Tc69 Utah Onlineapplication Form

Understanding the Tc69 Utah Online Application

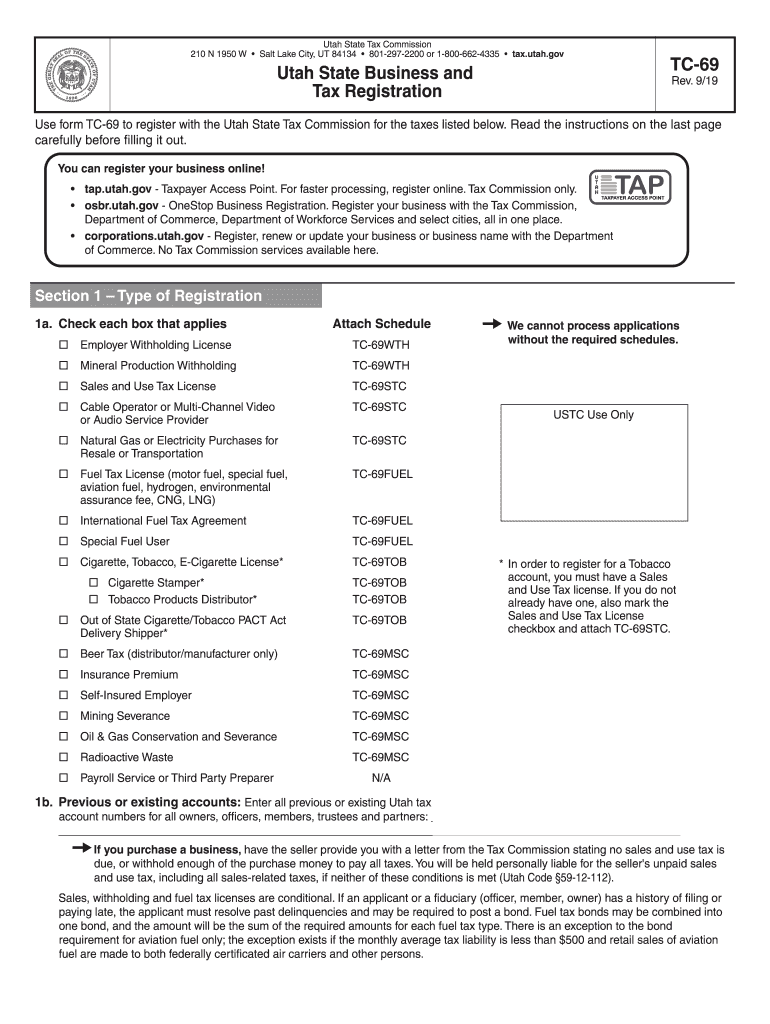

The Tc69 Utah Online Application is a crucial form used for various tax-related purposes in the state of Utah. This application allows businesses and individuals to obtain their Utah state tax identification number, which is essential for tax reporting and compliance. The form is designed to streamline the process of acquiring a tax ID, ensuring that applicants can efficiently manage their tax obligations.

Steps to Complete the Tc69 Utah Online Application

Completing the Tc69 Utah Online Application involves several key steps:

- Gather necessary information, including your business name, address, and type of entity.

- Access the online application portal provided by the Utah State Tax Commission.

- Fill out the required fields accurately, ensuring all information is up-to-date.

- Review your application for any errors or omissions before submission.

- Submit the application electronically and retain a copy for your records.

Required Documents for the Tc69 Utah Online Application

When applying for the Tc69 Utah Online Application, certain documents may be required to verify your identity and business details. Commonly needed documents include:

- Proof of business registration, such as articles of incorporation or a business license.

- Identification documents for individuals, like a driver's license or Social Security card.

- Any previous tax identification numbers, if applicable.

Legal Use of the Tc69 Utah Online Application

The Tc69 Utah Online Application is legally recognized and must be completed in accordance with state regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal consequences. The application serves as a formal request for a tax ID, which is necessary for fulfilling tax obligations in Utah.

Filing Deadlines and Important Dates

Being aware of filing deadlines is essential for compliance. For the Tc69 Utah Online Application, it is advisable to submit your application well in advance of any tax deadlines to avoid penalties. Key dates to keep in mind include:

- Annual tax filing deadlines for businesses.

- Quarterly estimated tax payment deadlines.

- Specific dates for renewing or updating your tax ID information.

Application Process and Approval Time

The application process for the Tc69 Utah Online Application is generally straightforward. After submission, applicants can expect to receive their tax ID number within a few business days, provided all information is accurate and complete. In some cases, additional verification may be required, which could extend the approval time.

Quick guide on how to complete utah state tax commission taxpayer services division210 n

Effortlessly prepare Tc69 Utah Onlineapplication on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents rapidly without unnecessary delays. Handle Tc69 Utah Onlineapplication on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to edit and eSign Tc69 Utah Onlineapplication with ease

- Find Tc69 Utah Onlineapplication and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select how you'd like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Alter and eSign Tc69 Utah Onlineapplication to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the utah state tax commission taxpayer services division210 n

How to create an eSignature for your Utah State Tax Commission Taxpayer Services Division210 N in the online mode

How to make an electronic signature for the Utah State Tax Commission Taxpayer Services Division210 N in Chrome

How to create an electronic signature for putting it on the Utah State Tax Commission Taxpayer Services Division210 N in Gmail

How to make an eSignature for the Utah State Tax Commission Taxpayer Services Division210 N right from your smartphone

How to make an eSignature for the Utah State Tax Commission Taxpayer Services Division210 N on iOS

How to make an eSignature for the Utah State Tax Commission Taxpayer Services Division210 N on Android devices

People also ask

-

What is the Tc69 Utah Onlineapplication and how does it work?

The Tc69 Utah Onlineapplication is an innovative tool provided by airSlate SignNow that allows users to easily send and eSign documents online. This platform simplifies the application process by enabling users to fill out forms and sign them digitally, ensuring a seamless experience for both applicants and administrators.

-

How much does the Tc69 Utah Onlineapplication cost?

The pricing for the Tc69 Utah Onlineapplication varies based on the features and number of users. airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes, making it a cost-effective solution for your document signing needs.

-

What features are included in the Tc69 Utah Onlineapplication?

The Tc69 Utah Onlineapplication includes a variety of features such as customizable templates, document tracking, and advanced security options. These features ensure that your documents are not only easy to manage but also secure, providing peace of mind for your business.

-

Can I integrate the Tc69 Utah Onlineapplication with other software?

Yes, the Tc69 Utah Onlineapplication can be easily integrated with numerous third-party applications, including CRM systems and cloud storage services. This capability allows businesses to streamline their workflows and enhance productivity by connecting their existing tools with airSlate SignNow.

-

What are the benefits of using the Tc69 Utah Onlineapplication?

Using the Tc69 Utah Onlineapplication offers multiple benefits, including increased efficiency, reduced paperwork, and enhanced user experience. With airSlate SignNow, businesses can signNowly speed up their document processes while maintaining compliance and security.

-

Is the Tc69 Utah Onlineapplication suitable for small businesses?

Absolutely! The Tc69 Utah Onlineapplication is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal solution for startups and small enterprises looking to improve their document management.

-

How secure is the Tc69 Utah Onlineapplication for electronic signatures?

The Tc69 Utah Onlineapplication prioritizes security with advanced encryption and compliance with e-signature laws. airSlate SignNow ensures that your documents are protected, giving you confidence in the integrity and authenticity of your electronically signed documents.

Get more for Tc69 Utah Onlineapplication

- Alternatives to adobe acrobat pdf programs plaintiff magazine form

- Washington state rcw 58 lease termination notice form

- Service animal addendum lease form

- House summary report doc form

- National trail schools nationaltrail k12 oh form

- Producer artist contract template form

- Product contract template form

- Product design contract template form

Find out other Tc69 Utah Onlineapplication

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template