Missouri Form 53 V

What is the Missouri Form 53 V

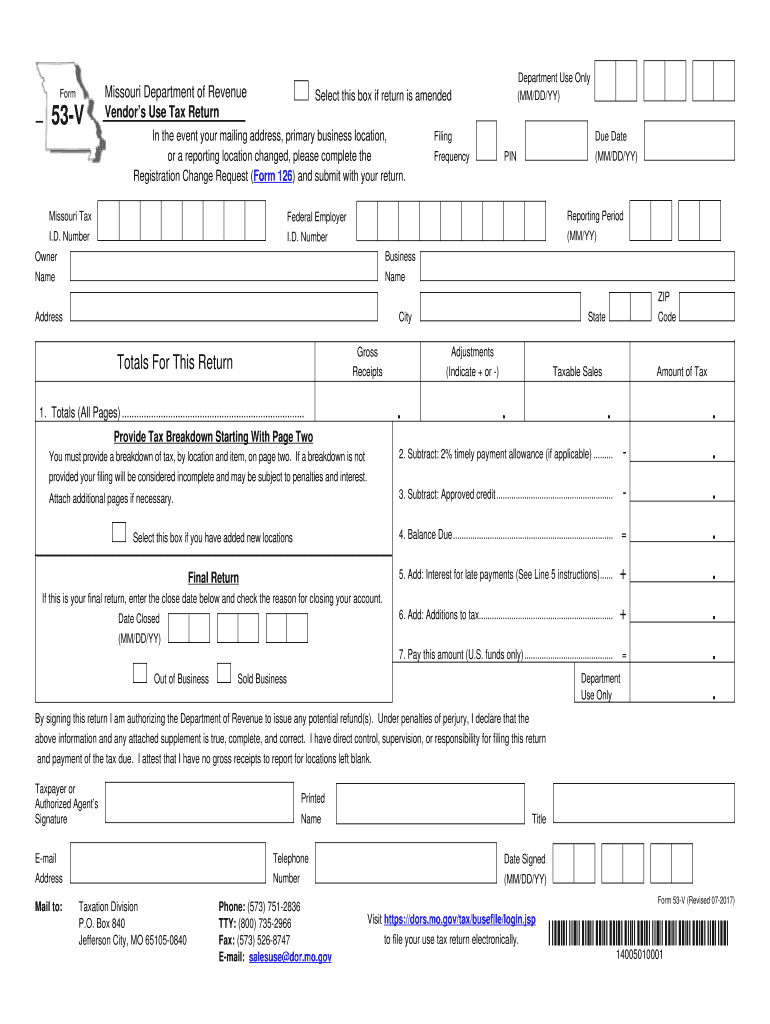

The Missouri Form 53 V is a tax return form specifically used for reporting use tax in the state of Missouri. This form is essential for individuals and businesses that purchase goods from out-of-state vendors without paying sales tax at the time of purchase. The 53 V form allows taxpayers to report and remit the use tax owed to the state, ensuring compliance with Missouri tax laws. Understanding this form is crucial for maintaining proper tax records and fulfilling legal obligations.

How to use the Missouri Form 53 V

Using the Missouri Form 53 V involves several straightforward steps. First, gather all necessary information regarding your purchases, including dates, amounts, and vendor details. Next, accurately complete the form by entering your personal or business information, followed by the details of the taxable purchases. After filling out the form, review it for accuracy to avoid any errors that could lead to penalties. Finally, submit the completed form along with any payment due to the Missouri Department of Revenue.

Steps to complete the Missouri Form 53 V

Completing the Missouri Form 53 V requires careful attention to detail. Follow these steps for successful completion:

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- List each purchase subject to use tax, including the date of purchase, description of the item, and purchase price.

- Calculate the total use tax owed by applying the current Missouri use tax rate to the total amount of taxable purchases.

- Sign and date the form to certify that the information provided is accurate to the best of your knowledge.

- Submit the form either online, by mail, or in person to the appropriate tax authority.

Legal use of the Missouri Form 53 V

The legal use of the Missouri Form 53 V is governed by state tax regulations. This form must be used by individuals and businesses that have made out-of-state purchases without paying sales tax. Properly completing and submitting the form ensures compliance with Missouri law, helping to avoid potential audits or penalties. It is important to retain a copy of the submitted form for your records, as it serves as proof of compliance with use tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri Form 53 V are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by the due date of your state income tax return. For most taxpayers, this deadline falls on April fifteenth of each year. However, if you are unable to file by this date, you may be eligible for an extension, but any use tax owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Missouri Form 53 V can be submitted through various methods, providing flexibility for taxpayers. You can file online through the Missouri Department of Revenue's e-filing system, which offers a convenient and efficient way to submit your form. Alternatively, you may print the completed form and mail it to the appropriate address specified by the Department of Revenue. For those who prefer face-to-face interactions, submitting the form in person at a local revenue office is also an option.

Quick guide on how to complete vendors use tax return form 53 v

Complete Missouri Form 53 V effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Missouri Form 53 V on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Missouri Form 53 V with minimal effort

- Obtain Missouri Form 53 V and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Edit and eSign Missouri Form 53 V and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vendors use tax return form 53 v

How to make an electronic signature for your Vendors Use Tax Return Form 53 V in the online mode

How to make an electronic signature for the Vendors Use Tax Return Form 53 V in Chrome

How to make an eSignature for putting it on the Vendors Use Tax Return Form 53 V in Gmail

How to create an eSignature for the Vendors Use Tax Return Form 53 V from your smart phone

How to create an eSignature for the Vendors Use Tax Return Form 53 V on iOS devices

How to make an electronic signature for the Vendors Use Tax Return Form 53 V on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 2020 mo v.?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The tool supports various legal requirements, including those outlined in the 2020 mo v. legislation, ensuring compliance and security throughout the signing process.

-

How much does airSlate SignNow cost for businesses interested in 2020 mo v. compliance?

airSlate SignNow offers a range of pricing plans suitable for businesses of all sizes, starting with a cost-effective basic plan. These plans are designed to help organizations efficiently manage their document workflows while ensuring adherence to regulations like those highlighted in the 2020 mo v.

-

What features does airSlate SignNow offer that support the 2020 mo v. requirements?

airSlate SignNow includes features such as customizable templates, secure storage, and audit trails, which are crucial for compliance with the 2020 mo v. These functionalities ensure that all electronic signatures are legally binding and traceable.

-

Can I integrate airSlate SignNow with other applications to enhance my 2020 mo v. workflows?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, such as CRM systems and project management tools. This capability allows businesses to enhance their workflows and maintain compliance with 2020 mo v. requirements within existing software ecosystems.

-

What are the benefits of using airSlate SignNow for businesses focusing on 2020 mo v.?

Using airSlate SignNow enables businesses to expedite their document signing processes, which is essential under the 2020 mo v. guidelines. Additionally, it reduces paper usage and storage costs, contributing to a more efficient and sustainable operational model.

-

Is airSlate SignNow suitable for industries affected by 2020 mo v. regulations?

Absolutely! airSlate SignNow is designed to meet the compliance needs of various industries affected by 2020 mo v. regulations, including healthcare, finance, and legal sectors. Its robust security features ensure that sensitive information is protected during the signing process.

-

How does airSlate SignNow ensure the security and legality of signatures under 2020 mo v.?

airSlate SignNow employs advanced encryption and authentication methods to secure documents and signatures, complying with the legal standards set by 2020 mo v. Every signed document is stored with an audit trail, ensuring transparency and accountability.

Get more for Missouri Form 53 V

- Development and testing of improved suicide functions for biological containment of bacteria ncbi nlm nih form

- Analytic and clinical evaluation of the abbott axsym cardiac troponin i form

- Ipls proceedings volume 19 issue 1 michbar form

- Puppy bill of sale contract template form

- Puppy buy contract template form

- Puppy breeder contract template form

- Puppy deposit contract template form

- Puppy for breeders contract template form

Find out other Missouri Form 53 V

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast