Booklet My Form

What is the Booklet My

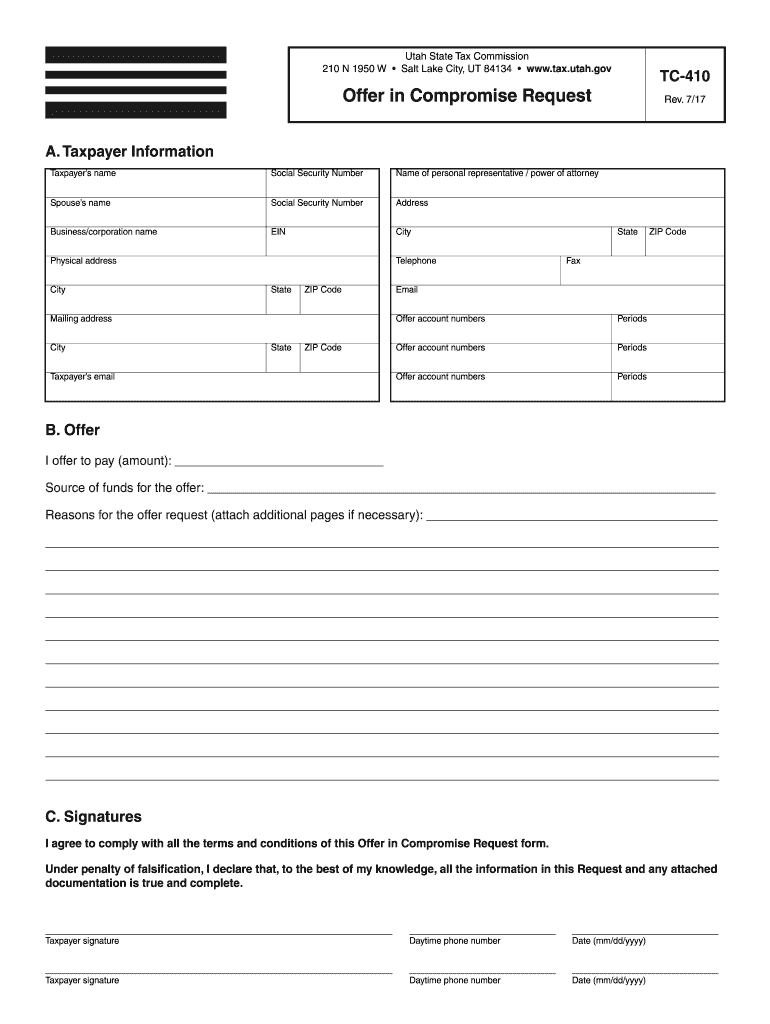

The Booklet My is a crucial document used in the tax compromise process. It outlines the necessary information and requirements for individuals seeking to settle their tax debts with the IRS or state tax authorities. This booklet typically includes guidelines on eligibility, required documentation, and the steps involved in submitting a tax compromise request. Understanding the contents of the Booklet My is essential for taxpayers looking to navigate the complexities of tax resolution effectively.

Eligibility Criteria

To qualify for a tax compromise, individuals must meet specific eligibility criteria outlined in the Booklet My. Generally, taxpayers should demonstrate an inability to pay their full tax liabilities due to financial hardship. This may include factors such as income level, expenses, and overall financial situation. Additionally, taxpayers must be current with their tax filings and not have any outstanding tax obligations that could disqualify them from consideration. Reviewing these criteria is vital for anyone considering a compromise.

Steps to Complete the Booklet My

Completing the Booklet My involves several key steps that taxpayers must follow to ensure their submission is accurate and complete. First, individuals should gather all necessary financial documents, including income statements and expense records. Next, they need to fill out the required sections of the booklet, providing detailed information about their financial situation. After completing the form, it is essential to review it for accuracy before submission. Finally, taxpayers should submit the Booklet My along with any required supporting documents to the appropriate tax authority.

Required Documents

When submitting the Booklet My, taxpayers must include several supporting documents to substantiate their claims. Commonly required documents include proof of income, such as pay stubs or tax returns, and records of monthly expenses, including bills and statements. Additionally, any documentation that demonstrates financial hardship, such as medical expenses or unemployment records, should be included. Providing comprehensive documentation is crucial for a successful tax compromise application.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Booklet My and the tax compromise process. These guidelines detail the criteria for eligibility, the types of compromises available, and the procedures for submitting requests. Taxpayers should familiarize themselves with these guidelines to understand what is expected during the compromise process. Adhering to IRS guidelines can significantly improve the chances of a successful resolution.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Booklet My through various methods, depending on their preference and the requirements of the tax authority. Submissions can typically be made online through secure portals, which offer a convenient option for many individuals. Alternatively, taxpayers may choose to mail their completed forms and supporting documents to the appropriate address. In some cases, in-person submissions may be possible at local tax offices. Understanding the available submission methods can help streamline the process.

Quick guide on how to complete tc 410

Prepare Booklet My effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly and efficiently. Handle Booklet My on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and electronically sign Booklet My with ease

- Locate Booklet My and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive details with tools designed specifically by airSlate SignNow for that intent.

- Generate your signature using the Sign function, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Booklet My to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 410

How to generate an eSignature for your Tc 410 in the online mode

How to make an electronic signature for the Tc 410 in Chrome

How to make an eSignature for signing the Tc 410 in Gmail

How to create an eSignature for the Tc 410 right from your smart phone

How to make an eSignature for the Tc 410 on iOS

How to generate an electronic signature for the Tc 410 on Android devices

People also ask

-

What is 'Booklet My' and how can it benefit my business?

'Booklet My' is an innovative feature within airSlate SignNow that allows you to create custom booklets for your documents. This functionality enhances your document presentation, making it easier for clients and partners to review and sign important paperwork. By utilizing 'Booklet My', you can streamline your document management process and improve overall efficiency.

-

How does the pricing for 'Booklet My' work with airSlate SignNow?

The 'Booklet My' feature is included in the competitive pricing plans of airSlate SignNow, which are designed to fit businesses of all sizes. You can choose from various subscription options that best suit your needs, ensuring that you get the most value for your investment. With 'Booklet My', you can enhance your document workflow without breaking the bank.

-

Can I integrate 'Booklet My' with other software solutions?

Yes, 'Booklet My' seamlessly integrates with a variety of third-party applications, enhancing your workflow. Whether you use CRM systems, project management tools, or cloud storage services, airSlate SignNow ensures compatibility with your existing software. This integration allows you to utilize 'Booklet My' alongside your favorite tools, streamlining your document processes further.

-

What types of documents can I create with 'Booklet My'?

'Booklet My' allows you to create professional-looking booklets for any type of document, including contracts, proposals, and reports. This flexibility means you can customize your documents to meet the specific needs of your business and clients. With airSlate SignNow, any document can be transformed into a booklet format for enhanced readability and engagement.

-

Is 'Booklet My' easy to use for non-technical users?

Absolutely! 'Booklet My' is designed with user-friendliness in mind, making it accessible for users with varying levels of technical expertise. With a simple interface and guided steps, anyone can create and manage booklets without needing extensive training. airSlate SignNow empowers you to focus on your business rather than getting bogged down by complicated software.

-

What security measures are in place for documents created with 'Booklet My'?

Security is a top priority for airSlate SignNow, and documents created with 'Booklet My' are protected with advanced encryption and compliance standards. Your data is secure, ensuring that sensitive information remains confidential throughout the signing process. Trusting 'Booklet My' means protecting your business and your clients with robust security features.

-

Is customer support available for users of 'Booklet My'?

Yes, airSlate SignNow provides excellent customer support for all users, including those utilizing 'Booklet My'. Whether you have questions about functionality or need assistance with integration, our support team is ready to help. We ensure that you have the resources you need to make the most out of 'Booklet My' and improve your document workflows.

Get more for Booklet My

Find out other Booklet My

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter