Conveyance Tax Form

What is the Conveyance Tax

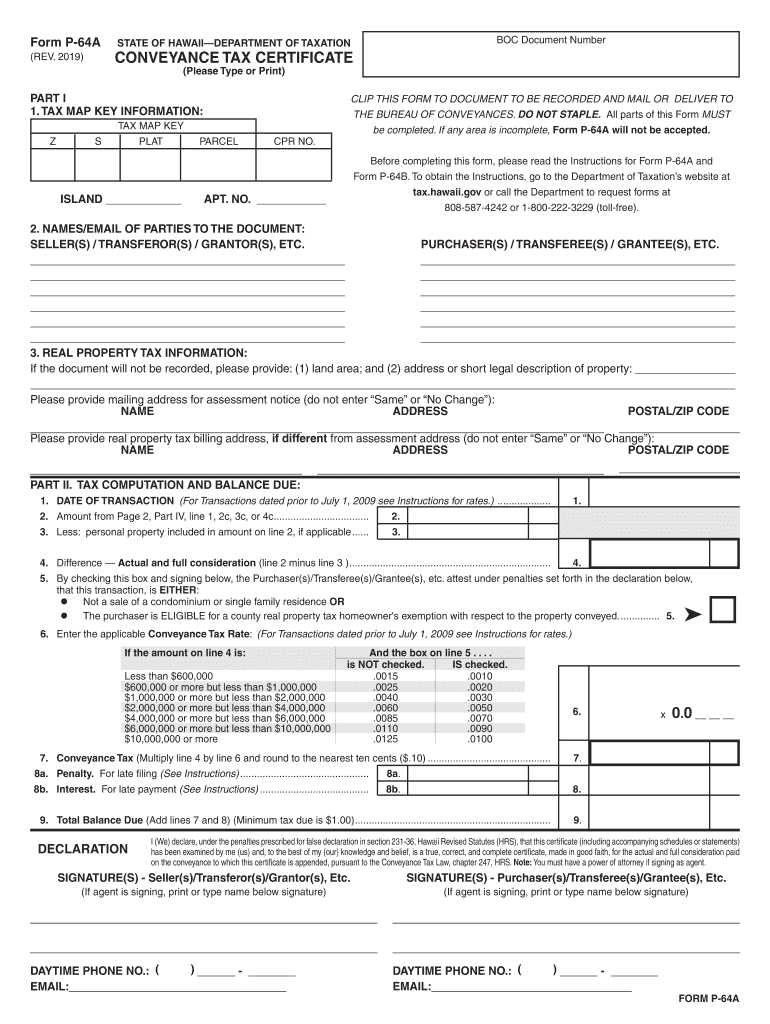

The conveyance tax is a fee imposed by the state of Hawaii on the transfer of real property. This tax is calculated based on the sales price or value of the property being transferred. The purpose of the conveyance tax is to generate revenue for the state and to support various public programs. Understanding this tax is essential for anyone involved in real estate transactions in Hawaii, as it directly impacts the financial aspects of property transfers.

Steps to Complete the Conveyance Tax

Completing the conveyance tax form P 64A involves several key steps:

- Gather necessary information about the property, including the sales price and any relevant details about the buyer and seller.

- Obtain the conveyance tax form P 64A, which can typically be downloaded from the state’s official website or obtained from local government offices.

- Fill out the form accurately, ensuring that all required fields are completed. This includes providing information about the property, the parties involved, and the tax calculation.

- Review the completed form for accuracy and completeness to avoid any issues during submission.

- Submit the form along with any required payment for the conveyance tax to the appropriate state agency.

Legal Use of the Conveyance Tax

The conveyance tax form P 64A must be used in compliance with state laws governing real estate transactions. This includes understanding the legal obligations associated with property transfers and ensuring that the tax is paid in a timely manner. Failure to comply with these regulations can result in penalties, including fines or delays in property transfer. It is crucial for both buyers and sellers to be aware of their responsibilities under the law when dealing with conveyance taxes.

Required Documents

When completing the conveyance tax form P 64A, certain documents are required to support the information provided. These may include:

- Proof of property ownership, such as a deed or title.

- Sales agreement or contract detailing the terms of the property transfer.

- Any previous conveyance tax forms if applicable.

- Identification of the parties involved in the transaction.

Form Submission Methods

The conveyance tax form P 64A can be submitted through various methods, depending on the preferences of the parties involved. Common submission methods include:

- Online submission through the state’s official tax portal.

- Mailing the completed form to the designated state agency.

- In-person submission at local government offices.

Penalties for Non-Compliance

Failure to file the conveyance tax form P 64A or pay the associated tax can result in significant penalties. These may include:

- Fines based on the amount of tax owed.

- Interest charges on late payments.

- Potential legal action to recover unpaid taxes.

It is essential for individuals and businesses involved in property transactions to ensure compliance with conveyance tax regulations to avoid these consequences.

Quick guide on how to complete form p 64a rev 2015 conveyance tax certificate hawaiigov

Complete Conveyance Tax effortlessly on any device

Digital document management has gained immense traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily access the right form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without interruptions. Handle Conveyance Tax on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to adjust and eSign Conveyance Tax without hassle

- Locate Conveyance Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Revise and eSign Conveyance Tax to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form p 64a rev 2015 conveyance tax certificate hawaiigov

How to generate an electronic signature for your Form P 64a Rev 2015 Conveyance Tax Certificate Hawaiigov online

How to create an eSignature for the Form P 64a Rev 2015 Conveyance Tax Certificate Hawaiigov in Chrome

How to make an electronic signature for signing the Form P 64a Rev 2015 Conveyance Tax Certificate Hawaiigov in Gmail

How to generate an electronic signature for the Form P 64a Rev 2015 Conveyance Tax Certificate Hawaiigov straight from your smartphone

How to create an eSignature for the Form P 64a Rev 2015 Conveyance Tax Certificate Hawaiigov on iOS

How to create an eSignature for the Form P 64a Rev 2015 Conveyance Tax Certificate Hawaiigov on Android

People also ask

-

What is conveyance tax in relation to eSigning documents?

Conveyance tax refers to the tax imposed on the transfer of ownership of real estate or property. When using airSlate SignNow for eSigning documents, understanding how conveyance tax applies can help streamline your transactions and ensure compliance with local laws regarding property transfer.

-

How does airSlate SignNow help with managing conveyance tax?

airSlate SignNow simplifies the document signing process, which is crucial for quickly handling conveyance tax documents. By using our platform, businesses can efficiently prepare, sign, and manage the necessary documents, ensuring that all requirements, including showing evidence of conveyance tax payment, are met.

-

What are the pricing options for using airSlate SignNow for conveyance tax-related documents?

airSlate SignNow offers various pricing plans that cater to different business needs, including those related to conveyance tax. Our pricing is transparent and competitive, ensuring that you receive excellent value while managing documents associated with conveyance tax without breaking the bank.

-

Can I integrate airSlate SignNow with other tools to manage conveyance tax documents?

Yes, airSlate SignNow integrates seamlessly with a variety of tools and platforms, enhancing your ability to track and manage documents related to conveyance tax. This integration allows for a more streamlined workflow, enabling you to import data or send reminders regarding conveyance tax filings effortlessly.

-

What are the benefits of using airSlate SignNow for signing conveyance tax documents?

Using airSlate SignNow for signing conveyance tax documents offers numerous benefits, including speed, security, and ease of use. Our platform ensures that all documents are legally binding and encrypted, which helps in facilitating smoother transactions related to conveyance tax without unnecessary delays.

-

Is airSlate SignNow compliant with regulations concerning conveyance tax?

Absolutely, airSlate SignNow prioritizes compliance by adhering to strict legal standards, especially regarding conveyance tax and property transactions. This ensures that all signed documents meet local regulations, providing peace of mind to businesses and individuals handling conveyance tax processes.

-

How can airSlate SignNow improve the efficiency of handling conveyance tax?

airSlate SignNow enhances the efficiency of handling conveyance tax by providing a user-friendly interface and features like templates and automated workflows. This means you can quickly prepare and send out documents, reducing the time spent on admin tasks associated with conveyance tax paperwork.

Get more for Conveyance Tax

- Dd form 2701 100272012

- Installation and maintenance manual for warren elevating 5th wheels form

- Franklin county auditor forms

- Rent to own home contract template form

- Rent to own contract template form

- Rent to own house contract template form

- Rent to own motorcycle contract template form

- Rent to rent contract template form

Find out other Conveyance Tax

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile