Form 8821 Authorization for Release of Confidential Information

What is the Form 8821 Authorization For Release Of Confidential Information

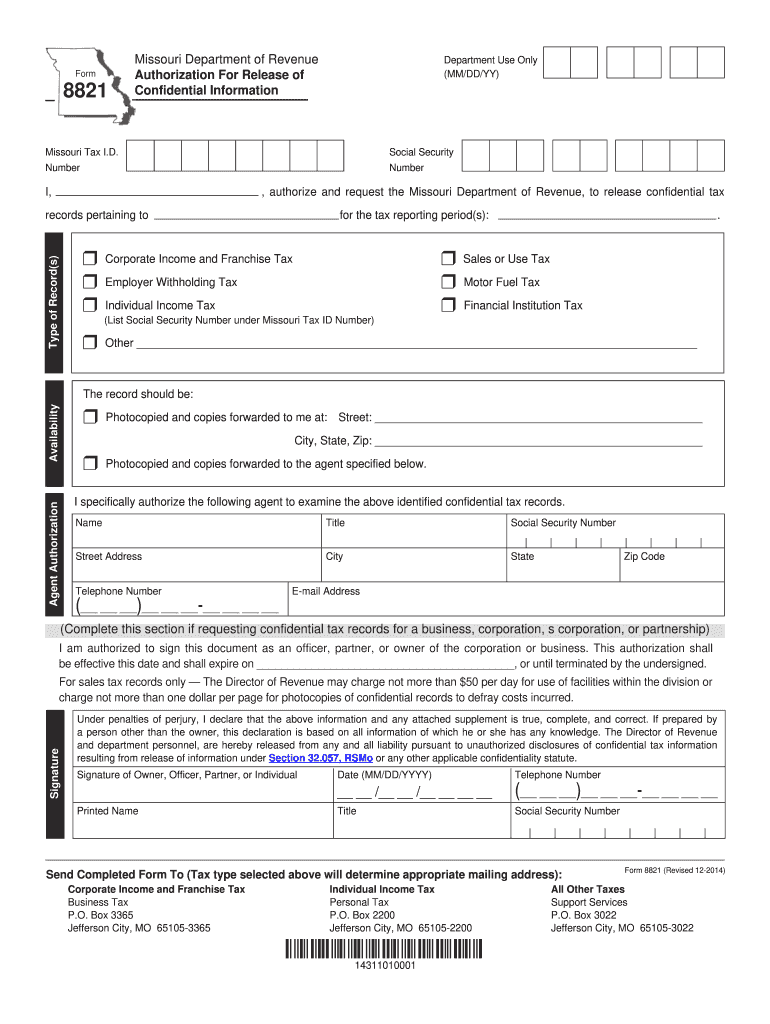

The Form 8821 is an official document used by taxpayers to authorize the release of confidential information to a designated individual or organization. This form allows the Internal Revenue Service (IRS) to disclose information related to a taxpayer's tax matters, including sales motor tax details, to the person or entity specified. By completing this form, taxpayers can ensure that their chosen representative has access to necessary tax information, facilitating smoother communication and assistance with tax-related issues.

How to use the Form 8821 Authorization For Release Of Confidential Information

To effectively use the Form 8821, taxpayers must complete the form by providing their personal information, including name, address, and taxpayer identification number. Additionally, the form requires the name and contact details of the individual or organization authorized to receive the information. Once the form is filled out, it must be signed and dated by the taxpayer. After submission, the IRS will process the request, allowing the designated representative to access the specified tax information.

Steps to complete the Form 8821 Authorization For Release Of Confidential Information

Completing the Form 8821 involves several key steps:

- Obtain the latest version of Form 8821 from the IRS website or other official sources.

- Fill in your full name, address, and taxpayer identification number in the appropriate sections.

- Provide the name and contact information of the person or organization you are authorizing.

- Specify the type of tax information you wish to be released, such as sales motor tax records.

- Sign and date the form to validate your authorization.

- Submit the completed form to the IRS using the designated submission methods.

Legal use of the Form 8821 Authorization For Release Of Confidential Information

The Form 8821 is legally binding once it is signed by the taxpayer. It complies with IRS regulations, ensuring that the designated representative can access the specified confidential information. This form is essential for maintaining proper authorization and safeguarding taxpayer privacy while allowing for necessary disclosures. It is important to ensure that the form is filled out accurately to avoid any legal complications or delays in processing.

Filing Deadlines / Important Dates

There are no specific filing deadlines for submitting Form 8821, as it is an authorization form rather than a tax return. However, it is advisable to submit the form as soon as the need for representation arises. This ensures that the authorized individual can access the necessary information in a timely manner, especially when approaching tax deadlines or during audits.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form 8821 through various methods:

- Online: The form can be submitted electronically through the IRS e-Services platform if the taxpayer is registered.

- Mail: Completed forms can be mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Taxpayers may also deliver the form in person to their local IRS office, ensuring immediate processing.

Quick guide on how to complete form 8821 authorization for release of confidential information

Effortlessly Prepare Form 8821 Authorization For Release Of Confidential Information on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form 8821 Authorization For Release Of Confidential Information on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Form 8821 Authorization For Release Of Confidential Information with Ease

- Locate Form 8821 Authorization For Release Of Confidential Information and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to store your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 8821 Authorization For Release Of Confidential Information to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8821 authorization for release of confidential information

How to create an eSignature for the Form 8821 Authorization For Release Of Confidential Information in the online mode

How to create an electronic signature for your Form 8821 Authorization For Release Of Confidential Information in Google Chrome

How to make an electronic signature for putting it on the Form 8821 Authorization For Release Of Confidential Information in Gmail

How to make an electronic signature for the Form 8821 Authorization For Release Of Confidential Information straight from your smart phone

How to make an electronic signature for the Form 8821 Authorization For Release Of Confidential Information on iOS devices

How to create an electronic signature for the Form 8821 Authorization For Release Of Confidential Information on Android

People also ask

-

What is sales motor tax and how does it relate to airSlate SignNow?

Sales motor tax refers to the tax imposed on the purchase of motor vehicles. With airSlate SignNow, businesses can streamline document management related to sales motor tax, ensuring compliance and expediting the signing process.

-

How can airSlate SignNow help businesses manage sales motor tax documents?

AirSlate SignNow provides an efficient platform for creating, sending, and eSigning sales motor tax documents. This ensures that all transactions related to motor vehicle sales are documented and processed accurately and securely.

-

Is airSlate SignNow suitable for businesses dealing with sales motor tax transactions?

Yes, airSlate SignNow is highly suitable for businesses handling sales motor tax transactions. Its user-friendly interface and robust features simplify the management of tax documents, helping to ensure timely compliance with tax regulations.

-

What features does airSlate SignNow offer for handling sales motor tax paperwork?

AirSlate SignNow offers features such as customizable templates, secure eSignatures, and automated workflows, all tailored for handling sales motor tax paperwork. These tools enhance efficiency and accuracy in managing tax-related documents.

-

How does pricing for airSlate SignNow support businesses managing sales motor tax?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes managing sales motor tax. These cost-effective solutions ensure that even smaller businesses can access the tools they need to efficiently handle tax documents without overspending.

-

Can airSlate SignNow integrate with other software for sales motor tax management?

Yes, airSlate SignNow seamlessly integrates with a variety of software systems, making it easier to manage sales motor tax alongside your existing tools. This integration capability enhances your workflow and reduces the likelihood of errors in documentation.

-

What benefits does airSlate SignNow provide for automating sales motor tax processes?

By automating sales motor tax processes with airSlate SignNow, businesses experience improved turnaround times and reduced manual errors. This not only saves time but also ensures that all tax documentation is completed accurately and on time.

Get more for Form 8821 Authorization For Release Of Confidential Information

Find out other Form 8821 Authorization For Release Of Confidential Information

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer