Michigan Form 1353

What is the Michigan Form 1353

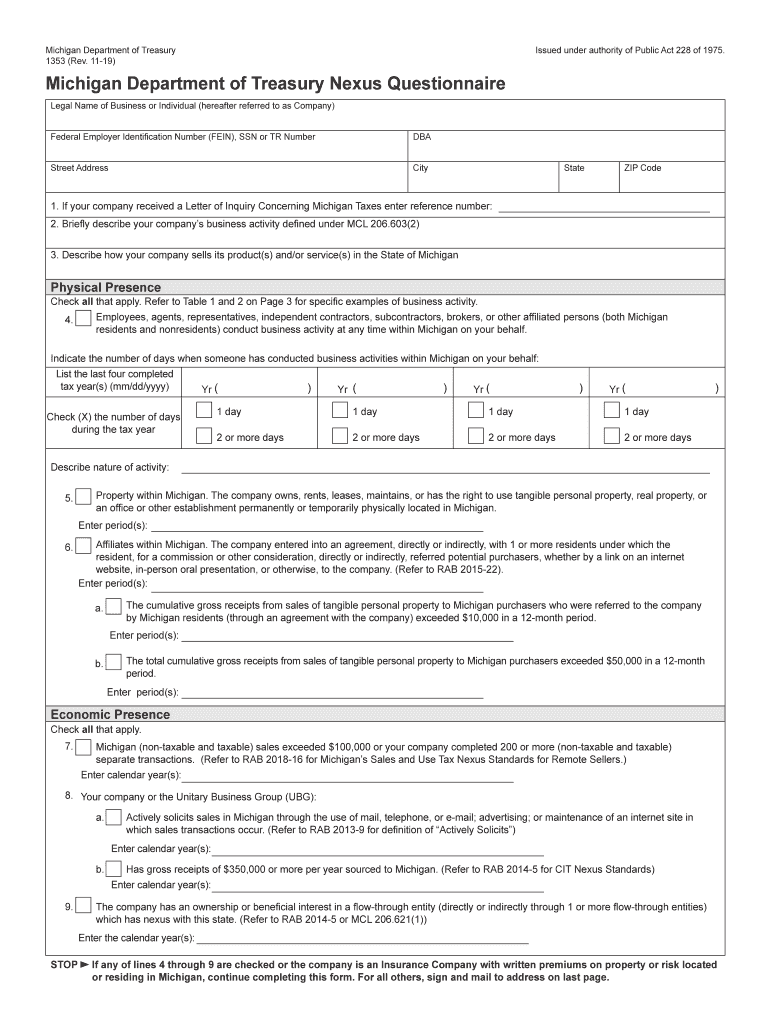

The Michigan Form 1353, commonly referred to as the Michigan sales tax nexus questionnaire, is a critical document used by businesses to determine their sales tax obligations in the state of Michigan. This form helps the Michigan Department of Treasury assess whether a business has established a nexus, or sufficient physical presence, in the state that would require them to collect and remit sales tax. Understanding the nuances of this form is essential for compliance with state tax laws.

Steps to complete the Michigan Form 1353

Completing the Michigan Form 1353 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding your business operations, including physical locations, sales activities, and employee presence in Michigan. Next, accurately fill out each section of the form, providing details about your business structure and any nexus-related activities. After completing the form, review it for any errors or omissions before submission. Finally, submit the form according to the specified instructions, ensuring you keep a copy for your records.

Key elements of the Michigan Form 1353

The Michigan Form 1353 includes several key elements that are crucial for determining nexus. These elements typically encompass the business name, address, and type of entity, along with detailed information about the nature of the business activities conducted in Michigan. Additionally, the form may require disclosure of any physical presence, such as offices or employees, as well as sales figures that indicate the volume of transactions within the state. Each of these components plays a vital role in the assessment of sales tax obligations.

Legal use of the Michigan Form 1353

The legal use of the Michigan Form 1353 is governed by state tax regulations. To be considered valid, the form must be completed accurately and submitted within the designated time frames outlined by the Michigan Department of Treasury. The information provided on the form is used to make determinations about a business's tax responsibilities, and any inaccuracies could result in penalties or compliance issues. Therefore, it is essential to ensure that the form is filled out truthfully and in accordance with Michigan tax laws.

Form Submission Methods

The Michigan Form 1353 can be submitted through various methods to accommodate different business needs. Businesses have the option to file the form online, which is often the most efficient method, allowing for quicker processing times. Alternatively, the form can be mailed to the appropriate address provided by the Michigan Department of Treasury. In some cases, in-person submissions may be accepted, though this method is less common. Whichever method is chosen, it is important to follow the specific guidelines to ensure successful submission.

Who Issues the Form

The Michigan Form 1353 is issued by the Michigan Department of Treasury. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Michigan. The department provides the necessary forms and instructions to help businesses understand their tax obligations, including the requirements for completing and submitting the Michigan sales tax nexus questionnaire. Engaging with the Department of Treasury can provide additional clarity on any questions related to the form.

Quick guide on how to complete form 1353 michigan department of treasury nexus questionnaire

Complete Michigan Form 1353 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Michigan Form 1353 on any device using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to alter and eSign Michigan Form 1353 with minimal effort

- Locate Michigan Form 1353 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Michigan Form 1353 to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1353 michigan department of treasury nexus questionnaire

How to make an electronic signature for your Form 1353 Michigan Department Of Treasury Nexus Questionnaire in the online mode

How to generate an electronic signature for the Form 1353 Michigan Department Of Treasury Nexus Questionnaire in Chrome

How to generate an eSignature for putting it on the Form 1353 Michigan Department Of Treasury Nexus Questionnaire in Gmail

How to create an electronic signature for the Form 1353 Michigan Department Of Treasury Nexus Questionnaire right from your smartphone

How to create an eSignature for the Form 1353 Michigan Department Of Treasury Nexus Questionnaire on iOS

How to generate an eSignature for the Form 1353 Michigan Department Of Treasury Nexus Questionnaire on Android

People also ask

-

What is Michigan Form 1353?

Michigan Form 1353 is a state form used for specific purposes defined by Michigan law. It is essential for individuals or businesses in Michigan who need to submit information related to tax credits, exemptions, or other fiscal responsibilities. Understanding how to properly complete Michigan Form 1353 can ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help me with Michigan Form 1353?

airSlate SignNow streamlines the process of filling out and submitting Michigan Form 1353. With its intuitive interface, you can easily fill out the form digitally, ensuring accuracy and efficiency. Our platform allows you to eSign and send the document securely, making the submission process faster and more reliable.

-

What features does airSlate SignNow offer for handling Michigan Form 1353?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and document tracking specifically for Michigan Form 1353. These tools enhance user experience by simplifying form completion and ensuring legal compliance. Additionally, users can easily collaborate with others through real-time editing and comments.

-

Is there a cost associated with using airSlate SignNow for Michigan Form 1353?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. Pricing is competitive, especially considering the time and resources saved when handling Michigan Form 1353. You can explore our subscription options to find the best plan that meets your specific requirements.

-

Can I integrate airSlate SignNow with other apps for Michigan Form 1353?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications that can help streamline the process of completing Michigan Form 1353. These integrations enhance productivity by allowing you to connect workflows with CRM systems, cloud storage, and more, ensuring your documents are in one place.

-

What are the benefits of using airSlate SignNow for Michigan Form 1353?

Using airSlate SignNow for Michigan Form 1353 provides numerous benefits such as reduced paperwork and improved turnaround time. The eSigning feature ensures that your form submissions are completed quickly and securely. Moreover, the ability to track document statuses ensures transparency and accountability throughout the process.

-

How secure is the information I input for Michigan Form 1353 on airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols to protect your data while filling out Michigan Form 1353 and during the eSigning process. Our platform adheres to industry-standard compliance and security practices, providing peace of mind for all users.

Get more for Michigan Form 1353

- Montserrat st cardi form

- Kentucky education and labor cabinet welcome form

- Recruitment agency contract template form

- Recruitment consultant contract template form

- Recruitment contract template form

- Recruitment process outsourc contract template form

- Recurr payment contract template form

- Recurr service contract template form

Find out other Michigan Form 1353

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed