Form 4891

What is the Form 4891

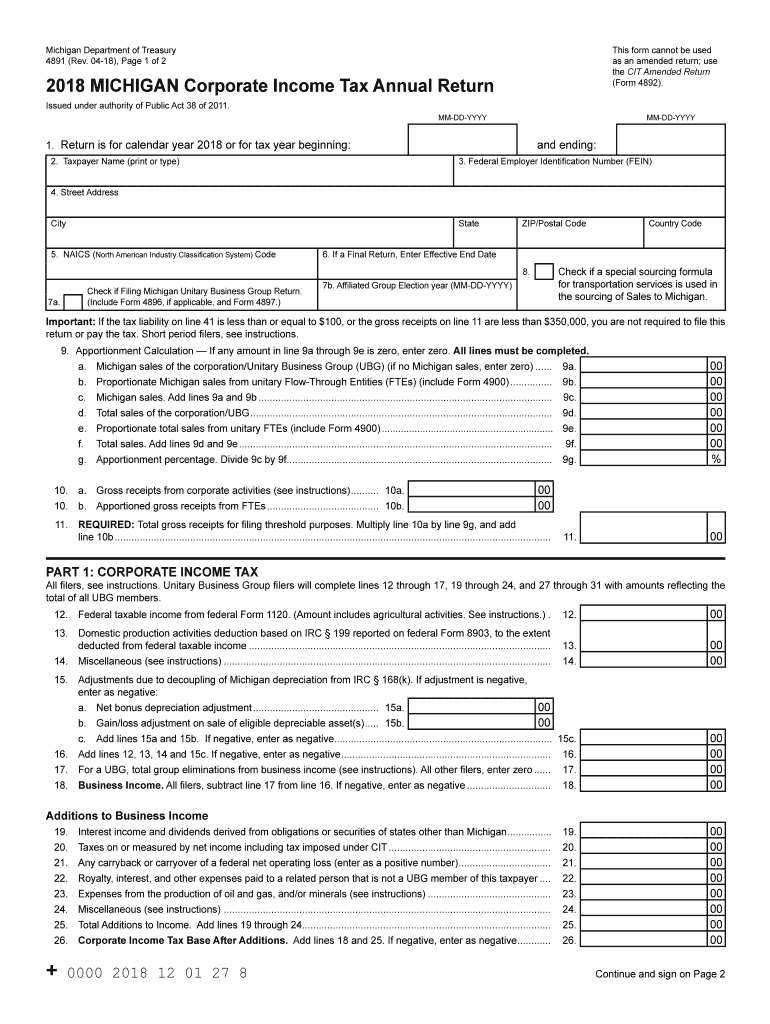

The Form 4891 is a Michigan state tax form used primarily for reporting specific tax information related to individual income. This form is essential for taxpayers who need to report their income accurately and ensure compliance with state tax regulations. It captures various details about income sources, deductions, and credits applicable for the tax year.

How to use the Form 4891

Using the Form 4891 involves filling out personal information, income details, and any applicable deductions or credits. Taxpayers must ensure that all information is accurate and complete. The form is designed to guide users through the necessary sections, making it easier to report income and calculate any tax owed or refunds due. Familiarity with the form's layout will aid in efficient completion.

Steps to complete the Form 4891

To complete the Form 4891, follow these steps:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Begin by entering your personal information, such as name, address, and Social Security number.

- Report your total income from all sources, ensuring to include any taxable benefits.

- List any deductions or credits you qualify for, as these can significantly affect your tax liability.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Form 4891

The Form 4891 is legally binding when filled out correctly and submitted to the Michigan Department of Treasury. It is crucial to comply with all state regulations regarding tax reporting. Using the form ensures that taxpayers meet their legal obligations and avoid potential penalties for inaccurate reporting. Electronic submissions are accepted, provided they meet the necessary legal standards.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form 4891. Typically, the form must be submitted by April fifteenth of the tax year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to keep track of these dates to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 4891 can be submitted through various methods, providing flexibility for taxpayers. It can be filed online through the Michigan Department of Treasury's website, mailed to the appropriate address, or submitted in person at designated offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete 4909 corporate income tax amended return state of michigan

Effortlessly prepare Form 4891 on any device

The management of online documents has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed forms, allowing you to access the necessary paperwork and securely archive it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without any holdups. Handle Form 4891 on any device with the airSlate SignNow applications for Android or iOS and enhance your document-driven processes today.

Steps to modify and electronically sign Form 4891 with ease

- Obtain Form 4891 and click on Get Form to begin.

- Utilize the provided tools to complete your form.

- Mark important sections of the documents or obscure sensitive details using the specific tools offered by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, and errors that necessitate reprinting new copies. airSlate SignNow satisfies all your document management requirements with just a few clicks from any device you choose. Modify and electronically sign Form 4891 to ensure seamless communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4909 corporate income tax amended return state of michigan

How to create an electronic signature for your 4909 Corporate Income Tax Amended Return State Of Michigan in the online mode

How to generate an electronic signature for your 4909 Corporate Income Tax Amended Return State Of Michigan in Chrome

How to make an eSignature for signing the 4909 Corporate Income Tax Amended Return State Of Michigan in Gmail

How to make an eSignature for the 4909 Corporate Income Tax Amended Return State Of Michigan straight from your smart phone

How to make an eSignature for the 4909 Corporate Income Tax Amended Return State Of Michigan on iOS

How to create an electronic signature for the 4909 Corporate Income Tax Amended Return State Of Michigan on Android OS

People also ask

-

What are the mi 4891 instructions 2020?

The mi 4891 instructions 2020 provide essential guidelines for completing the form accurately. This document outlines the requirements for filing, ensuring you include all necessary information for successful submission. Familiarizing yourself with the mi 4891 instructions 2020 is crucial for avoiding delays or rejections.

-

How can airSlate SignNow assist with the mi 4891 instructions 2020?

airSlate SignNow simplifies the process of signing and sending documents related to the mi 4891 instructions 2020. Our platform allows you to easily upload, eSign, and share your forms, ensuring compliance with filing requirements. This helps streamline your workflow while maintaining accuracy with the mi 4891 instructions 2020.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to fit different business needs. Our plans cover essential features that assist with signing and managing documents, including compliance with mi 4891 instructions 2020. For detailed pricing, visit our website for a comprehensive overview of each plan.

-

What features does airSlate SignNow provide for document management?

Our platform includes features such as customizable templates, document tracking, and secure cloud storage. These capabilities are particularly useful for managing documents related to the mi 4891 instructions 2020, ensuring that you can easily access, complete, and submit your filings. The user-friendly interface enhances your overall document management experience.

-

Are there any benefits of using airSlate SignNow for eSigning?

Yes, airSlate SignNow offers numerous benefits for eSigning, especially for forms like the mi 4891 instructions 2020. With our solution, you can eliminate the need for physical paperwork and speed up the signing process. Additionally, our electronic signatures are legally binding, providing you peace of mind while navigating compliance requirements.

-

Can I integrate airSlate SignNow with other software?

Absolutely! AirSlate SignNow supports seamless integrations with various software solutions such as CRM, ERP, and document management systems. These integrations enhance your workflow efficiency and ensure that your document handling processes for the mi 4891 instructions 2020 are streamlined and accurate.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, security is a top priority for airSlate SignNow. Our platform utilizes advanced encryption and complies with industry standards to protect your sensitive documents, including those related to the mi 4891 instructions 2020. You can trust us to safeguard your data while managing eSignatures and document submissions.

Get more for Form 4891

- Kentucky surcharge form

- Bcs fellowship form

- Change request contract template form

- Real estate sale contract template form

- Real estate rent to own contract template form

- Real estate termination contract template form

- Real estate team contract template form

- Real estate wholesale contract template form

Find out other Form 4891

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now