St 7r Form

What is the St 7r

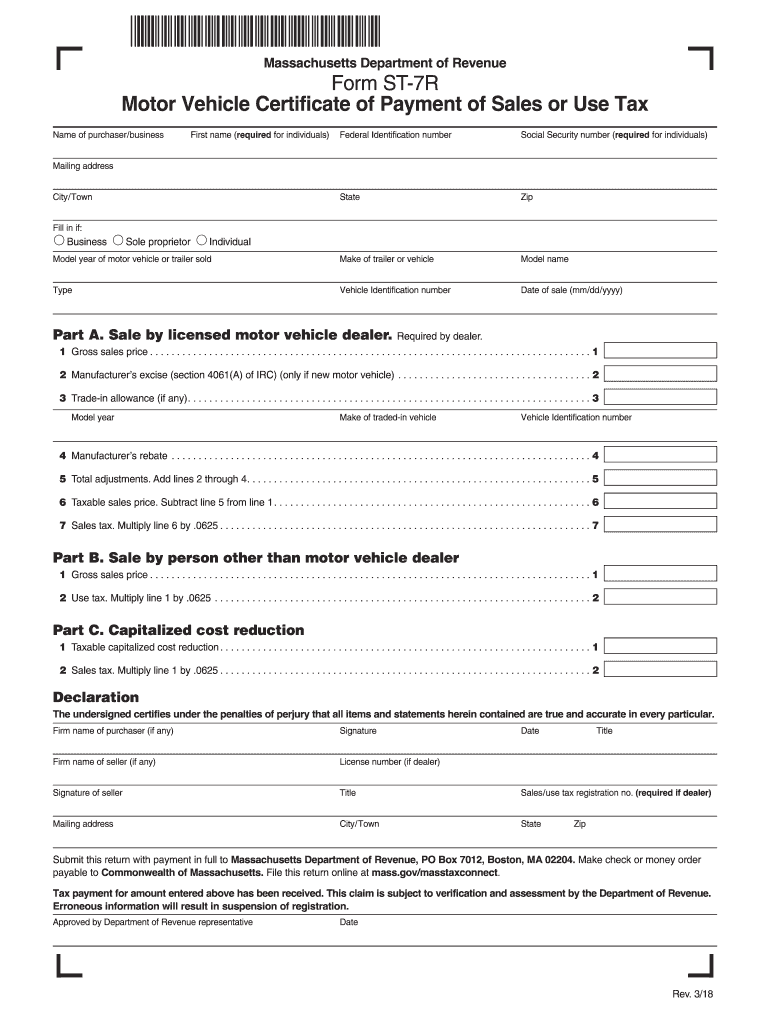

The St 7r form, also known as the Massachusetts Sales Tax Resale Certificate, is a crucial document used by businesses in Massachusetts. This form allows retailers to purchase goods without paying sales tax when those goods are intended for resale. The St 7r is essential for maintaining compliance with state tax regulations and ensuring that businesses do not incur unnecessary costs on inventory that will be sold to customers.

How to use the St 7r

Using the St 7r form involves a straightforward process. First, a business must complete the form by providing necessary details such as the seller's name, address, and the type of goods being purchased. The buyer must also include their information and indicate that the items are for resale. Once filled out, the St 7r should be presented to the seller at the time of purchase. This document serves as proof that the buyer is exempt from sales tax on the transaction.

Steps to complete the St 7r

Completing the St 7r form requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain the St 7r form from the Massachusetts Department of Revenue website or through your accounting software.

- Fill out the seller's information, including their name and address.

- Provide your business name, address, and sales tax registration number.

- Clearly describe the items being purchased for resale.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the St 7r

The legal use of the St 7r form is governed by Massachusetts tax laws. This form must be used in good faith, meaning that the buyer genuinely intends to resell the items listed. Misuse of the St 7r, such as using it for personal purchases or items not intended for resale, can lead to penalties and fines. It is important for businesses to understand the legal implications and ensure compliance with state regulations.

Required Documents

To effectively use the St 7r form, certain documents may be required. These include:

- A valid Massachusetts sales tax registration number.

- Proof of business identity, such as a business license or incorporation documents.

- Any additional documentation that supports the claim of resale, if necessary.

Form Submission Methods

The St 7r form does not need to be submitted to the Massachusetts Department of Revenue at the time of purchase. Instead, it should be retained by the seller for their records. However, businesses must ensure that they keep accurate records of all transactions involving the St 7r for tax reporting purposes. This includes maintaining copies of the completed forms in case of audits or inquiries from tax authorities.

Quick guide on how to complete massachusetts department of revenue form st 7r motor

Complete St 7r effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without any holdups. Handle St 7r on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign St 7r effortlessly

- Locate St 7r and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and electronically sign St 7r and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form st 7r motor

How to create an electronic signature for the Massachusetts Department Of Revenue Form St 7r Motor online

How to create an eSignature for your Massachusetts Department Of Revenue Form St 7r Motor in Chrome

How to create an electronic signature for signing the Massachusetts Department Of Revenue Form St 7r Motor in Gmail

How to make an electronic signature for the Massachusetts Department Of Revenue Form St 7r Motor straight from your smartphone

How to create an eSignature for the Massachusetts Department Of Revenue Form St 7r Motor on iOS

How to create an eSignature for the Massachusetts Department Of Revenue Form St 7r Motor on Android

People also ask

-

What is form 7r and how does it work?

Form 7r is a specific document type that allows users to streamline their eSignature process. With airSlate SignNow, you can easily create, send, and sign form 7r documents, ensuring compliance and efficiency in your workflow.

-

How much does it cost to use airSlate SignNow for form 7r?

Pricing for using airSlate SignNow with form 7r varies based on the plan you choose. We offer flexible subscription options, including monthly and annual billing, which cater to businesses of all sizes looking to manage form 7r efficiently.

-

What features are available for managing form 7r with airSlate SignNow?

airSlate SignNow provides various features for handling form 7r, including customizable templates, automated workflows, and real-time tracking. These features enhance the signing experience and ensure that your form 7r documents are processed smoothly.

-

Can I integrate airSlate SignNow with other tools for form 7r?

Yes, airSlate SignNow supports seamless integrations with a wide range of applications. You can easily connect tools like CRM systems or cloud storage solutions to manage your form 7r documents more effectively.

-

What are the benefits of using airSlate SignNow for form 7r?

Using airSlate SignNow to manage form 7r offers numerous benefits, including reduced turnaround time, improved accuracy, and enhanced security. With its user-friendly interface, you can ensure a streamlined signing process for your business.

-

Is it easy to create a form 7r in airSlate SignNow?

Absolutely! Creating a form 7r in airSlate SignNow is straightforward with our intuitive design tools. You can customize the form according to your needs and set up the signing workflow with just a few clicks.

-

How can airSlate SignNow help ensure compliance with form 7r?

airSlate SignNow incorporates security features that ensure compliance when handling form 7r. Our platform complies with eSignature laws and provides audit trails to verify the signing process and maintain document integrity.

Get more for St 7r

- M a a a a ma aa m m a m m aaa aaaaaaaaaaaeaaaaaaaaaaaaaaaa michigan form

- La fill amsterdamny form

- Printable pdf calendar download monthly amp yearly printable pdf calendar download monthly amp yearly create and distribute pdf form

- Press web design contract template form

- Pressure wash bid contract template form

- Pressure wash service power wash contract template form

- Pressure wash contract template form

- Preventive maintenance contract template form

Find out other St 7r

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe