Form 05 163

What is the Form 05-163

The Form 05-163 is a Texas franchise tax report that businesses must file to report their revenue and calculate the amount of taxes owed to the state. This form is essential for various business entities, including corporations and limited liability companies (LLCs). The information provided on this form helps the Texas Comptroller's office assess the tax liability of the business based on its gross receipts. Understanding the purpose of the Form 05-163 is crucial for compliance with state tax regulations.

Steps to Complete the Form 05-163

Completing the Form 05-163 involves several key steps to ensure accurate reporting of your business's financial information. Start by gathering all necessary financial documents, including income statements and balance sheets. Next, fill out the form by entering your business's gross receipts, deductions, and any applicable credits. Be sure to review the instructions provided with the form to ensure all sections are completed accurately. Once completed, verify that all calculations are correct to avoid penalties or delays in processing.

Legal Use of the Form 05-163

The Form 05-163 is legally binding when submitted to the Texas Comptroller's office. It must be completed in accordance with state tax laws and regulations. Any misrepresentation or failure to file can result in penalties, including fines or interest on unpaid taxes. To ensure legal compliance, businesses should maintain accurate records and file the form by the designated deadlines. Utilizing electronic filing options can streamline the process and enhance security.

Filing Deadlines / Important Dates

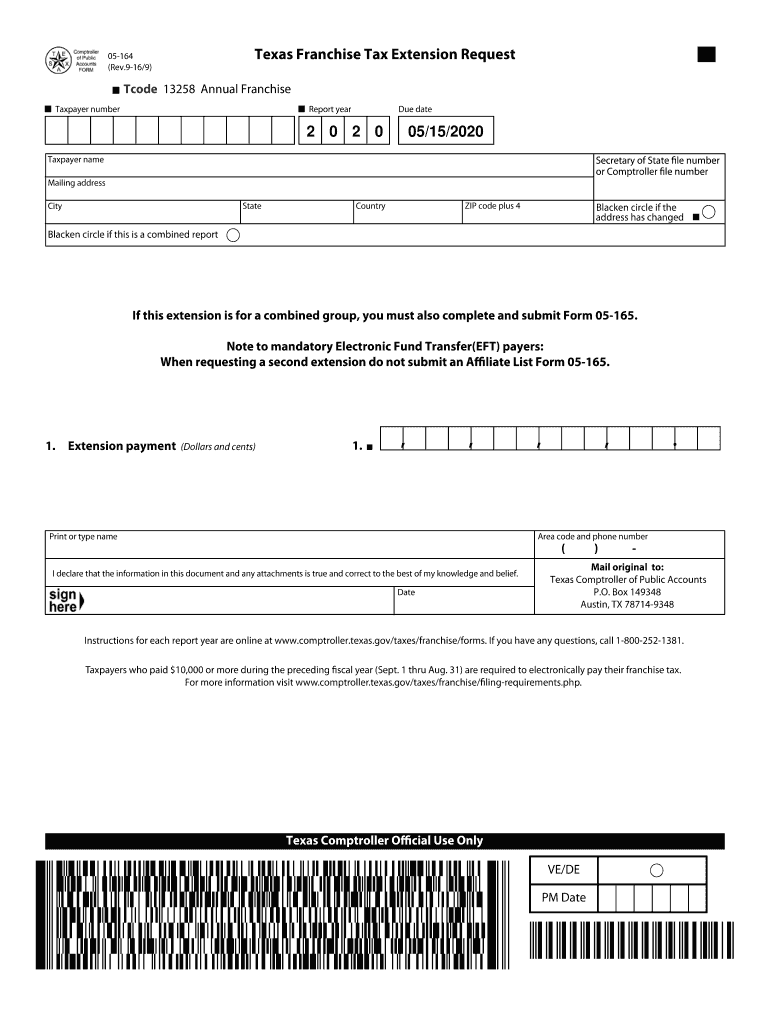

It is crucial to be aware of the filing deadlines associated with the Form 05-163 to avoid penalties. Typically, the form is due on May 15 of each year for most businesses. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, businesses may need to file an extension if they cannot meet the deadline. Understanding these dates helps ensure timely compliance with Texas tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 05-163 can be submitted through various methods, offering flexibility for businesses. Online submission is encouraged for its efficiency and speed, allowing for immediate confirmation of receipt. Alternatively, businesses can mail the completed form to the Texas Comptroller's office or submit it in person at designated locations. Each submission method has specific guidelines, so it is important to follow the instructions carefully to ensure proper processing.

Key Elements of the Form 05-163

The Form 05-163 includes several key elements that must be addressed for accurate reporting. These elements typically include the business's name, address, and taxpayer identification number. Additionally, the form requires details about gross receipts, allowable deductions, and any credits claimed. Each section must be completed thoroughly to reflect the business's financial status accurately. Understanding these key elements is essential for successful tax reporting.

Quick guide on how to complete amal abdualh baytcom people

Ease of Preparing Form 05 163 on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 05 163 across any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to Edit and eSign Form 05 163 Effortlessly

- Find Form 05 163 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to apply your changes.

- Choose how you'd like to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 05 163 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the amal abdualh baytcom people

How to create an electronic signature for your Amal Abdualh Baytcom People online

How to create an eSignature for the Amal Abdualh Baytcom People in Google Chrome

How to make an eSignature for putting it on the Amal Abdualh Baytcom People in Gmail

How to create an electronic signature for the Amal Abdualh Baytcom People from your mobile device

How to generate an eSignature for the Amal Abdualh Baytcom People on iOS

How to make an eSignature for the Amal Abdualh Baytcom People on Android devices

People also ask

-

What are the benefits of using airSlate SignNow for comptroller texas gov taxes franchise forms?

Using airSlate SignNow for comptroller texas gov taxes franchise forms offers a streamlined eSignature solution that enhances efficiency and accuracy. Our platform ensures that your documents are securely signed and stored, minimizing the chances of errors. Additionally, it saves time and resources, allowing businesses to focus on growth instead of paperwork.

-

How does airSlate SignNow integrate with other applications for comptroller texas gov taxes franchise forms?

airSlate SignNow seamlessly integrates with a variety of applications including CRM and project management tools to streamline the process of handling comptroller texas gov taxes franchise forms. This connectivity allows for easy document sharing and collaboration across teams. The robust API ensures that you can automate workflows and manage documents in a more cohesive manner.

-

What is the pricing structure for airSlate SignNow when handling comptroller texas gov taxes franchise forms?

airSlate SignNow offers flexible pricing plans tailored to fit the needs of different businesses managing comptroller texas gov taxes franchise forms. Our plans range from basic to advanced features, ensuring you only pay for what you need. We also provide discounts for annual subscriptions, making it a cost-effective solution for organizations of all sizes.

-

Is airSlate SignNow secure for managing comptroller texas gov taxes franchise forms?

Yes, airSlate SignNow is designed with top-notch security features to protect your documents, including those for comptroller texas gov taxes franchise forms. We utilize advanced encryption methods and comply with industry standards to safeguard sensitive information. Our platform also offers audit trails for added transparency and compliance.

-

Can I customize templates for comptroller texas gov taxes franchise forms in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize templates for comptroller texas gov taxes franchise forms to suit their specific requirements. You can easily add interactive fields, branding, and compliance information to your templates. This ensures that your documents meet both your organizational standards and legal requirements.

-

How user-friendly is airSlate SignNow for eSigning comptroller texas gov taxes franchise forms?

airSlate SignNow is designed to be intuitive and user-friendly, making it easy for anyone to eSign comptroller texas gov taxes franchise forms without extensive training. The platform features a straightforward interface that guides users through each step of the signing process. This simplicity aids in quicker turnaround times and increased user adoption.

-

What customer support options are available for airSlate SignNow users managing comptroller texas gov taxes franchise forms?

Customers using airSlate SignNow for comptroller texas gov taxes franchise forms have access to a variety of support options. We offer 24/7 customer service through chat, email, and phone support to assist with any inquiries or issues. Additionally, our extensive online resources, including tutorials and FAQs, provide immediate help for users.

Get more for Form 05 163

- 032018the housing authority of the city of los an form

- Northwood community association owner resident information form date property address owners names as written on title owner 1

- Sample independent living rental agreement ila form

- Portrait photographer contract template form

- Portrait photography contract template form

- Position contract template form

- Portrait session contract template form

- Post construction clean contract template form

Find out other Form 05 163

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online