by individuals who are nonresidents or part-year residents of New York State. This form allows you to report your income earned in New York and calculate your tax liability for the year. It is essential for compliance with New York tax laws.

-

Who needs to file the IT 203 form?

Individuals who lived outside of New York State for part of the year but earned income from New York sources must file the IT 203 form. This includes nonresidents and part-year residents who have income from New York City or Yonkers. Filing this form ensures that you meet your tax obligations in New York.

-

What are the benefits of using airSlate SignNow for filing the IT 203 form?

Using airSlate SignNow simplifies the process of filing the IT 203 New York State Department Of Taxation And Finance Nonresident And Part Year Resident Income Tax Return. Our platform allows you to easily eSign and send documents securely, ensuring that your tax return is filed accurately and on time. This cost-effective solution saves you time and reduces the stress of tax season.

-

How much does it cost to use airSlate SignNow for tax document management?

airSlate SignNow offers various pricing plans to cater to different needs, making it a cost-effective solution for managing your tax documents, including the IT 203 New York State Department Of Taxation And Finance Nonresident And Part Year Resident Income Tax Return. You can choose a plan that fits your budget and requirements, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow can be integrated with various tax preparation software and tools, enhancing your workflow when filing the IT 203 New York State Department Of Taxation And Finance Nonresident And Part Year Resident Income Tax Return. This integration allows for seamless document management and eSigning, making the tax filing process more efficient.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as secure eSigning, document templates, and real-time collaboration, which are essential for managing tax documents like the IT 203 New York State Department Of Taxation And Finance Nonresident And Part Year Resident Income Tax Return. These features help streamline the filing process and ensure compliance with tax regulations.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! airSlate SignNow prioritizes the security of your sensitive tax information, including details related to the IT 203 New York State Department Of Taxation And Finance Nonresident And Part Year Resident Income Tax Return. Our platform uses advanced encryption and security protocols to protect your data, giving you peace of mind while managing your tax documents.

Get more for IT 203 New York State Department Of Taxation And Finance Nonresident And Part Year Resident Income Tax Return New York State New

- Work permit application sweetwater union high school district syh sweetwaterschools form

- Statement regarding assistance of non attorney local bankruptcy rule 1002 1 rev 1203 form

- Ssa 795 6270679 form

- Wicourts form

- Online pantone converter form

- Xnx universal transmitter manual form

- Mic form

- Form tm 11 ipo

Find out other IT 203 New York State Department Of Taxation And Finance Nonresident And Part Year Resident Income Tax Return New York State New

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe