Debt Snowball Worksheet Form

What is the Debt Snowball Worksheet

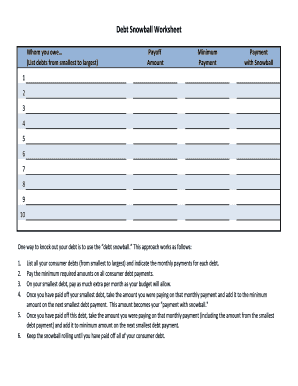

The Debt Snowball Worksheet is a financial tool designed to help individuals manage and eliminate their debt systematically. It follows the debt snowball method, which encourages users to focus on paying off their smallest debts first while making minimum payments on larger debts. This approach not only simplifies the debt repayment process but also provides psychological motivation as users experience quick wins by eliminating smaller debts. The worksheet typically includes sections for listing debts, their balances, interest rates, and minimum monthly payments.

How to use the Debt Snowball Worksheet

Using the Debt Snowball Worksheet involves several straightforward steps. First, gather all relevant financial information, including the total amount owed for each debt, interest rates, and minimum payments. Next, list these debts in order from the smallest balance to the largest. Once the debts are organized, allocate any extra funds towards the smallest debt while continuing to make minimum payments on others. As each debt is paid off, the freed-up funds can be applied to the next smallest debt, creating a snowball effect that accelerates debt repayment.

Steps to complete the Debt Snowball Worksheet

Completing the Debt Snowball Worksheet involves a few essential steps:

- List all debts: Write down each debt, including credit cards, loans, and any other outstanding balances.

- Note details: For each debt, include the total balance, interest rate, and minimum monthly payment.

- Prioritize debts: Arrange the debts from the smallest to the largest balance.

- Calculate extra payments: Determine how much extra money can be allocated to debt repayment each month.

- Track progress: As debts are paid off, update the worksheet to reflect the new balances and continue the process until all debts are eliminated.

Key elements of the Debt Snowball Worksheet

The Debt Snowball Worksheet typically includes several key elements that aid in effective debt management. These elements consist of:

- Debt name: The name of the creditor or the type of debt.

- Balance: The total amount owed on each debt.

- Interest rate: The annual percentage rate charged on the debt.

- Minimum payment: The lowest amount required to be paid each month.

- Extra payment: Any additional funds allocated to pay off the smallest debt.

- Status: A section to track whether the debt is paid off or still outstanding.

How to obtain the Debt Snowball Worksheet

The Debt Snowball Worksheet can be easily obtained through various sources. Many financial websites offer free downloadable templates in PDF or Excel formats. Additionally, personal finance books often include worksheets as part of their resources. Users can also create a custom worksheet using spreadsheet software, allowing for personalization based on individual financial situations. Ensuring that the worksheet is tailored to specific needs can enhance its effectiveness in managing debt.

Examples of using the Debt Snowball Worksheet

Examples of using the Debt Snowball Worksheet can provide clarity on its practical application. For instance, consider an individual with three debts: a credit card balance of $500, a personal loan of $1,500, and a car loan of $5,000. Using the worksheet, the individual would first focus on the credit card. By allocating any extra funds towards this debt while making minimum payments on the others, they would pay off the credit card quickly. Once paid, the funds previously used for the credit card can then be redirected to the personal loan, and so on, until all debts are cleared.

Quick guide on how to complete debt snowball worksheet

Prepare Debt Snowball Worksheet seamlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without interruptions. Manage Debt Snowball Worksheet on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric operation today.

The easiest way to modify and eSign Debt Snowball Worksheet effortlessly

- Obtain Debt Snowball Worksheet and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign Debt Snowball Worksheet to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the debt snowball worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a debt snowball spreadsheet PDF?

A debt snowball spreadsheet PDF is a financial tool designed to help individuals manage and pay off their debts systematically. It allows users to list their debts, prioritize them, and track their progress as they make payments. This method can lead to quicker debt payoff and improved financial health.

-

How can I use the debt snowball spreadsheet PDF effectively?

To use the debt snowball spreadsheet PDF effectively, start by listing all your debts from smallest to largest. Focus on paying off the smallest debt first while making minimum payments on others. Once the smallest debt is paid off, move to the next one, creating a snowball effect that accelerates your debt repayment.

-

Is the debt snowball spreadsheet PDF free to download?

Yes, the debt snowball spreadsheet PDF is available for free download on our website. This allows you to start managing your debts without any upfront costs. Simply visit our landing page to access the PDF and begin your journey towards financial freedom.

-

What features does the debt snowball spreadsheet PDF include?

The debt snowball spreadsheet PDF includes features such as debt tracking, payment scheduling, and progress visualization. It is designed to be user-friendly, allowing you to easily input your debt information and monitor your repayment journey. These features help keep you motivated and organized.

-

Can I customize the debt snowball spreadsheet PDF?

Yes, the debt snowball spreadsheet PDF can be customized to fit your specific financial situation. You can add or remove debt entries, adjust payment amounts, and modify the layout to suit your preferences. This flexibility ensures that the tool works effectively for your unique needs.

-

What are the benefits of using a debt snowball spreadsheet PDF?

Using a debt snowball spreadsheet PDF offers several benefits, including increased motivation, better organization, and a clear repayment strategy. It helps you visualize your progress, making it easier to stay committed to your debt repayment plan. Ultimately, this can lead to faster debt elimination and improved financial stability.

-

Does the debt snowball spreadsheet PDF integrate with other financial tools?

While the debt snowball spreadsheet PDF is a standalone tool, it can complement other financial tools you may be using. You can manually input data from your bank accounts or budgeting apps to keep track of your overall financial health. This integration helps create a comprehensive view of your finances.

Get more for Debt Snowball Worksheet

Find out other Debt Snowball Worksheet

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online